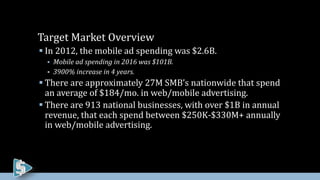

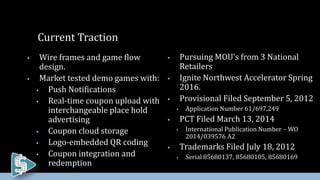

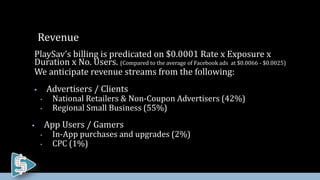

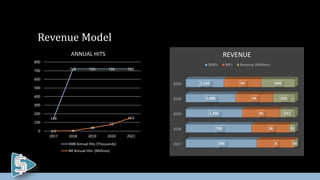

This presentation proposes an interactive gaming platform called PlaySav that incorporates advertisements. PlaySav aims to eliminate user frustration with ads by rewarding users with discounts for engaging with ads embedded in mobile games. This creates a mutually beneficial relationship between advertisers and users. The presentation outlines PlaySav's target markets of small and large businesses, analyzes the growing gaming market, and presents financial projections showing PlaySav becoming profitable by 2019 with positive EBITDA margins going forward. It requests $1 million in funding to develop PlaySav's app and game titles and launch initial marketing efforts.