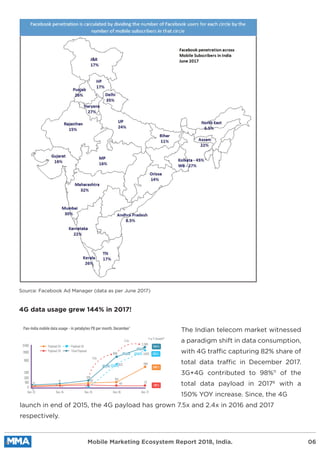

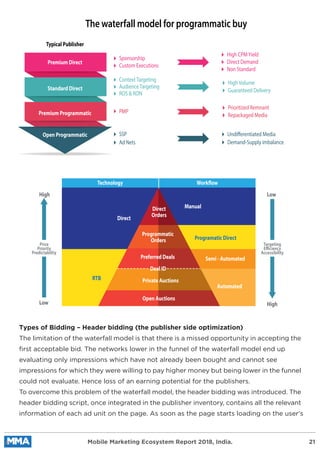

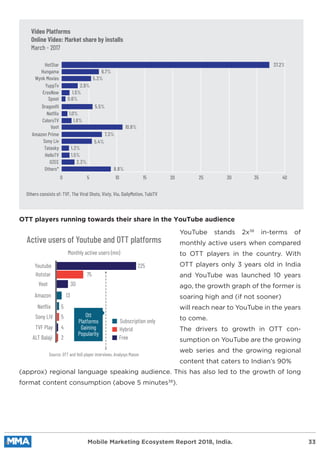

The 2018 Mobile Marketing Ecosystem report highlights significant changes in India's mobile landscape, driven primarily by the rapid adoption of 4G technology and the impact of Reliance Jio, which added over 200 million subscribers within two years. The report indicates a considerable increase in mobile internet users, particularly from rural areas, and emphasizes the growing prominence of OTT platforms and mobile gaming as key drivers of data consumption. Additionally, it discusses the evolution of advertising in the mobile domain, pointing towards increased programmatic spending and the importance of vernacular content over the next five years.