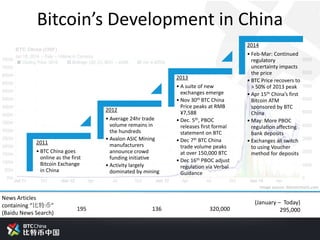

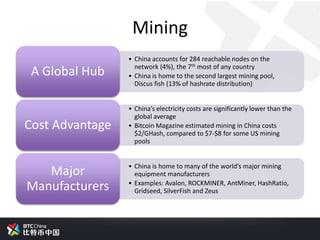

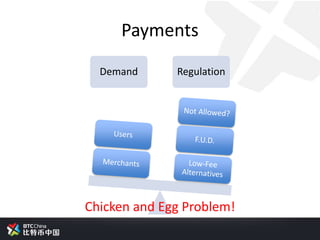

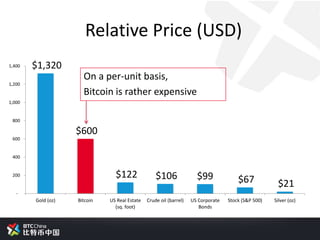

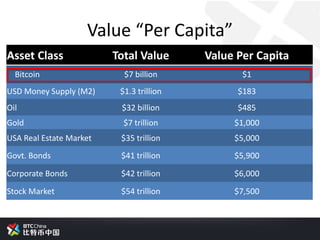

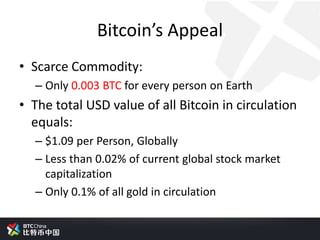

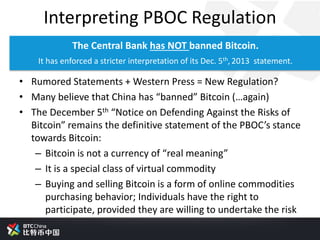

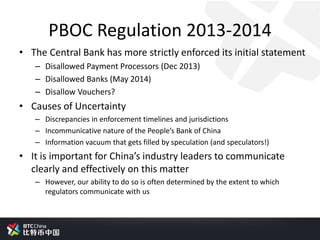

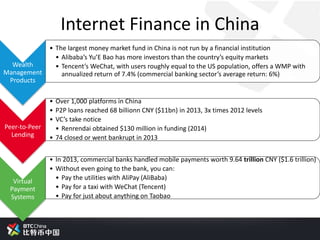

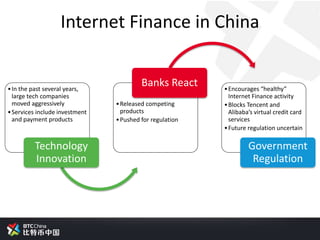

Bobby Lee, CEO of BTC China and board member of the Bitcoin Foundation, gave a presentation on the past, present, and future of Bitcoin in China. He discussed how Bitcoin first emerged in China in 2011 with the founding of BTC China. While regulatory uncertainty caused volatility, Bitcoin trading and mining have continued growing. Lee framed Bitcoin as a potential new asset class and store of value, arguing its value per capita is still relatively low. He believes China's regulation seeks to manage risks rather than ban Bitcoin, and sees opportunities for Bitcoin to develop alongside China's expanding internet finance sector. Going forward, Lee expects China's Bitcoin industry to grow globally while adapting to ongoing regulatory trends within China.