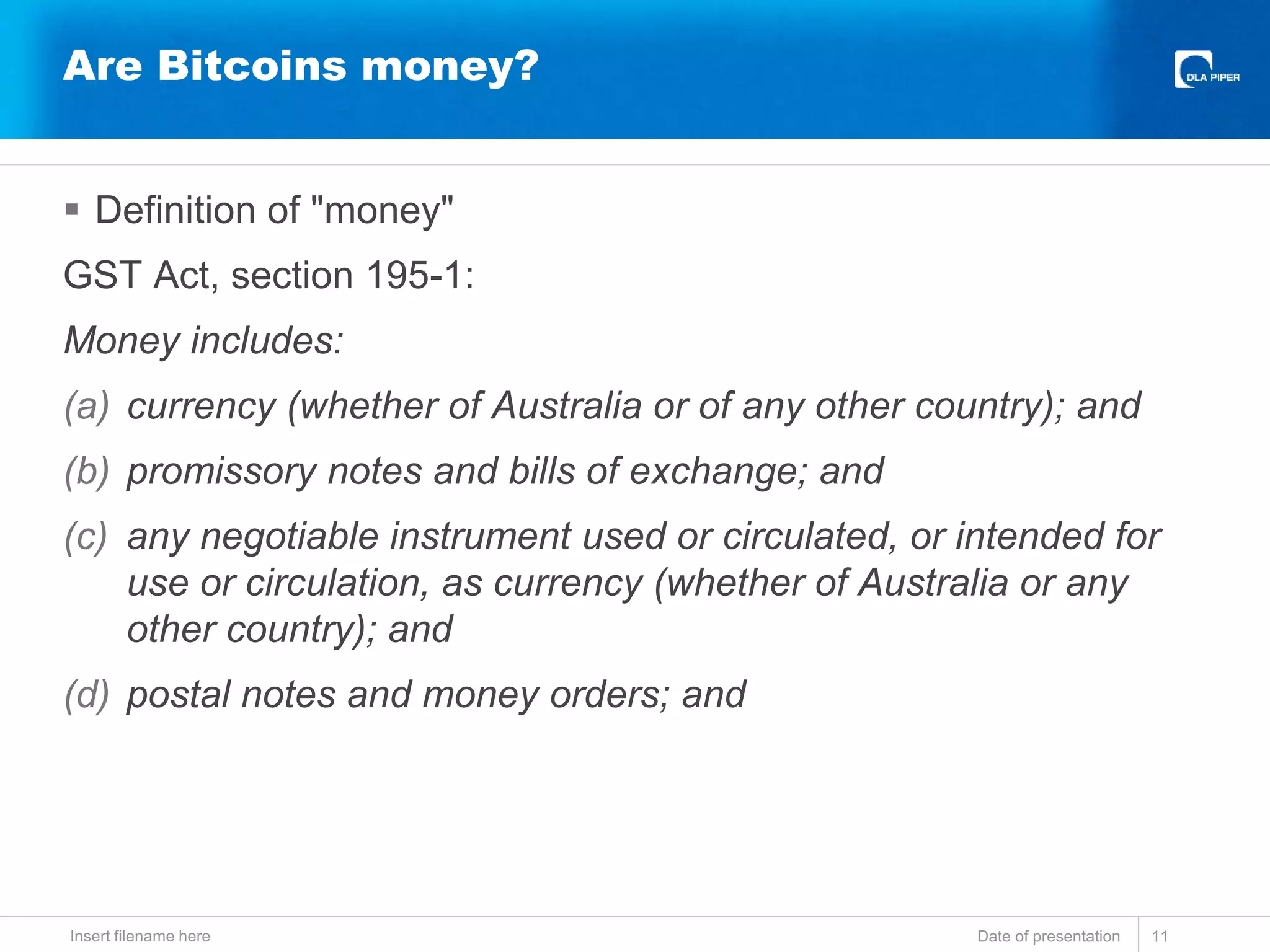

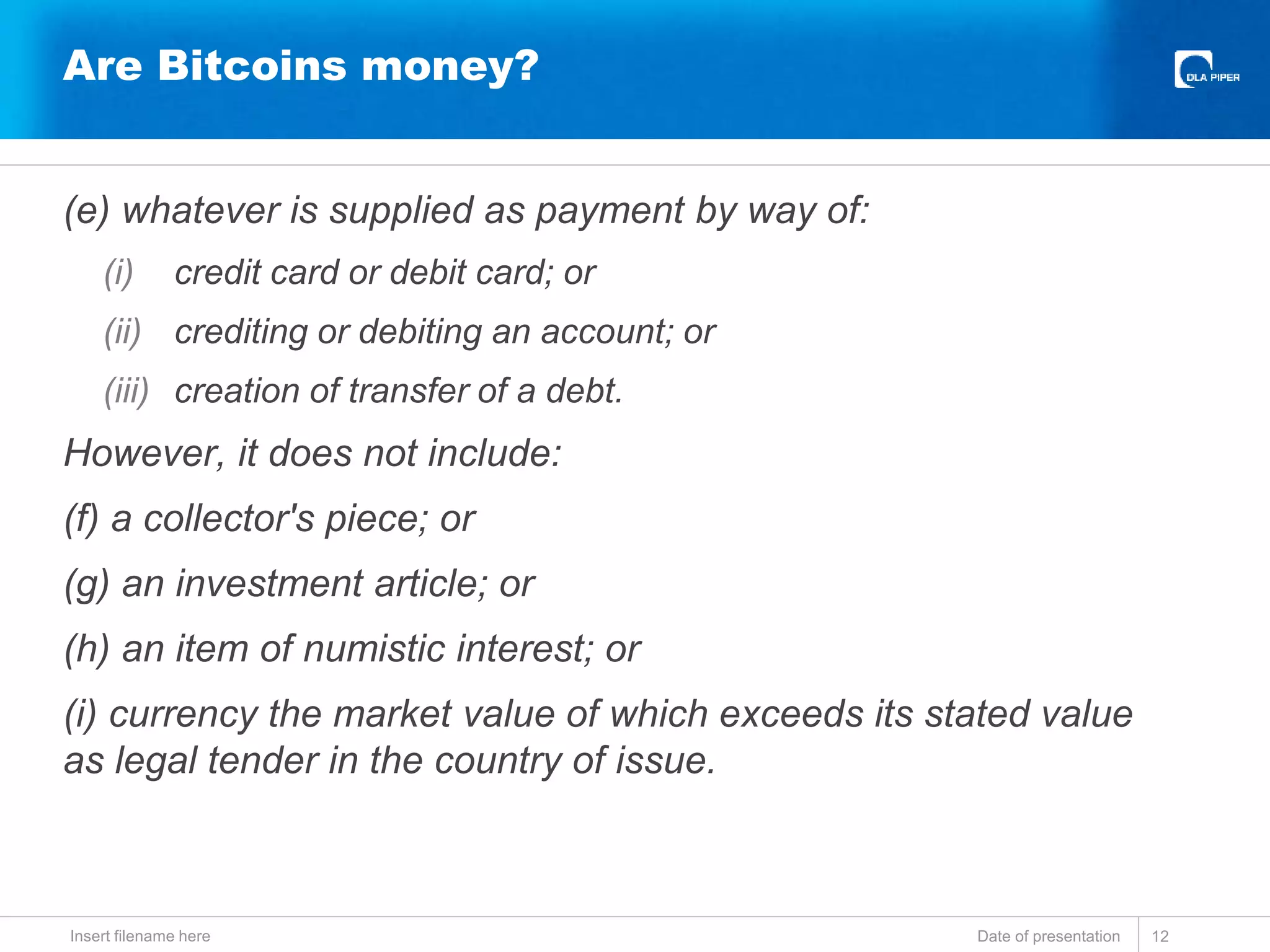

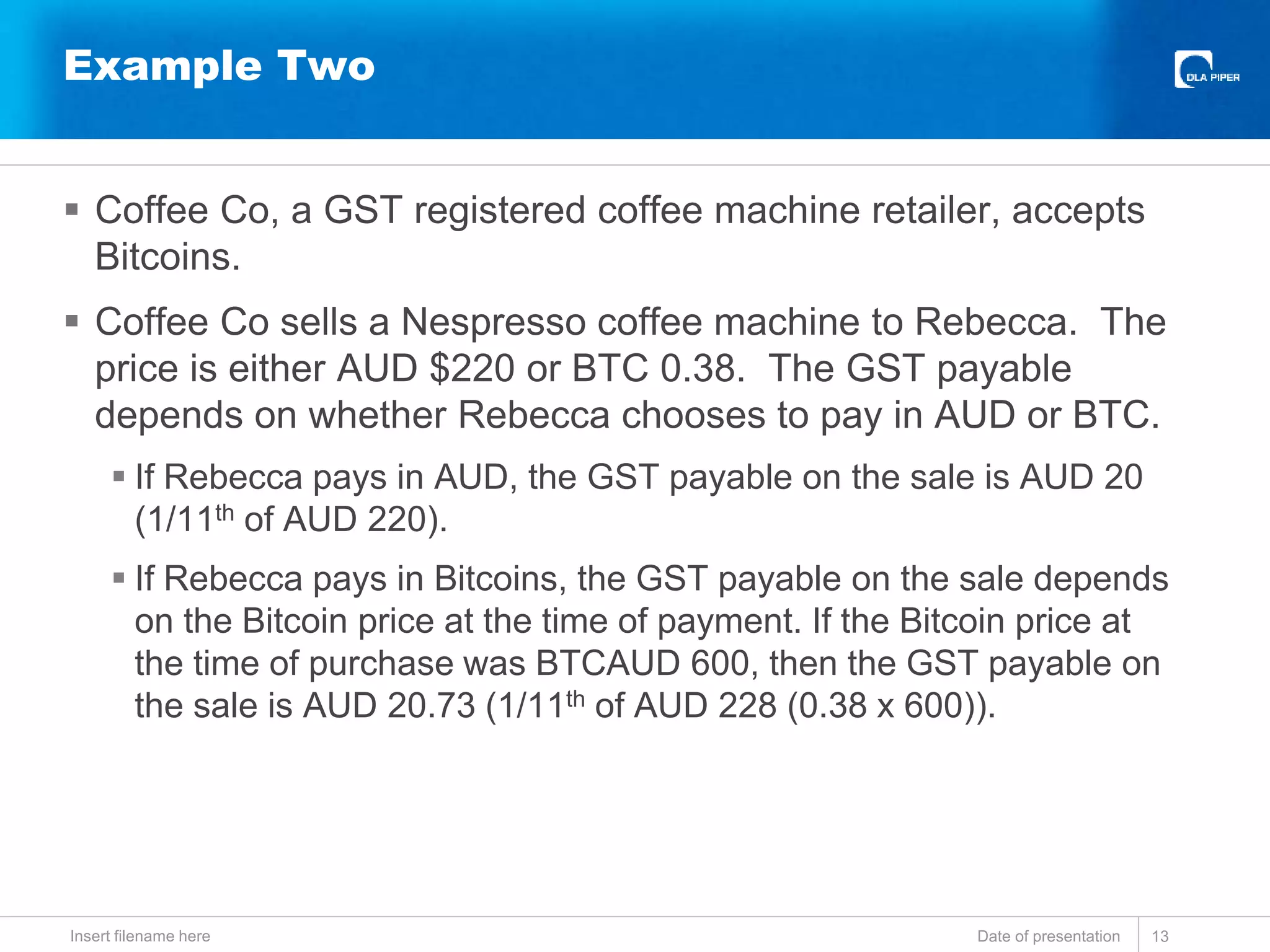

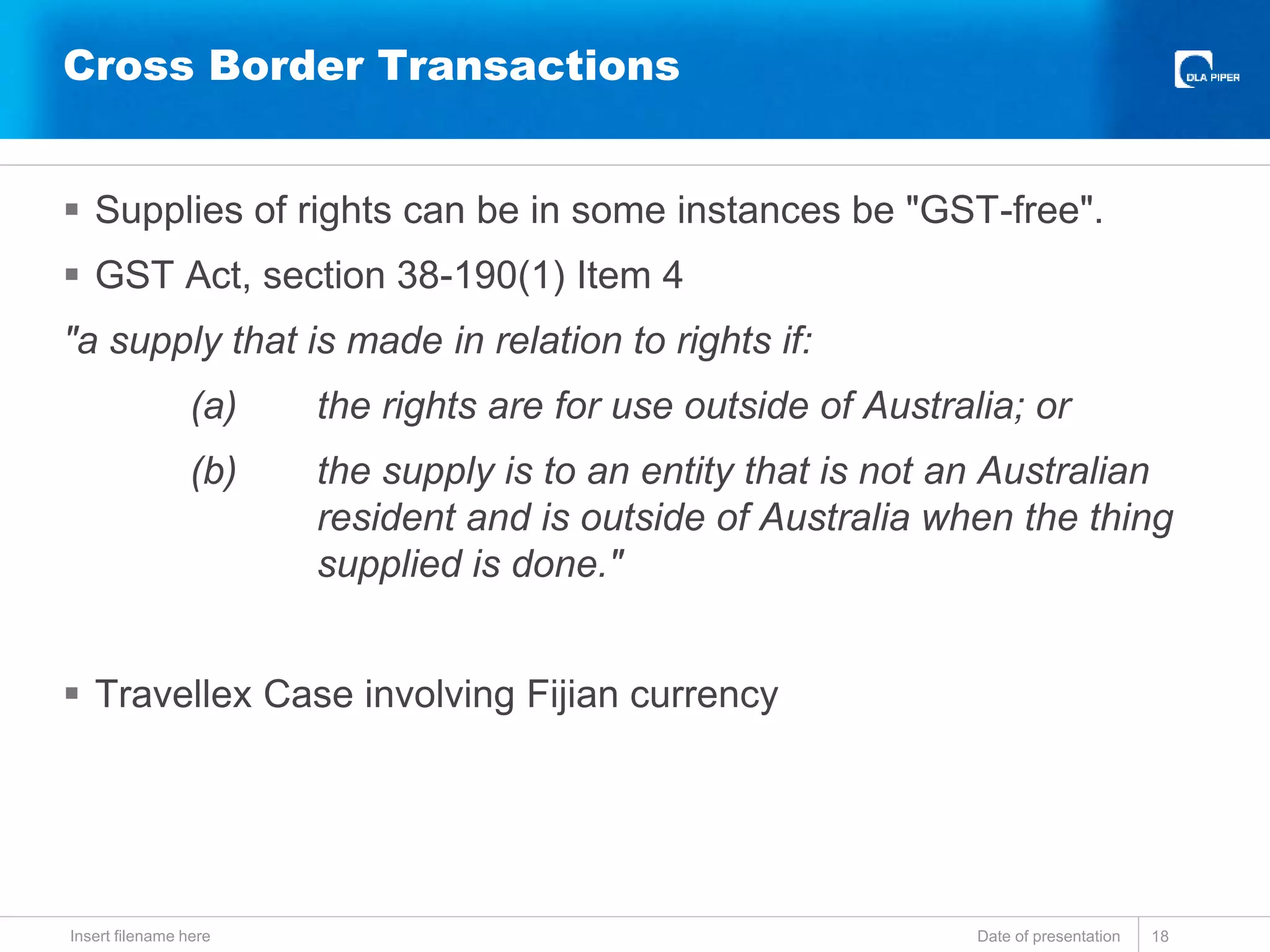

This document discusses potential GST issues related to bitcoin transactions in Australia. It notes that if a GST registered business sells bitcoins or uses bitcoins to purchase goods and services in Australia, a GST liability may arise. However, bitcoins are not clearly defined as "money" under the GST Act, so bitcoin transactions could be considered barter transactions subject to GST. The document also discusses practical challenges of calculating GST on bitcoin transactions and potential double taxation in some cross-border situations.