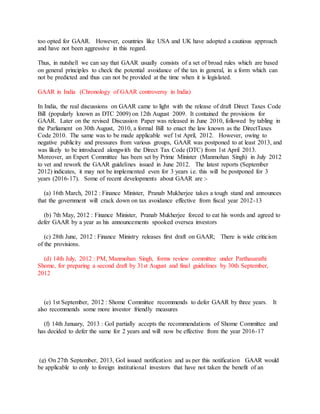

General Anti-Avoidance Rules (GAAR) are designed to prevent tax avoidance by denying tax benefits to transactions lacking commercial substance. In India, GAAR has faced significant opposition due to fears of arbitrary application by tax authorities, leading to multiple delays in implementation. Ultimately, GAAR is set to be implemented starting April 1, 2017, with assurances from the government regarding procedural safeguards to protect taxpayers.