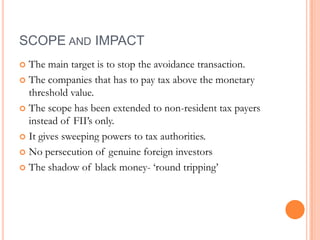

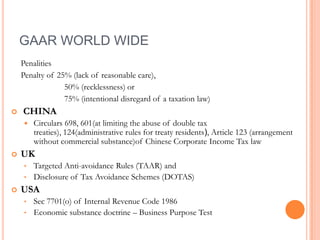

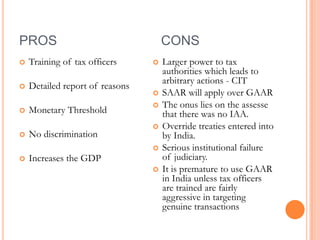

GAAR is a set of broad rules introduced by the Indian government to prevent tax avoidance. It allows tax authorities to deny tax benefits from "impermissible avoidance arrangements" that lack commercial purpose or result in a misuse of tax treaty provisions. While aimed at stopping abusive tax avoidance, critics argue GAAR gives too much power to tax authorities and could discourage foreign investment if applied arbitrarily. The Shome Committee recommended safeguards like monetary thresholds and appeals processes before GAAR is invoked to address these concerns. Overall, GAAR remains a controversial but important measure for curbing tax avoidance so long as it is implemented judiciously.