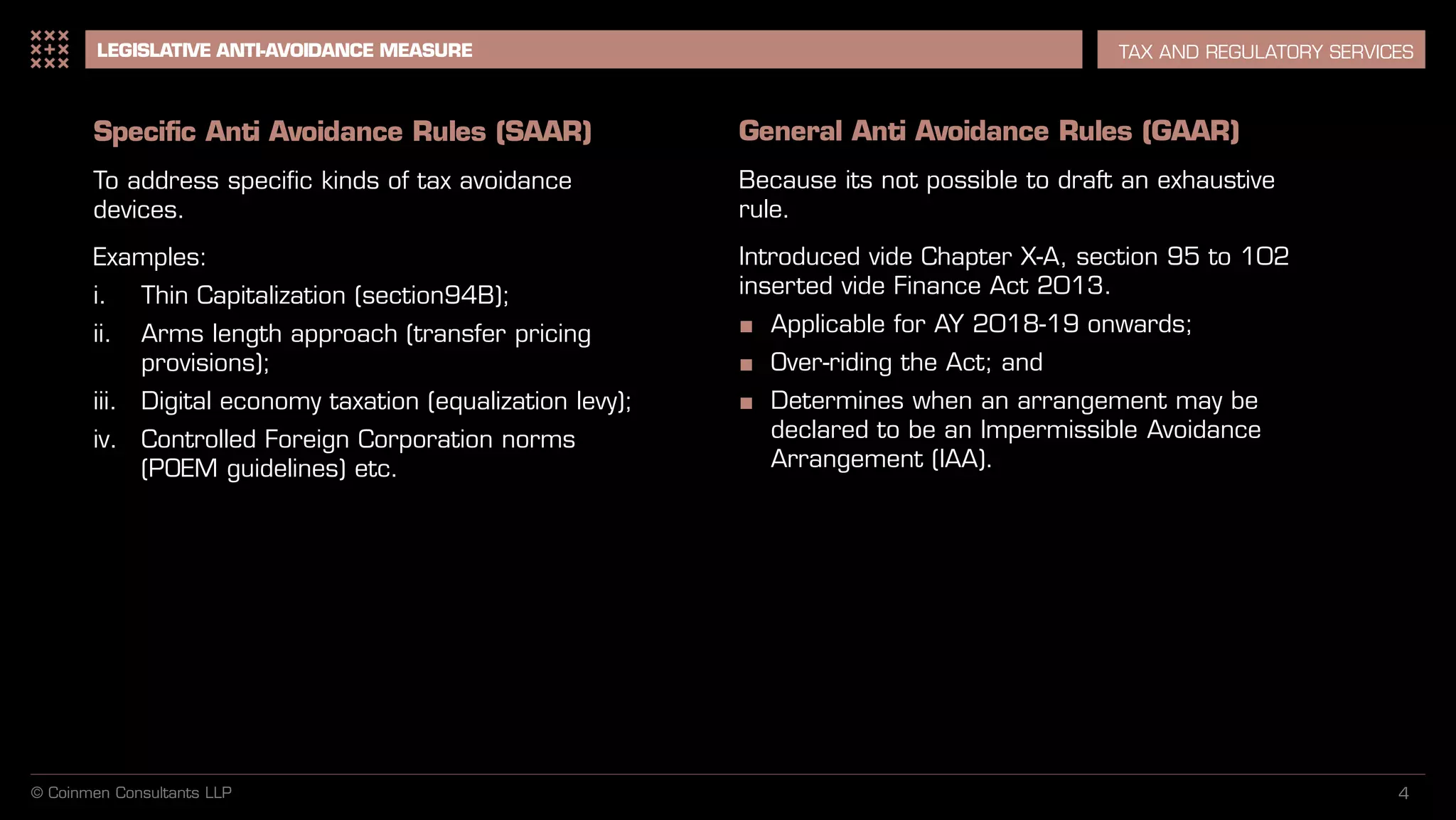

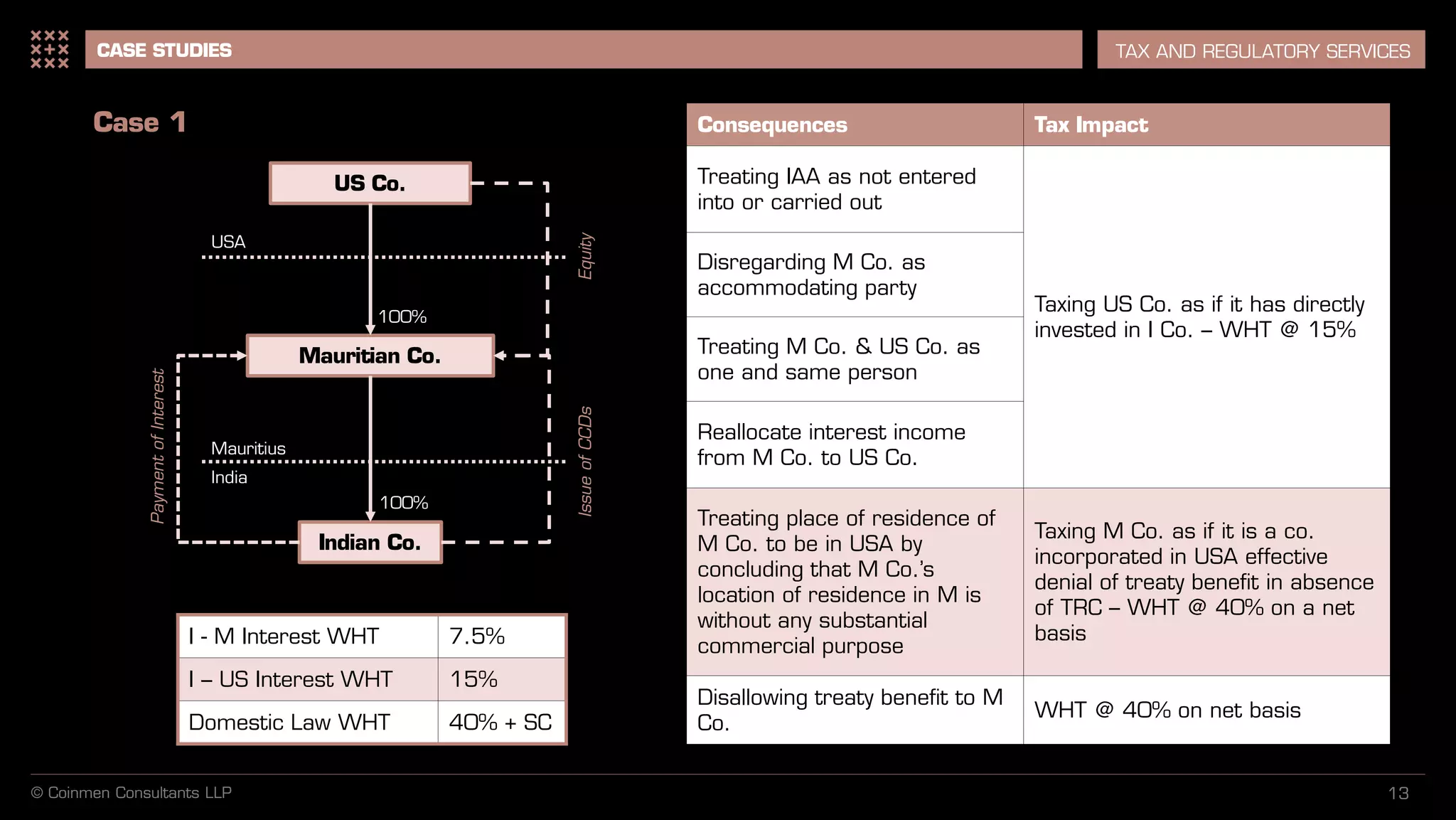

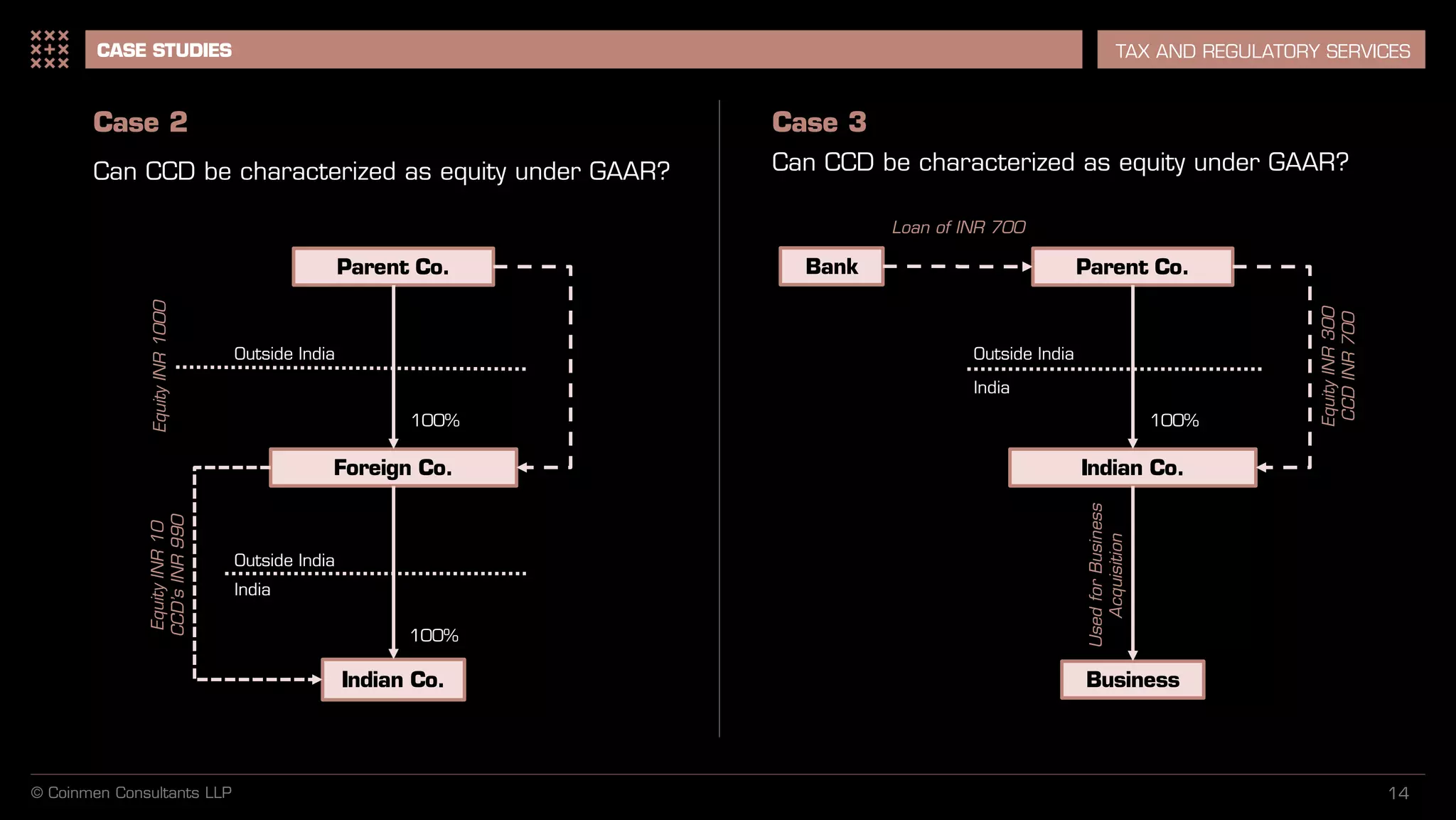

The document outlines the General Anti-Avoidance Rule (GAAR) introduced in India to combat tax avoidance through various arrangements deemed as impermissible avoidance arrangements (IAA). It details the criteria for classifying arrangements as IAAs, including lack of commercial substance and the potential consequences, such as denial of tax benefits. The document further clarifies the coexistence of GAAR and Specific Anti-Avoidance Rules (SAAR), along with conditions under which GAAR may not apply.