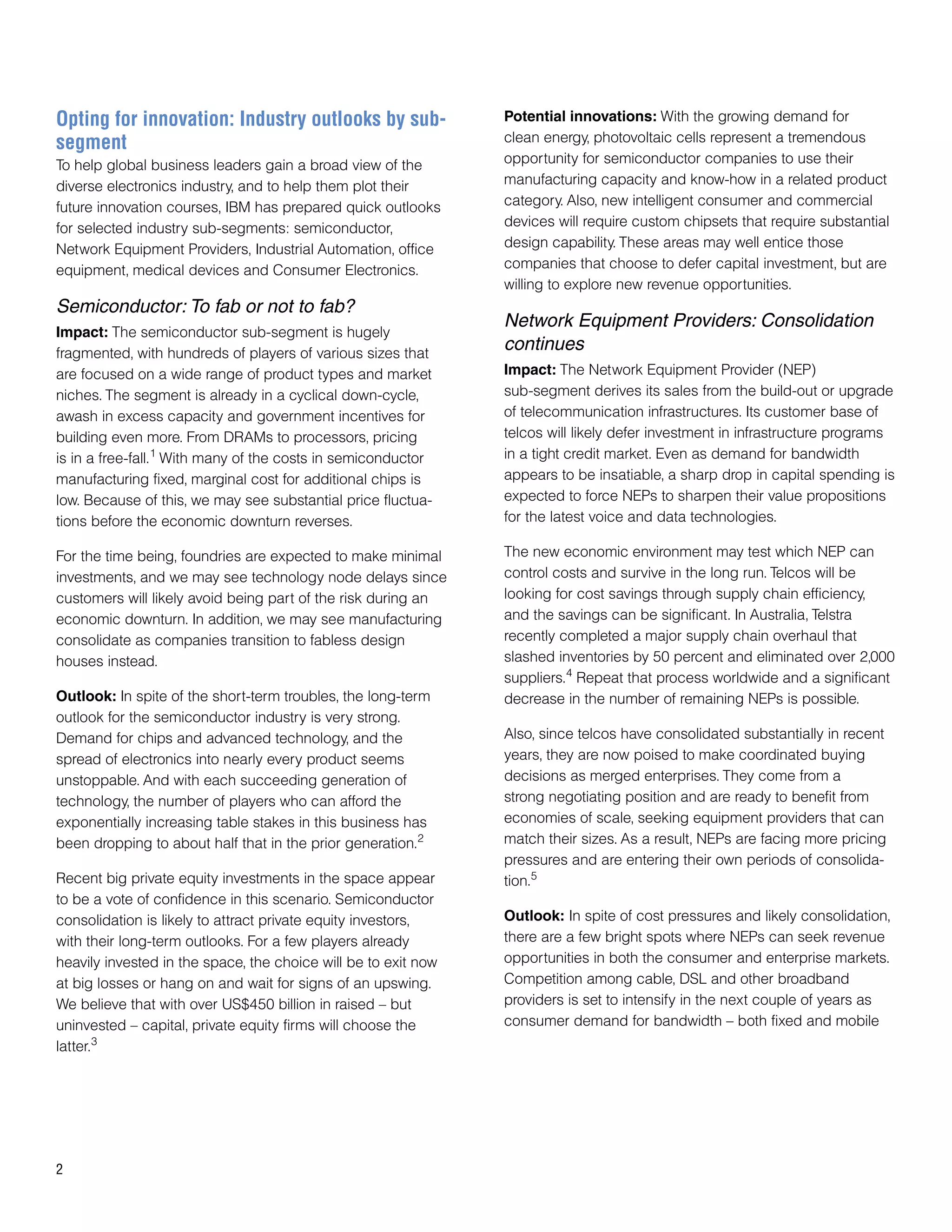

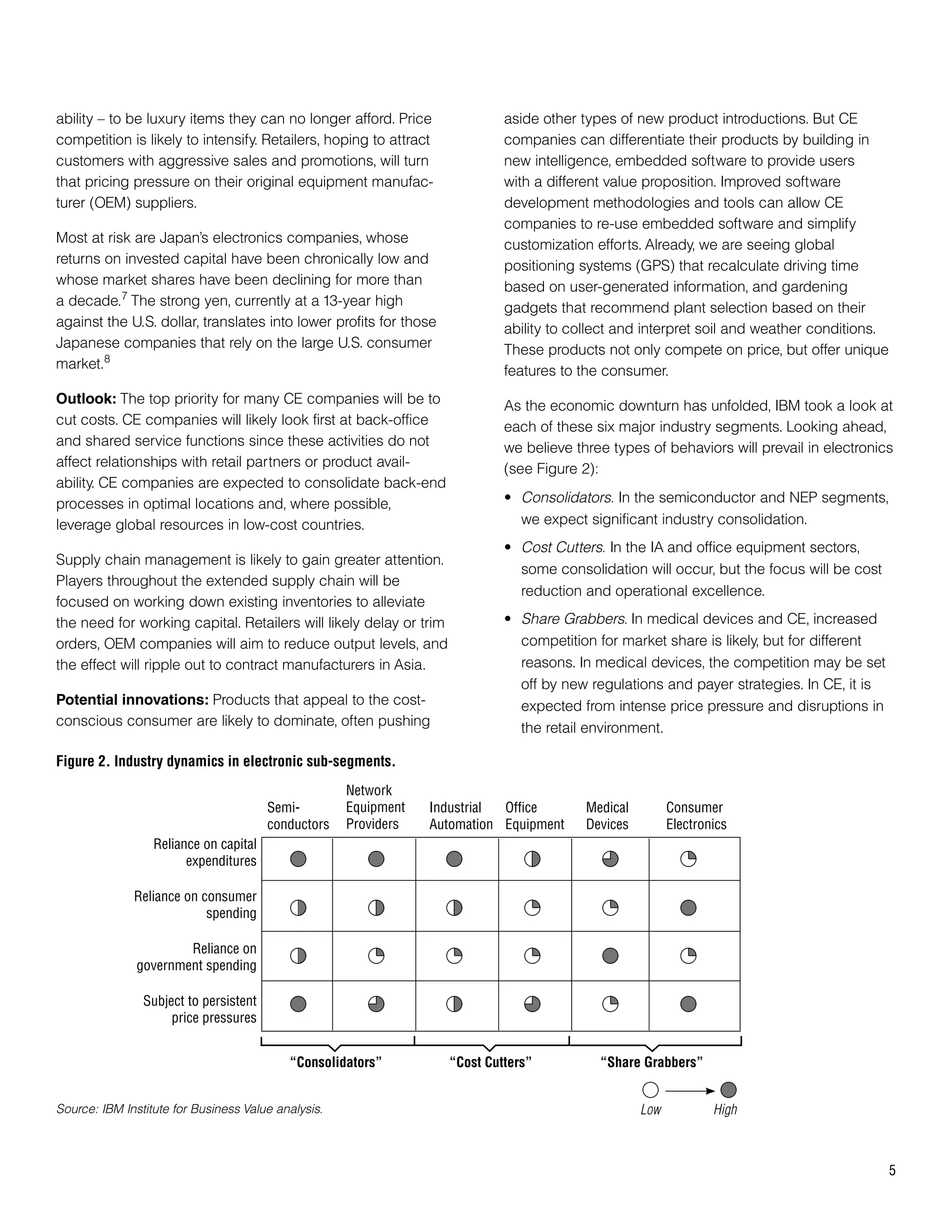

The document discusses the challenges and opportunities facing various sub-segments of the electronics industry amid economic downturns, emphasizing the need for innovation and adaptation. It categorizes segments such as semiconductors, network equipment providers, and consumer electronics, each responding differently to lowered consumer spending and stricter access to capital. Key strategies identified include consolidation, cost-cutting, and focusing on emerging technologies to maintain competitiveness and drive future growth.