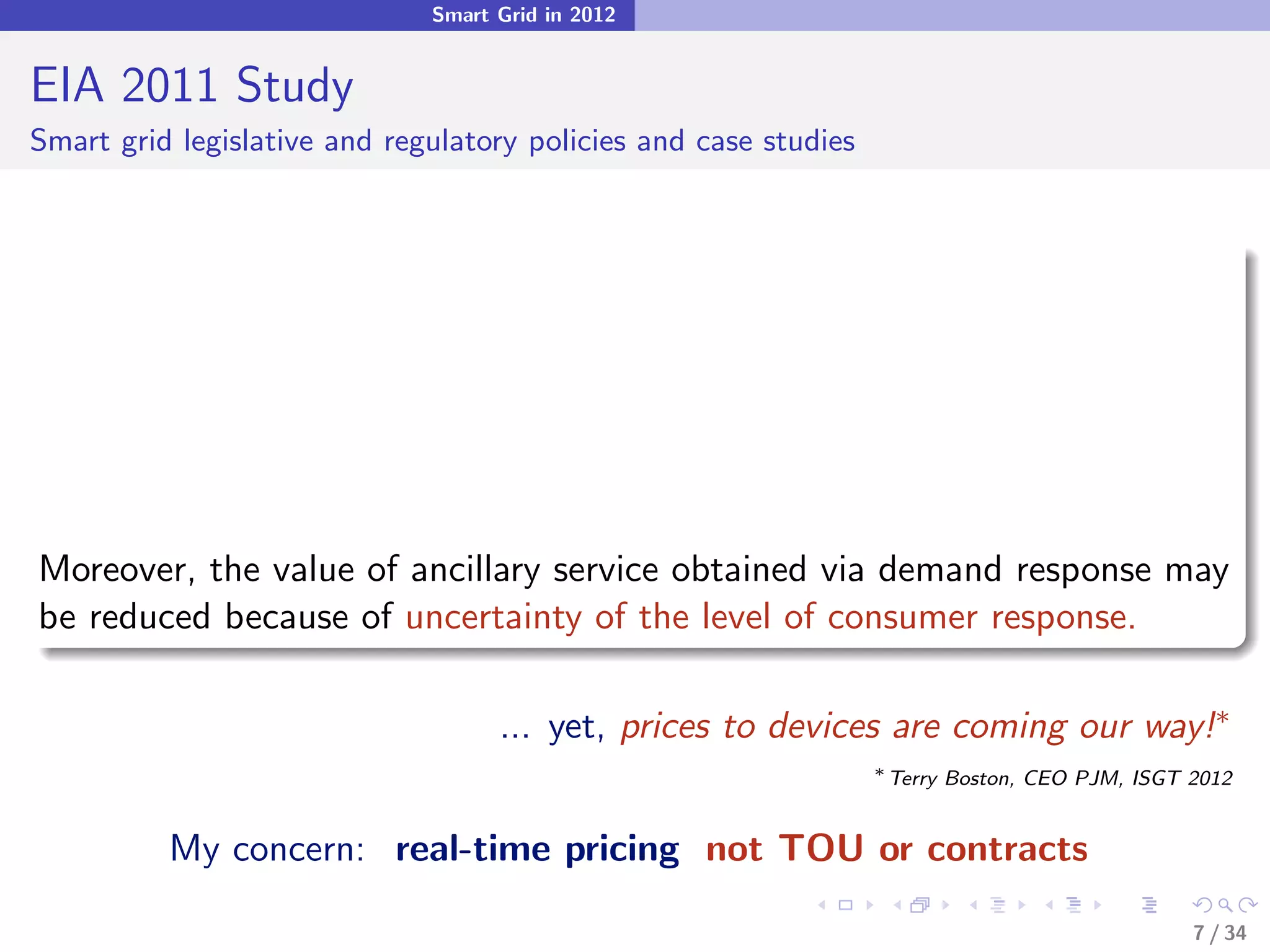

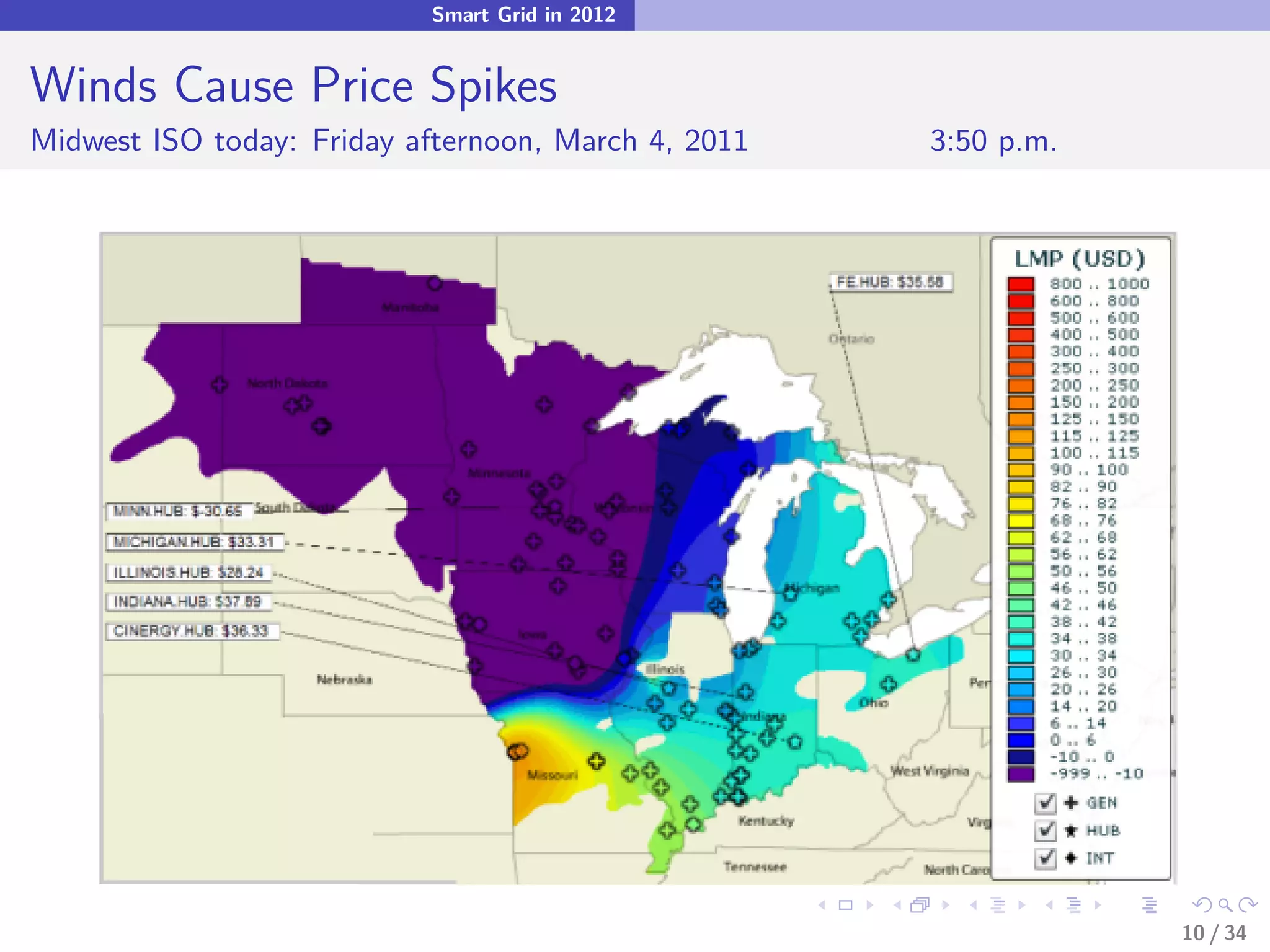

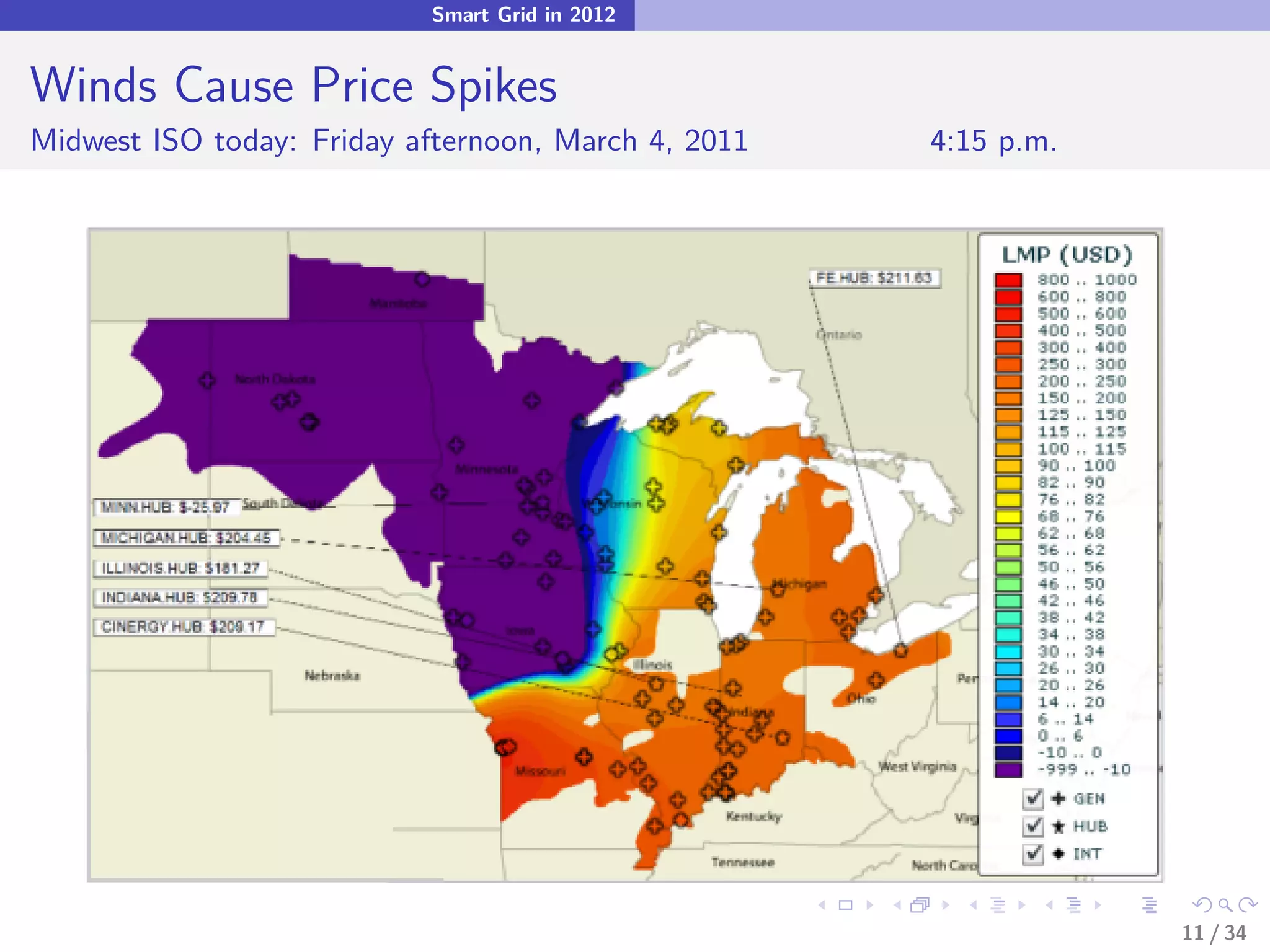

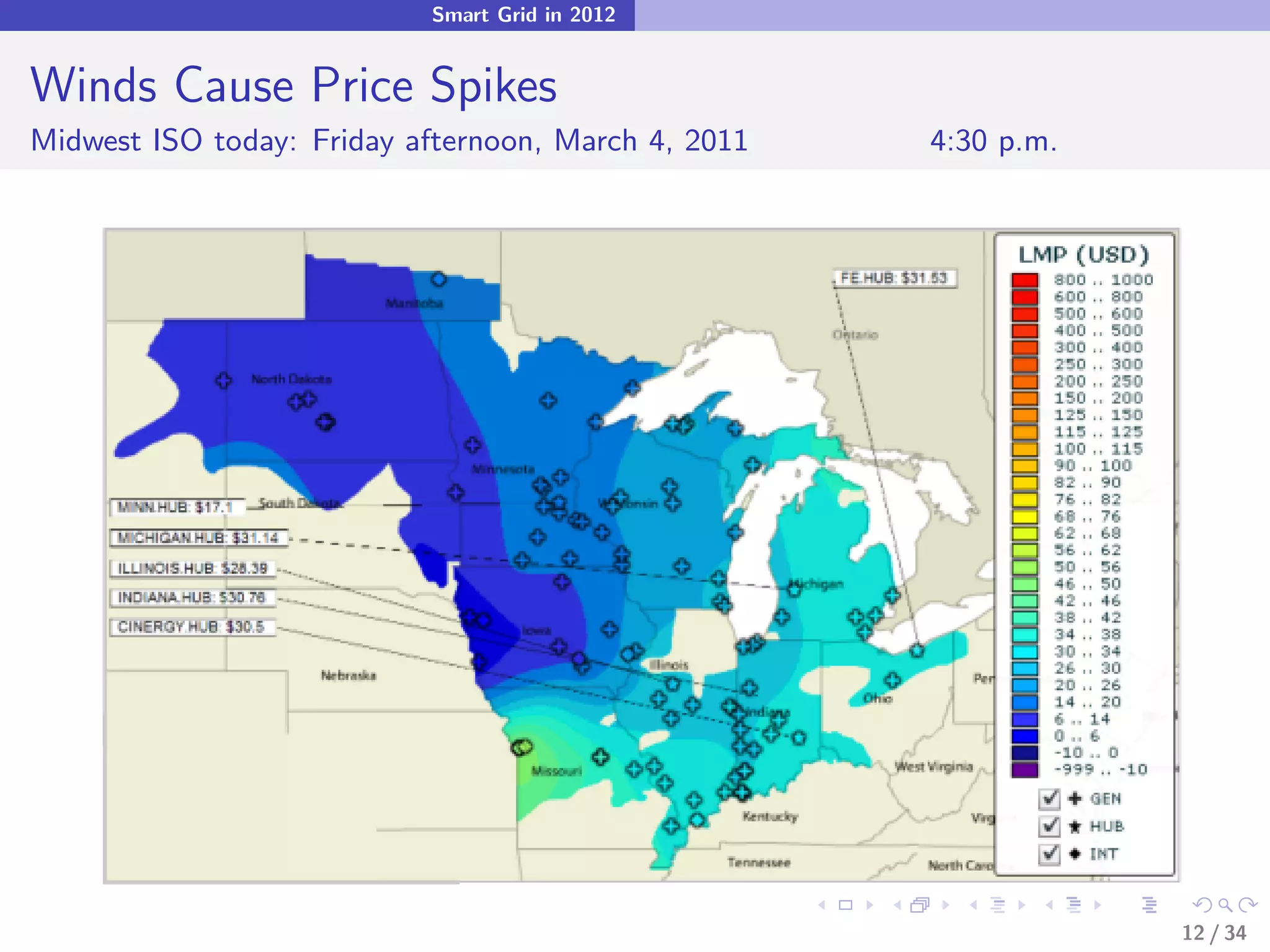

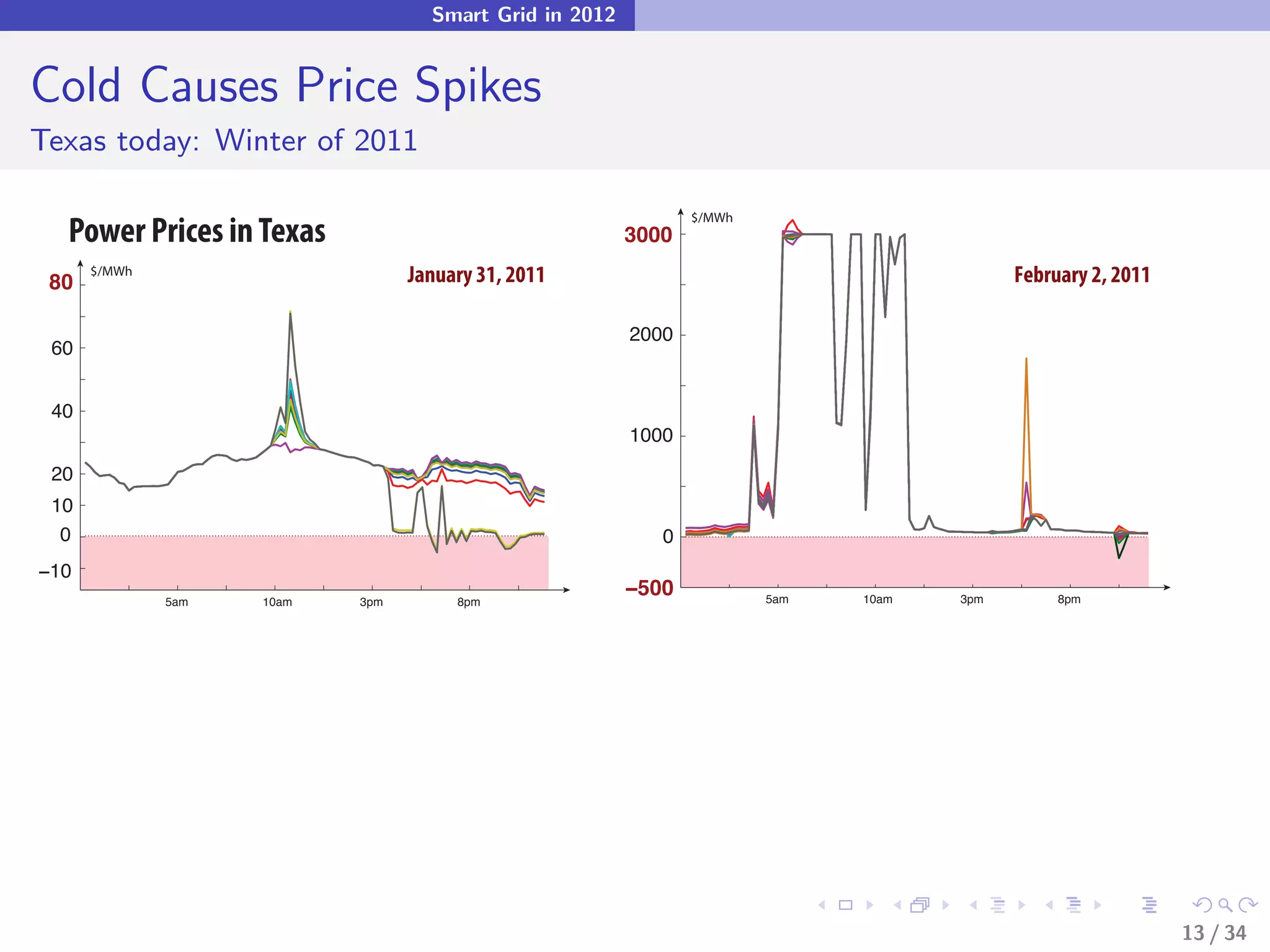

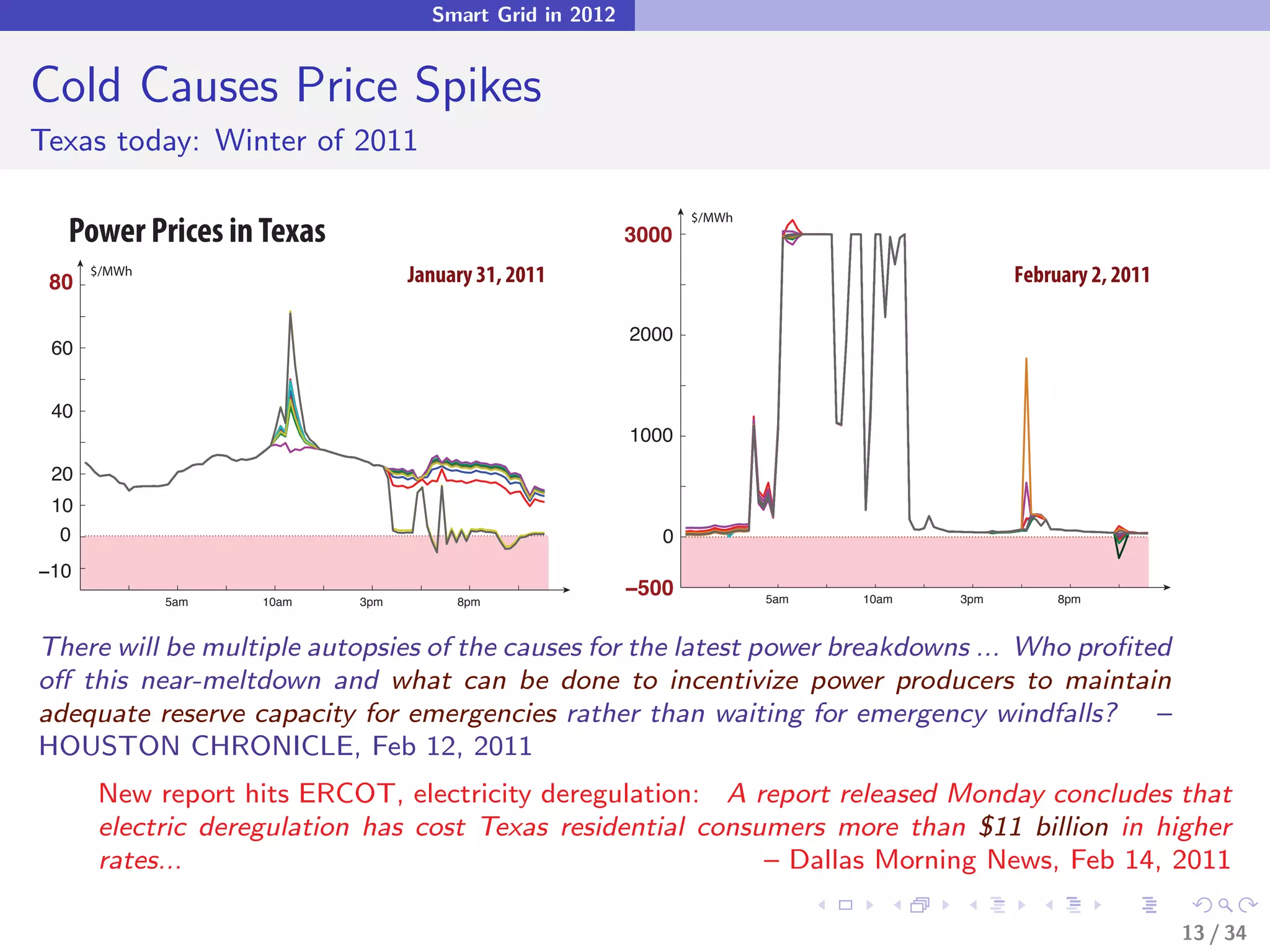

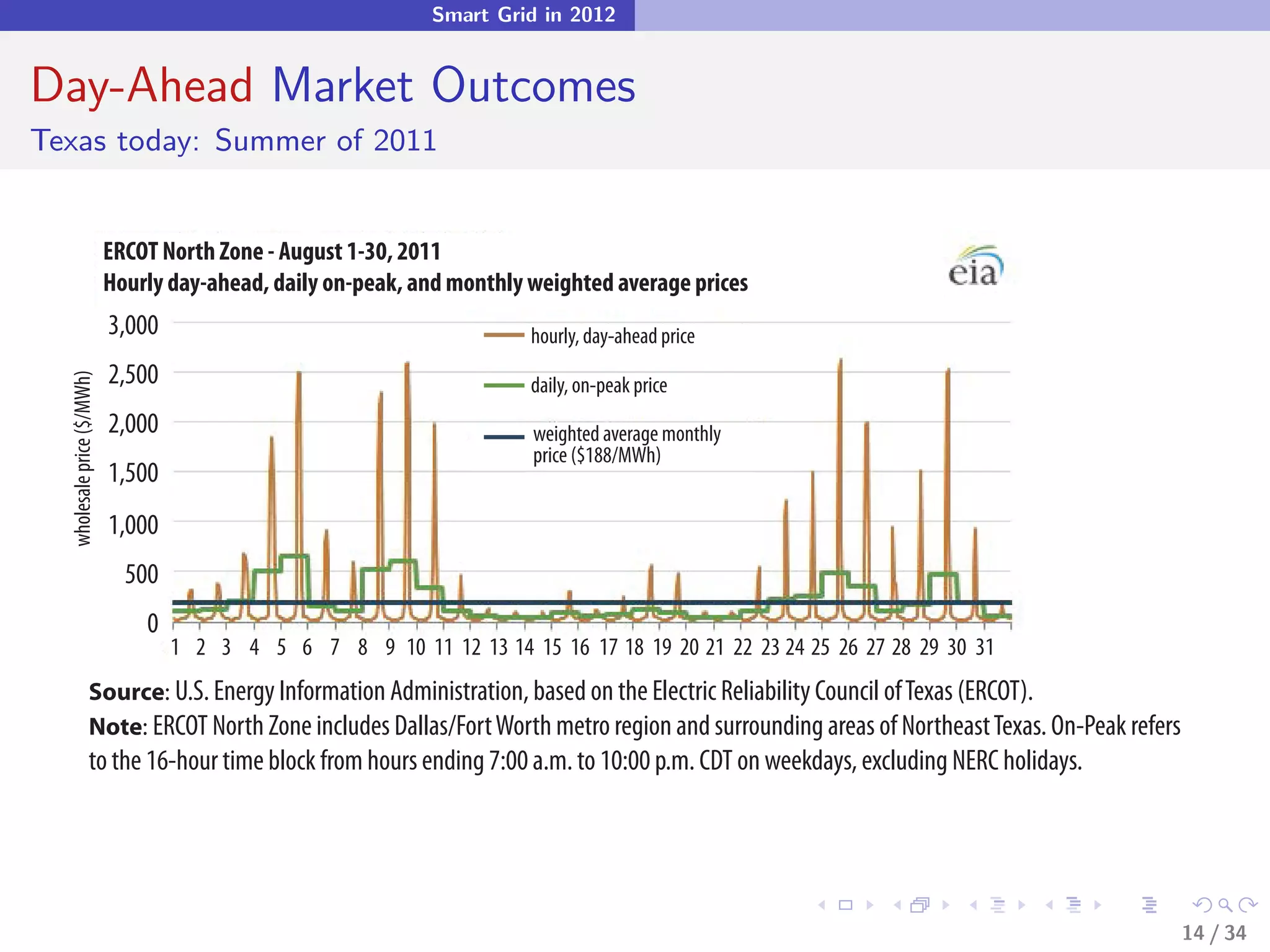

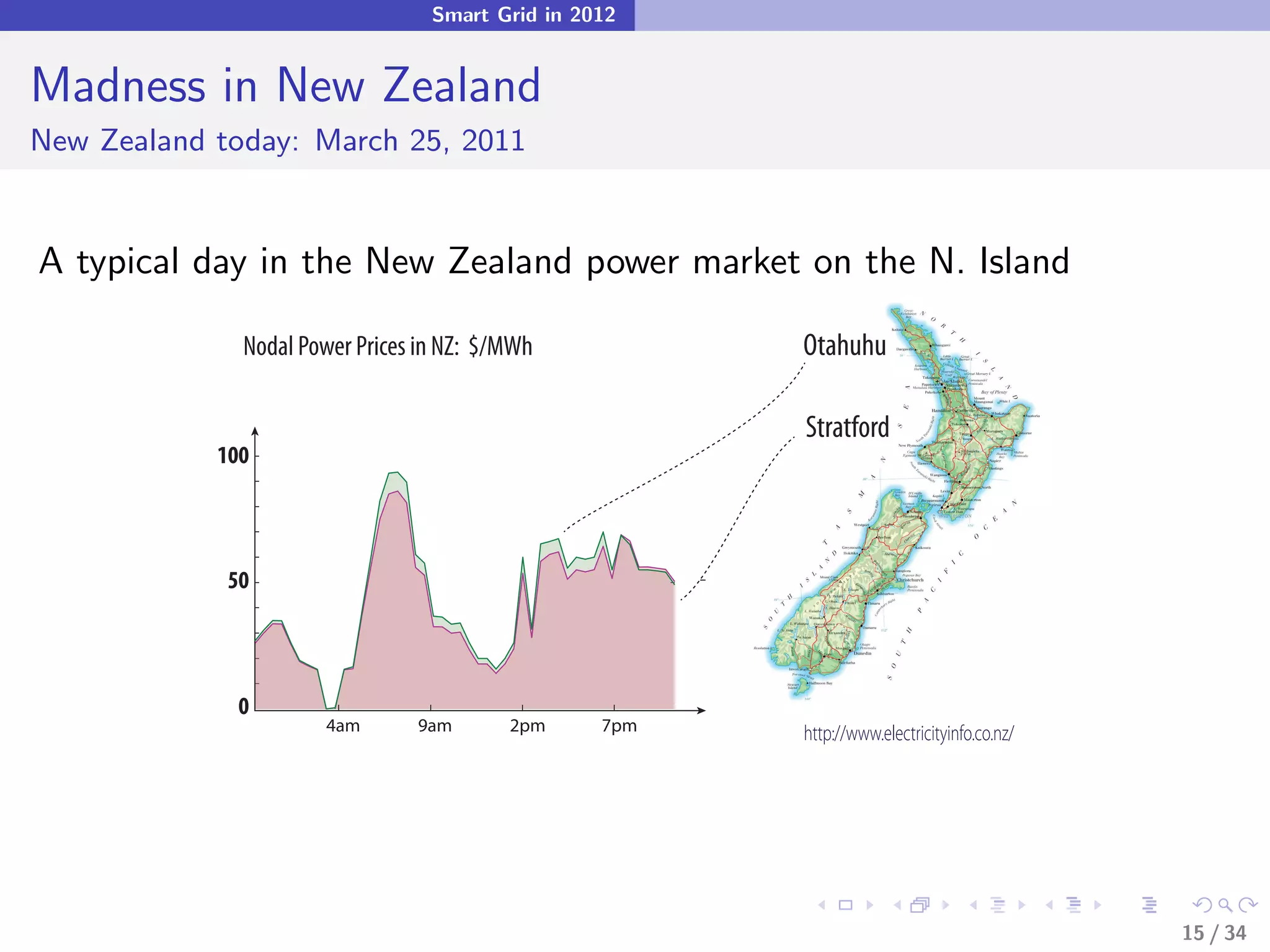

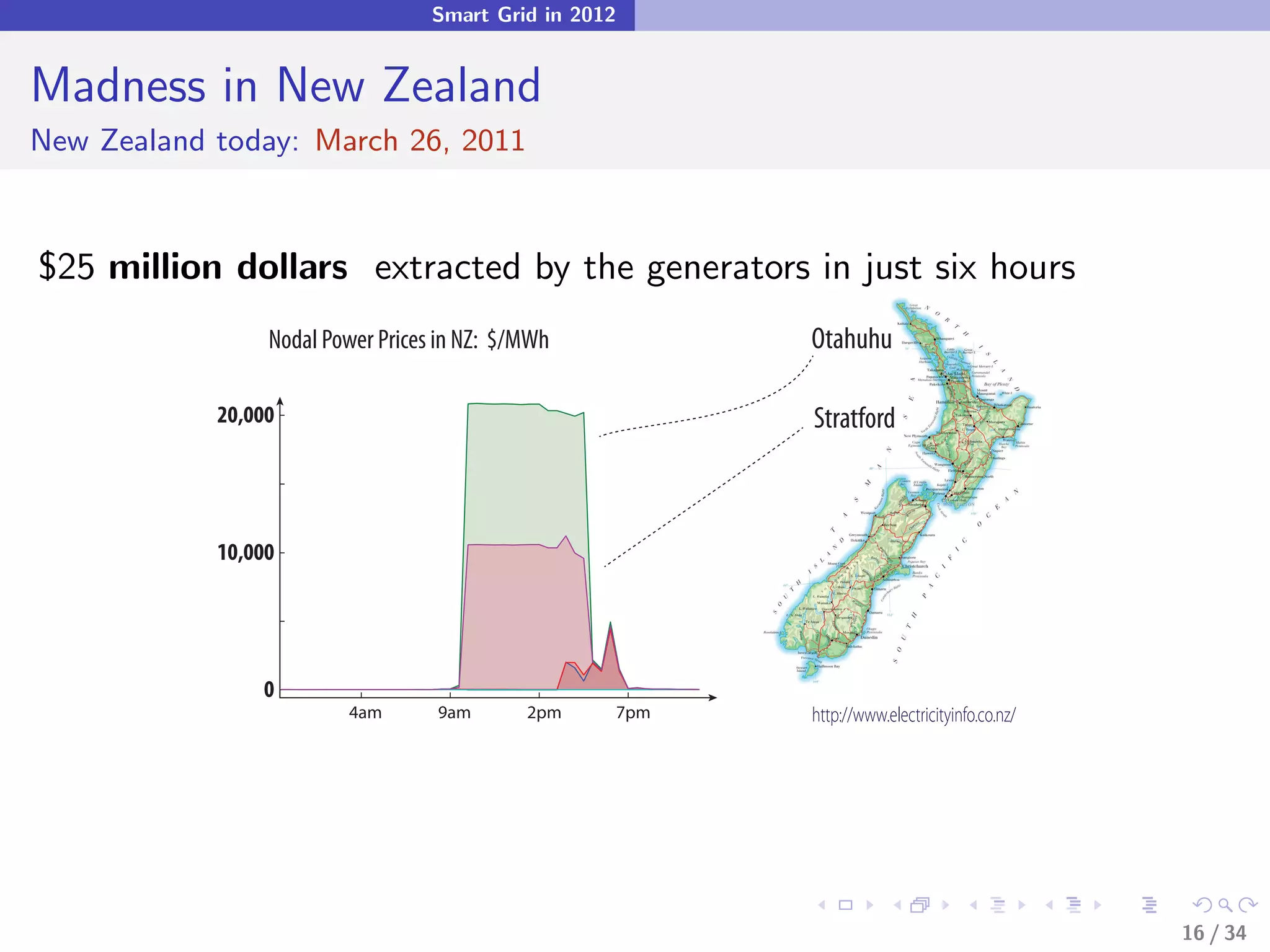

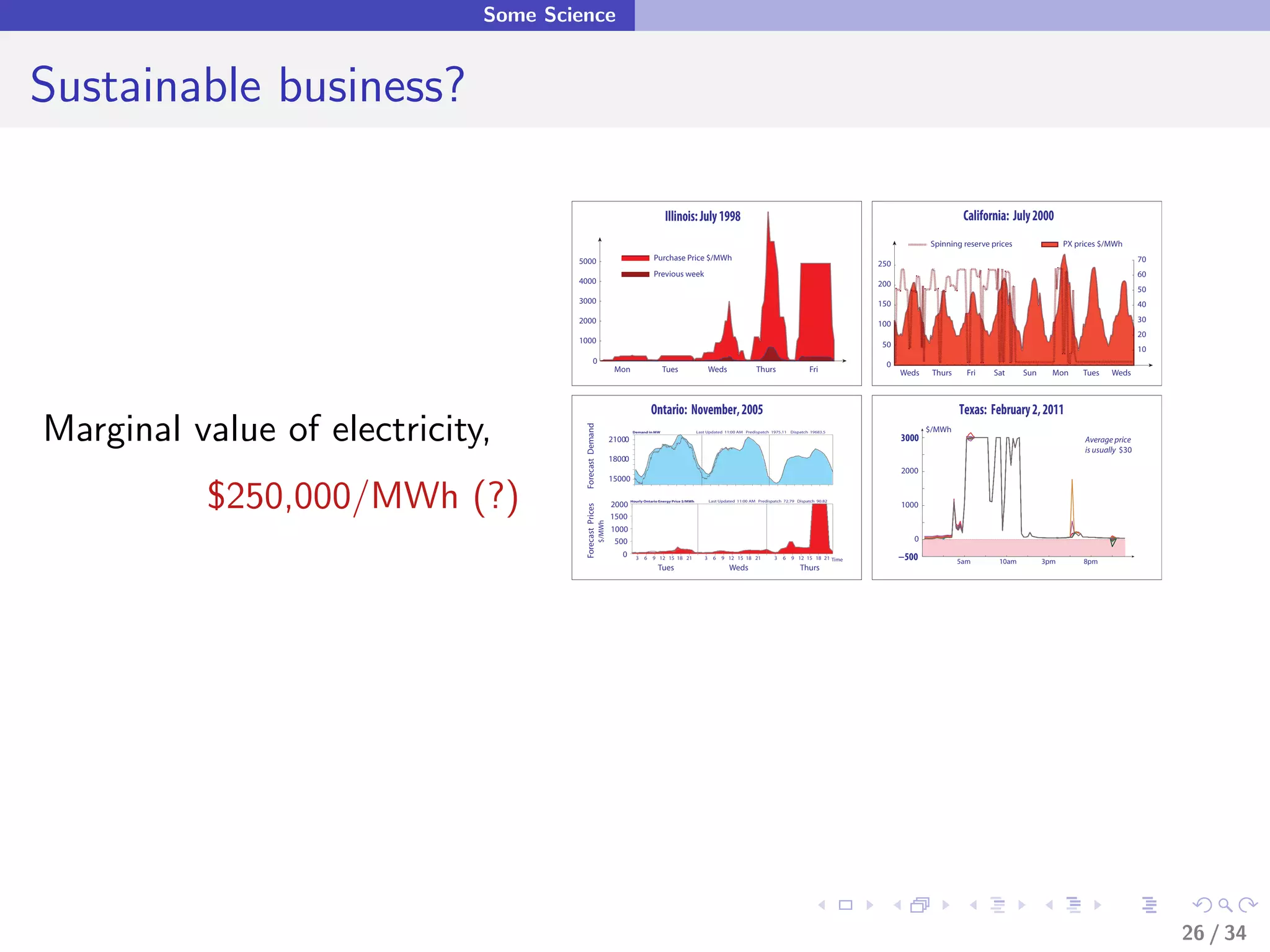

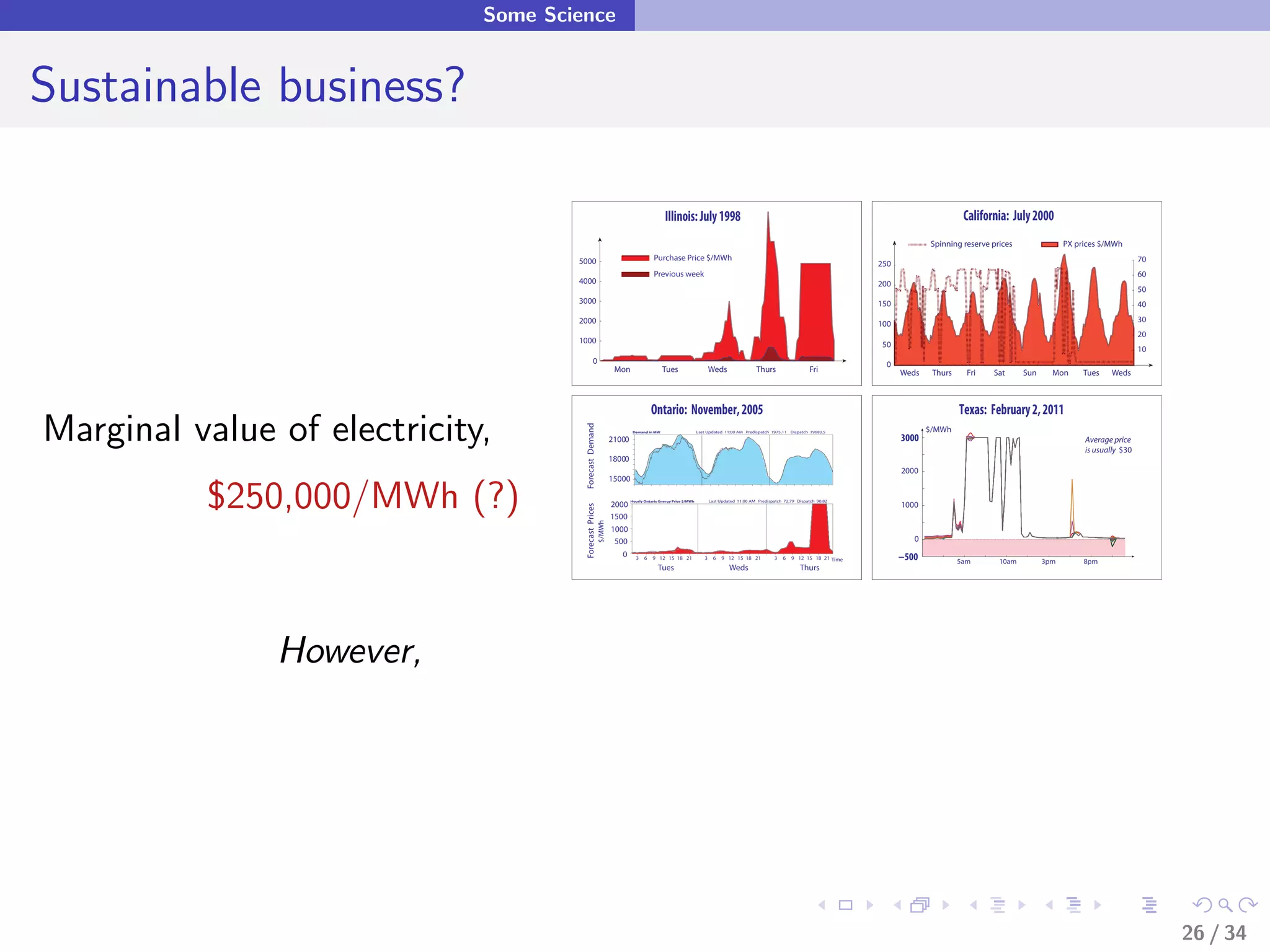

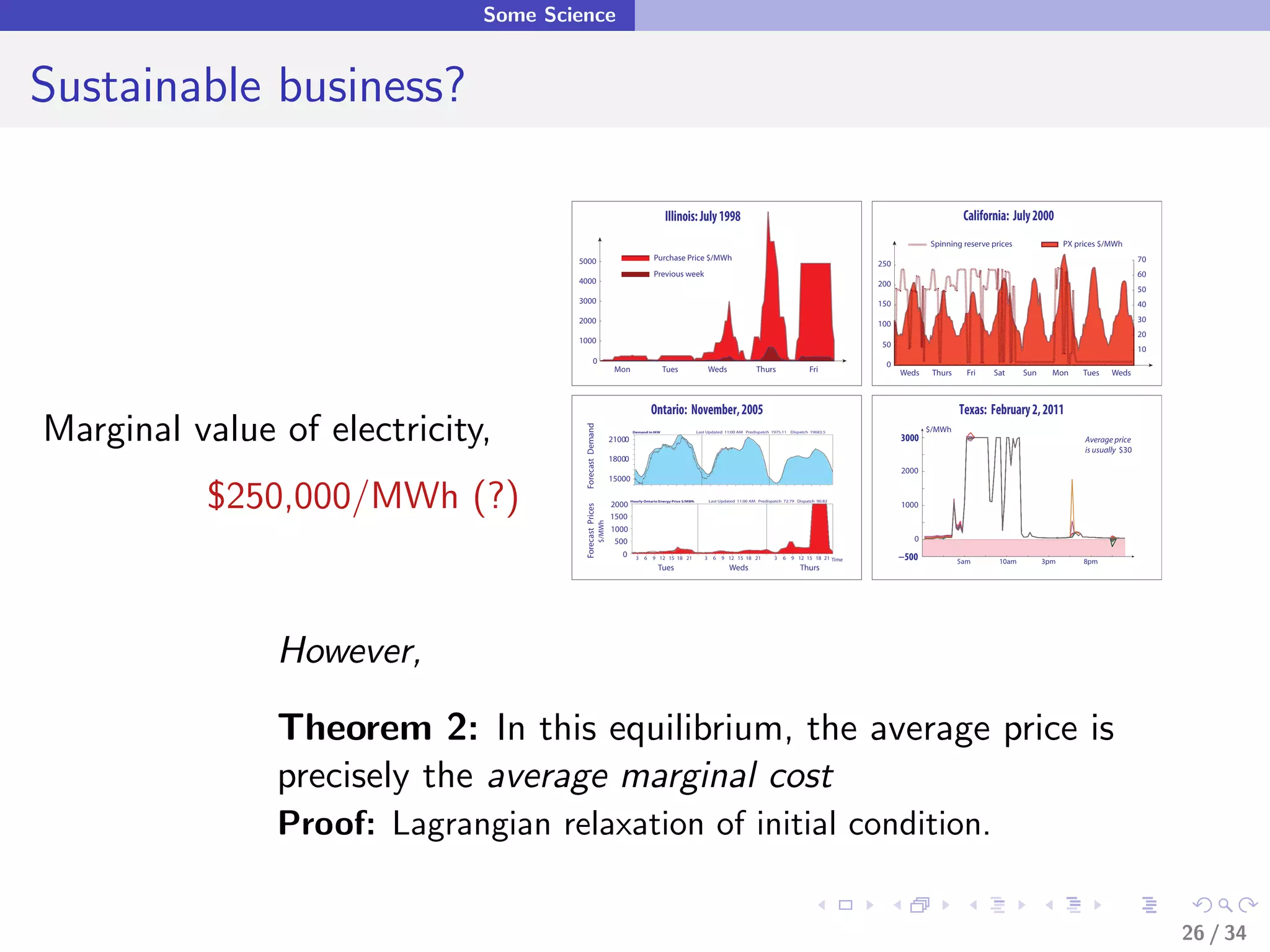

The document discusses the need for a new energy infrastructure to support renewable energy, emphasizing that electricity should be treated as a service rather than a commodity. It outlines various advancements and challenges in implementing smart grid technologies, highlighting the importance of real-time control and the active participation of consumers in managing electricity demand. Additionally, it presents insights into market dynamics, pricing strategies, and regulatory changes necessary for integrating renewable energy sources.

![Smart Grid in 2012

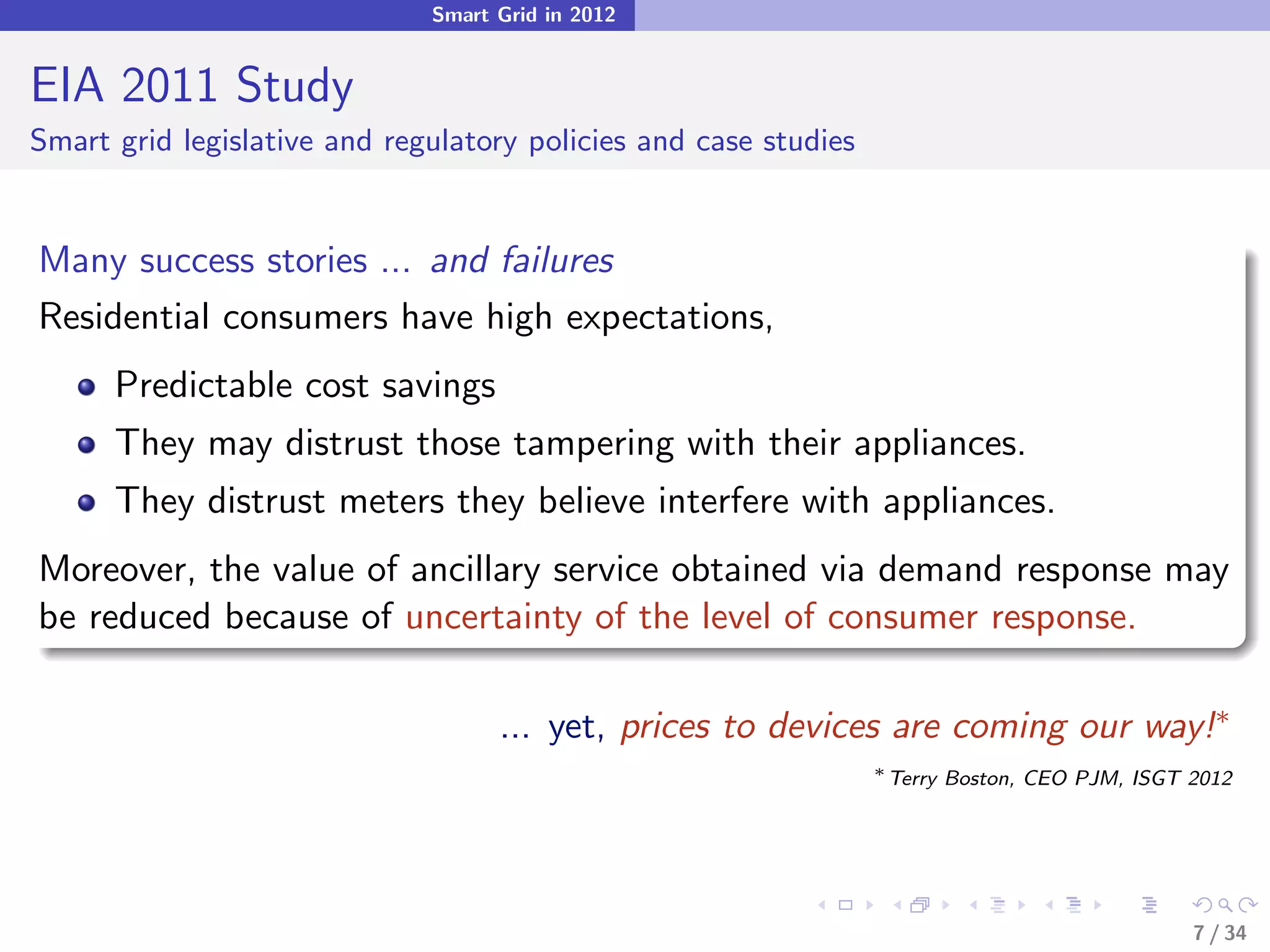

EIA 2011 Study

Case studies ... very little to say on real-time prices

"The active participation of final demand in the wholesale market is essential to managing

the greater intermittency of renewable resources and in limiting the ability of wholesale

electricity suppliers to exercise unilateral market power. A demand that is able to reduce its

consumption in real-time in response to higher prices limits the ability of suppliers

to exercise unilateral market power in a formal wholesale market such as the California ISO"

(http://www.stanford.edu/group/fwolak/cgi-

bin/sites/default/files/files/little_hoover_testimony_wolak_sept_2011.pdf) -F. Wolak

"Virtually all economists agree that the outcome [of the California crisis] was exacerbated by the inability of the demand side of the

market to respond to real or artificial supply shortages. This realization prompted my research stream on real-time electricity

pricing." - S. Borenstein

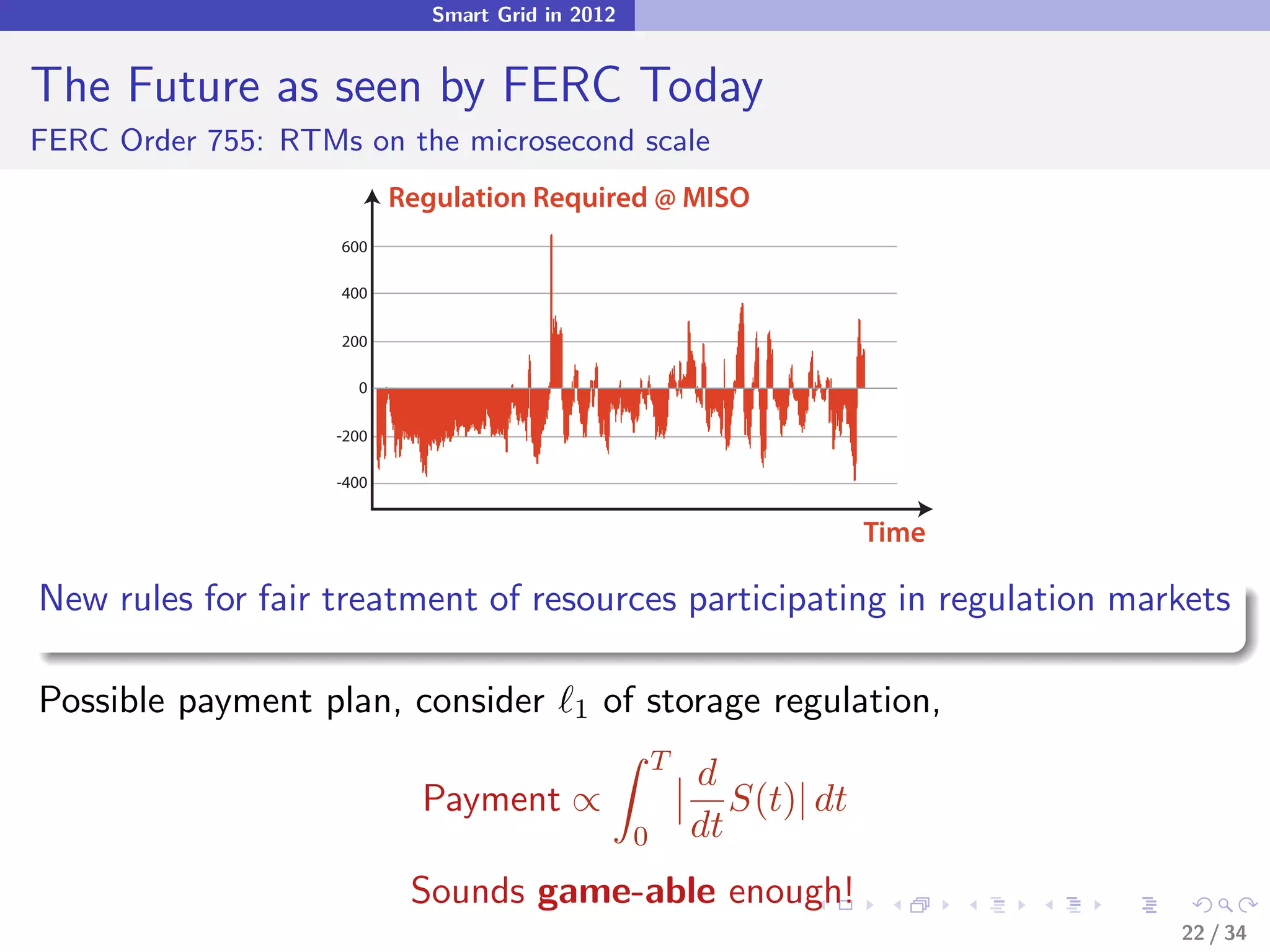

My concern: real-time pricing not TOU or contracts

8 / 34](https://image.slidesharecdn.com/montrealtutorialspm-121107150219-phpapp01/75/2012-Tutorial-Markets-for-Differentiated-Electric-Power-Products-15-2048.jpg)

![Some Science

Equilibrium with Dynamics & Network Constraints

Entropic prices

Theorem 1: When dynamics (temporal constraints) are taken into

account, price is never equal to marginal cost [5, 4, 3, 1]

24 / 34](https://image.slidesharecdn.com/montrealtutorialspm-121107150219-phpapp01/75/2012-Tutorial-Markets-for-Differentiated-Electric-Power-Products-40-2048.jpg)

![Some Science

Equilibrium with Dynamics & Network Constraints

Entropic prices

Theorem 1: When dynamics (temporal constraints) are taken into

account, price is never equal to marginal cost [5, 4, 3, 1]

Equilibrium price

The equilibrium price process is a function of equilibrium reserves:

P ∗ (t) = p∗ (Re (t))

The marginal value of power to the consumer.

24 / 34](https://image.slidesharecdn.com/montrealtutorialspm-121107150219-phpapp01/75/2012-Tutorial-Markets-for-Differentiated-Electric-Power-Products-41-2048.jpg)

![Some Science

Equilibrium with Dynamics & Network Constraints

Entropic prices

Theorem 1: When dynamics (temporal constraints) are taken into

account, price is never equal to marginal cost [5, 4, 3, 1]

Equilibrium price

The equilibrium price process is a function of equilibrium reserves:

P ∗ (t) = p∗ (Re (t))

The marginal value of power to the consumer.

Proof: Lagrangian decomposition,

as in the static Second Welfare Theorem,

24 / 34](https://image.slidesharecdn.com/montrealtutorialspm-121107150219-phpapp01/75/2012-Tutorial-Markets-for-Differentiated-Electric-Power-Products-42-2048.jpg)

![Some Science

Equilibrium with Dynamics & Network Constraints

Entropic prices

Theorem 1: When dynamics (temporal constraints) are taken into

account, price is never equal to marginal cost [5, 4, 3, 1]

Equilibrium price

The equilibrium price process is a function of equilibrium reserves:

P ∗ (t) = p∗ (Re (t))

The marginal value of power to the consumer.

Proof: Lagrangian decomposition,

as in the static Second Welfare Theorem,

or the proof of the Minimum Principle.

24 / 34](https://image.slidesharecdn.com/montrealtutorialspm-121107150219-phpapp01/75/2012-Tutorial-Markets-for-Differentiated-Electric-Power-Products-43-2048.jpg)

![Some Science

Equilibrium with Dynamics & Network Constraints

Entropic prices

What is marginal value?

It is not always obvious. With the introduction of network constraints,

Prices can go well beyond marginal value (as defined in static model)

Prices can go well below zero

[Dynamic competitive equilibria in electricity markets. Wang et. al. 2011]

25 / 34](https://image.slidesharecdn.com/montrealtutorialspm-121107150219-phpapp01/75/2012-Tutorial-Markets-for-Differentiated-Electric-Power-Products-45-2048.jpg)

![Some Science

Equilibrium with Dynamics & Network Constraints

Entropic prices

What is marginal value?

It is not always obvious. With the introduction of network constraints,

Prices can go well beyond marginal value (as defined in static model)

Prices can go well below zero

[Dynamic competitive equilibria in electricity markets. Wang et. al. 2011]

Without price-caps, Australia might look like an efficient equilibrium:

10,000 19,000 1,400

9,000

Victoria Demand 1,200 Tasmania 1,000

Price (Aus $/MWh)

8,000

Price (Aus $/MWh)

Volume (MW)

1,000

Volume (MW)

7,000

Demand

6,000 800

10,000

5,000 0

Prices 600

4,000

3,000 400

2,000 Prices

200 - 1,000

1,000 1,000

0 - 1,000 0 - 1,500

00:00

01:00

02:00

03:00

04:00

05:00

06:00

07:00

08:00

09:00

10:00

11:00

12:00

13:00

14:00

15:00

16:00

17:00

18:00

19:00

20:00

21:00

22:00

23:00

24:00

00:00

01:00

02:00

03:00

04:00

05:00

06:00

07:00

08:00

09:00

10:00

11:00

12:00

13:00

14:00

15:00

16:00

17:00

18:00

19:00

20:00

21:00

22:00

23:00

24:00

25 / 34](https://image.slidesharecdn.com/montrealtutorialspm-121107150219-phpapp01/75/2012-Tutorial-Markets-for-Differentiated-Electric-Power-Products-46-2048.jpg)

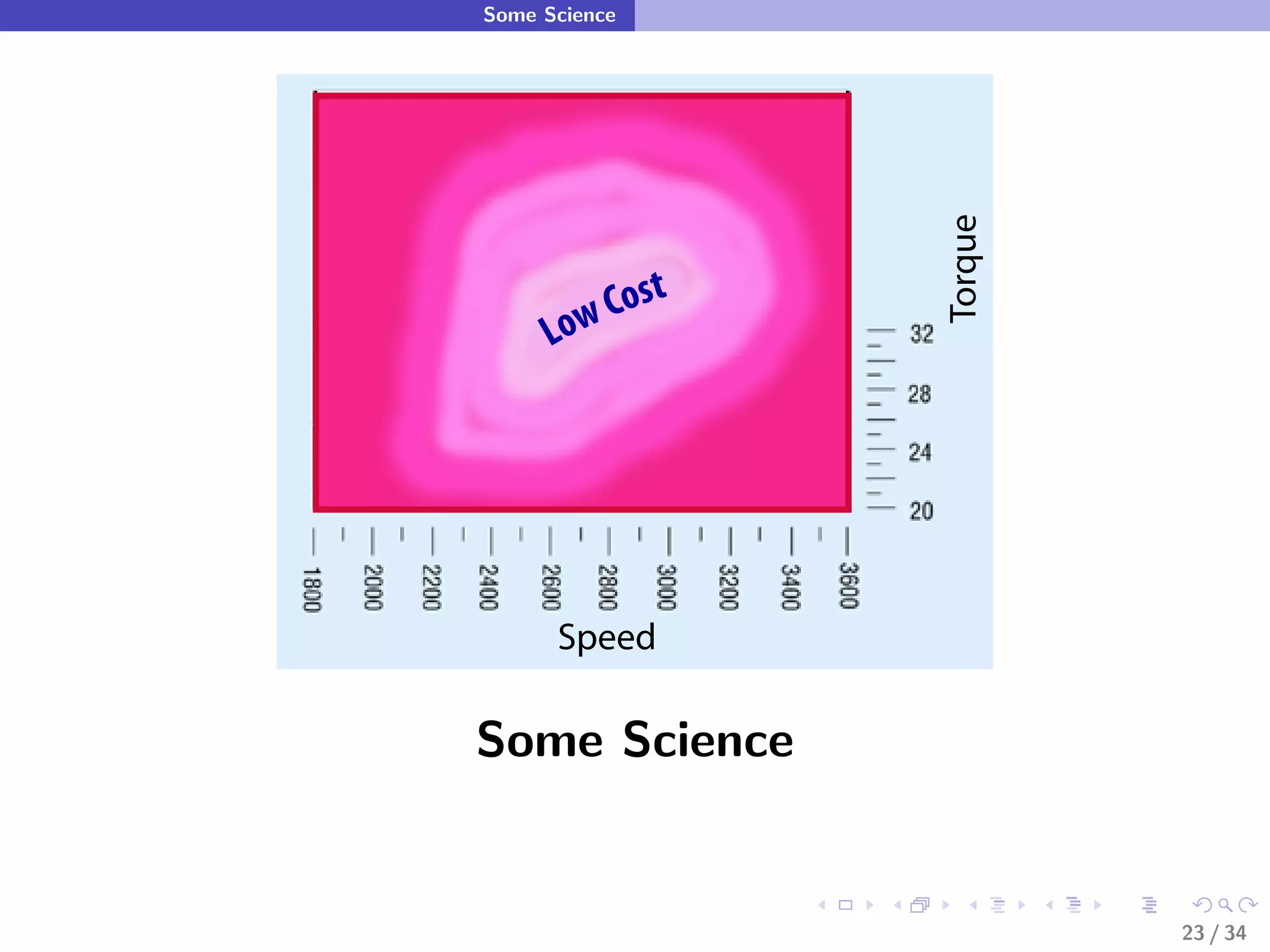

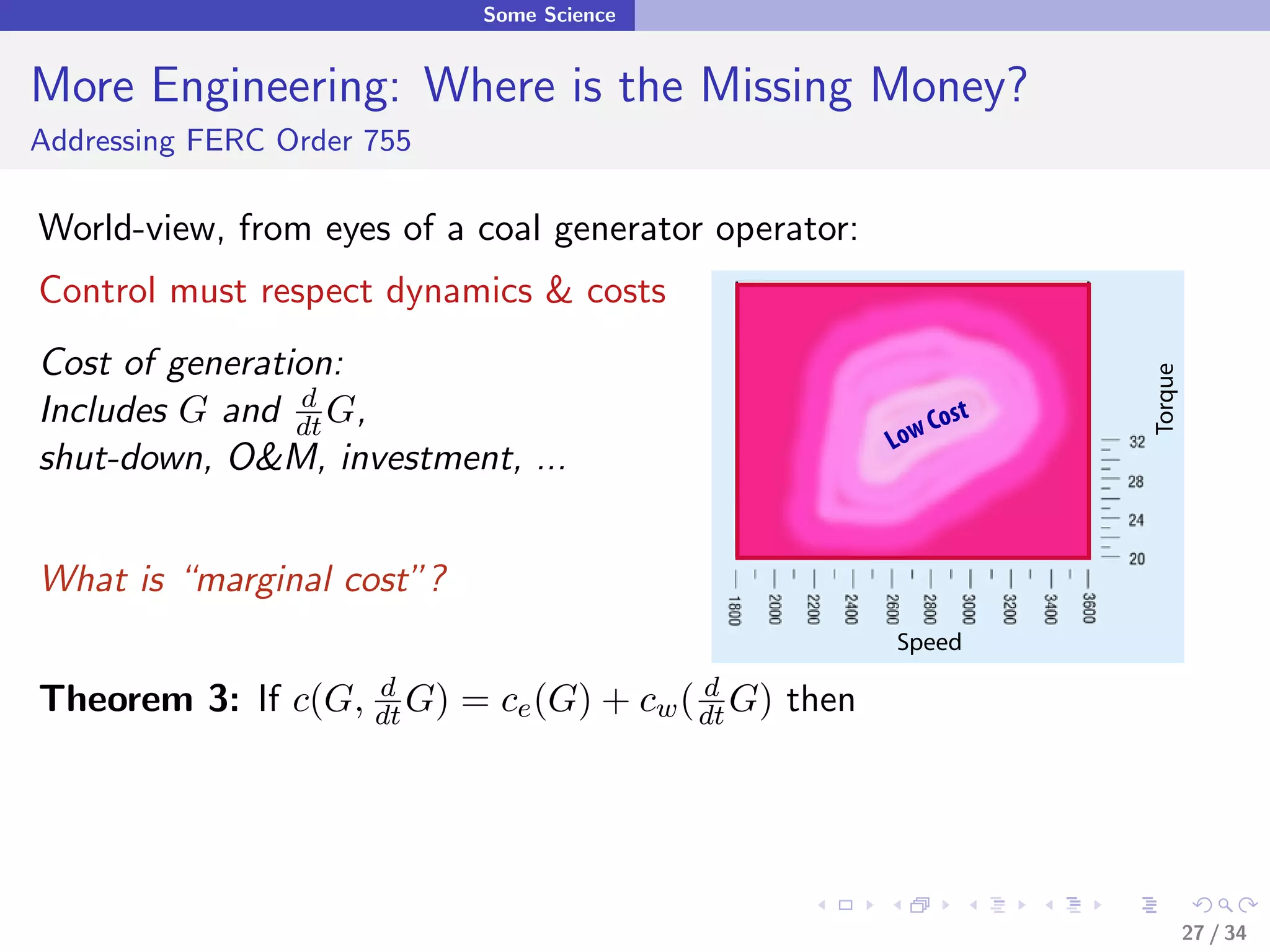

![Some Science

More Engineering: Where is the Missing Money?

Addressing FERC Order 755

World-view, from eyes of a coal generator operator:

Control must respect dynamics & costs

Cost of generation:

Torque

Includes G and dt G,

d

Cost

Low

shut-down, O&M, investment, ...

What is “marginal cost”?

Speed

Theorem 3: If c(G, dt G)

d

= ce (G) + cw ( dt G)

d

then

E[P ∗ ] = E[ ce (G)]

27 / 34](https://image.slidesharecdn.com/montrealtutorialspm-121107150219-phpapp01/75/2012-Tutorial-Markets-for-Differentiated-Electric-Power-Products-56-2048.jpg)

![Some Science

More Engineering: Where is the Missing Money?

Addressing FERC Order 755

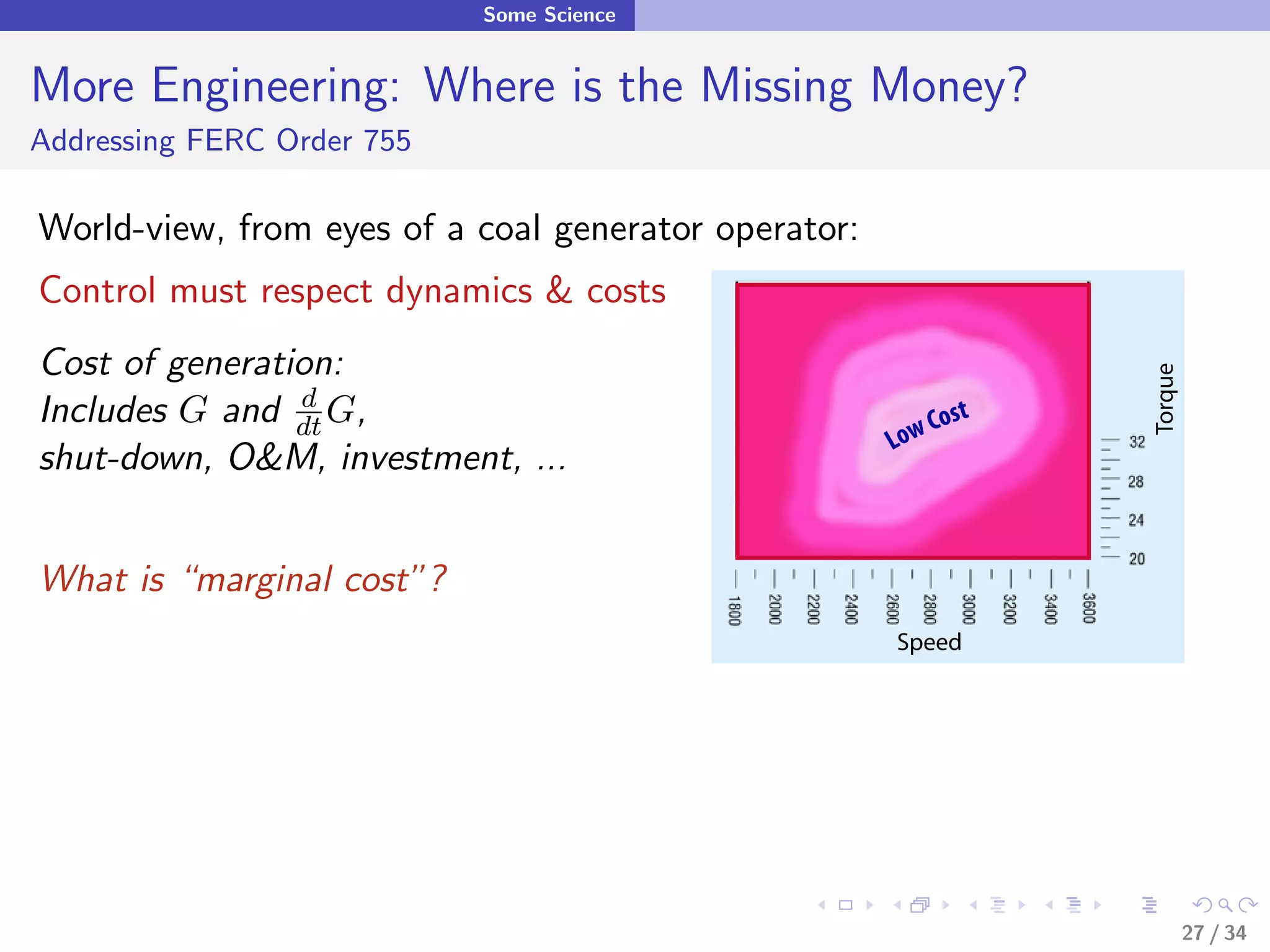

World-view, from eyes of a coal generator operator:

Control must respect dynamics & costs

Cost of generation:

Torque

Includes G and dt G,

d

Cost

Low

shut-down, O&M, investment, ...

What is “marginal cost”?

Speed

Theorem 3: If c(G, dt G)

d

= ce (G) + cw ( dt G)

d

then

E[P ∗ ] = E[ ce (G)] =⇒ lots of missing money

27 / 34](https://image.slidesharecdn.com/montrealtutorialspm-121107150219-phpapp01/75/2012-Tutorial-Markets-for-Differentiated-Electric-Power-Products-57-2048.jpg)

![Some Science

More Engineering: Where is the Missing Money?

Addressing FERC Order 755

World-view, from eyes of a coal generator operator:

Control must respect dynamics & costs

Cost of generation:

Torque

Includes G and dt G,

d

Cost

Low

shut-down, O&M, investment, ...

What is “marginal cost”?

Speed

Theorem 3: If c(G, dt G)

d

= ce (G) + cw ( dt G)

d

then

E[P ∗ ] = E[ ce (G)] =⇒ lots of missing money

Competitive equilibrium never compensates for “wear and tear”.

27 / 34](https://image.slidesharecdn.com/montrealtutorialspm-121107150219-phpapp01/75/2012-Tutorial-Markets-for-Differentiated-Electric-Power-Products-58-2048.jpg)

![Conclusions & Suggestions

Pre-publication version for on-line viewing. Monograph available for purchase at your favorite retailer August 2008 Pre-publication version for on-line viewing. Monograph to appear Februrary 2009

More information available at http://www.cambridge.org/us/catalogue/catalogue.asp?isbn=9780521884419

Control Techniques Markov Chains

FOR and

Complex Networks Stochastic Stability

P n (x, · ) − π f →0

sup Ex [SτC (f )] < ∞

C

π(f ) < ∞

∆V (x) ≤ −f (x) + bIC (x)

Sean Meyn S. P. Meyn and R. L. Tweedie

References

33 / 34](https://image.slidesharecdn.com/montrealtutorialspm-121107150219-phpapp01/75/2012-Tutorial-Markets-for-Differentiated-Electric-Power-Products-82-2048.jpg)