Embed presentation

Download to read offline

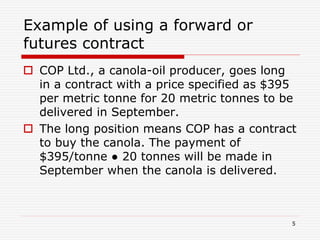

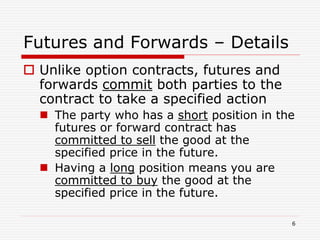

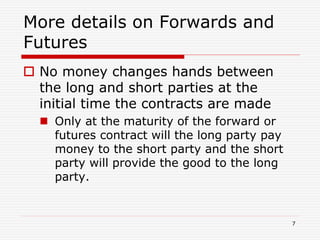

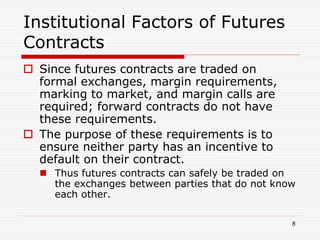

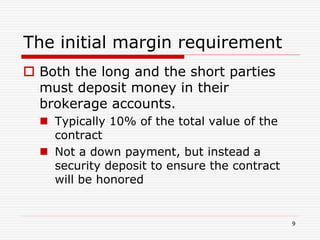

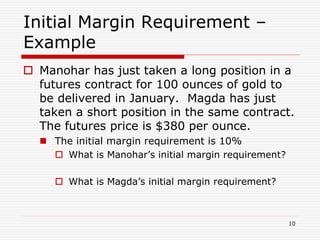

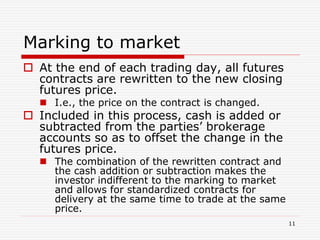

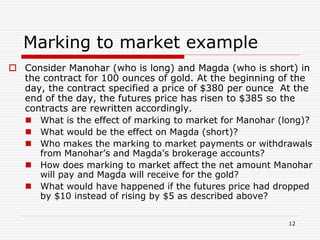

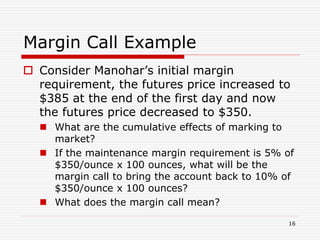

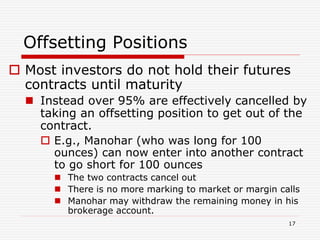

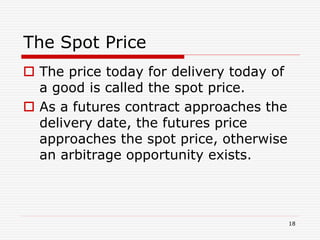

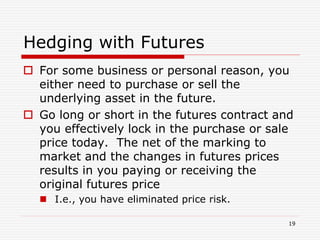

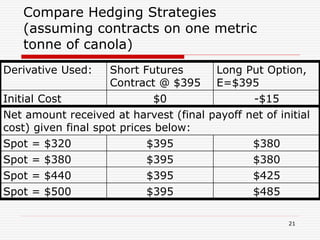

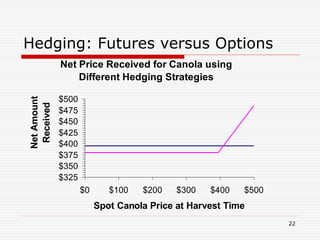

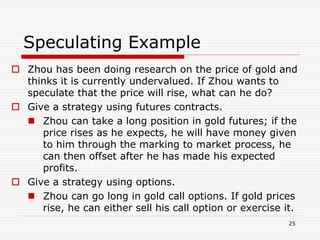

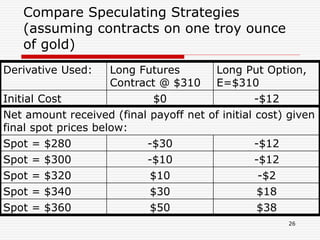

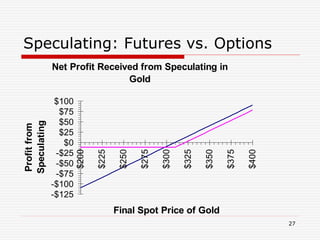

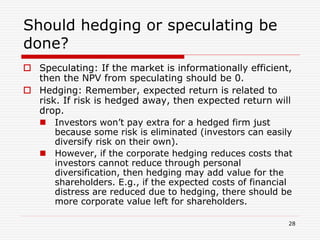

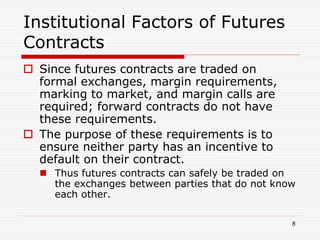

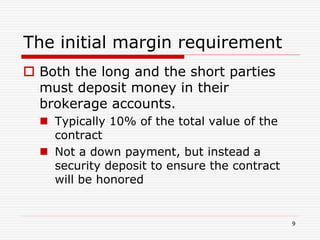

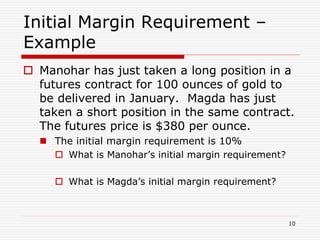

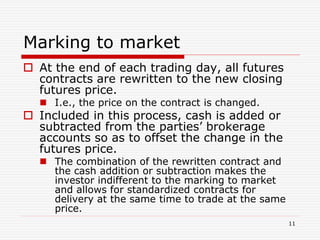

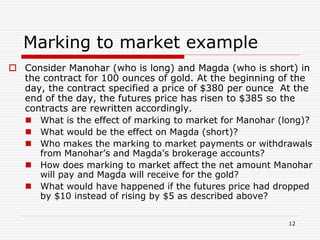

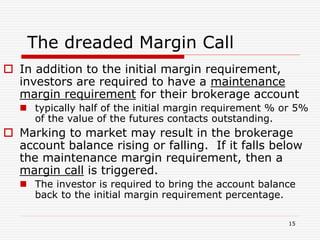

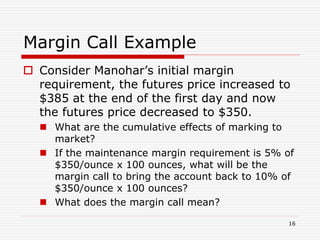

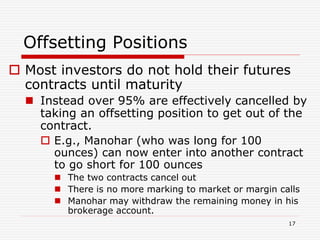

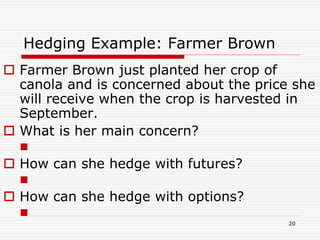

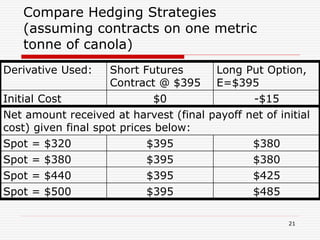

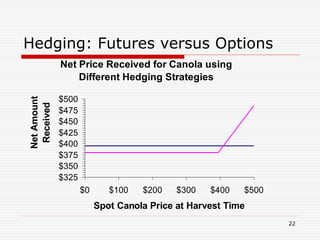

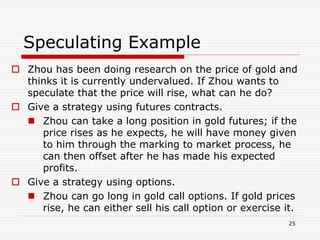

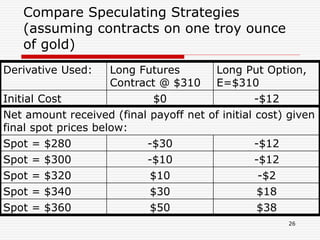

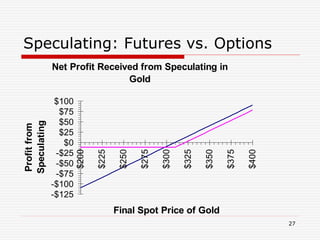

Forward and futures contracts allow parties to lock in a price today for buying or selling an asset in the future. Futures contracts are traded on exchanges and have features like margin requirements and marking to market that reduce default risk. Both can be used for hedging to reduce price risk or for speculating to profit from price changes, with futures generally having lower upfront costs but potential for larger losses than options.