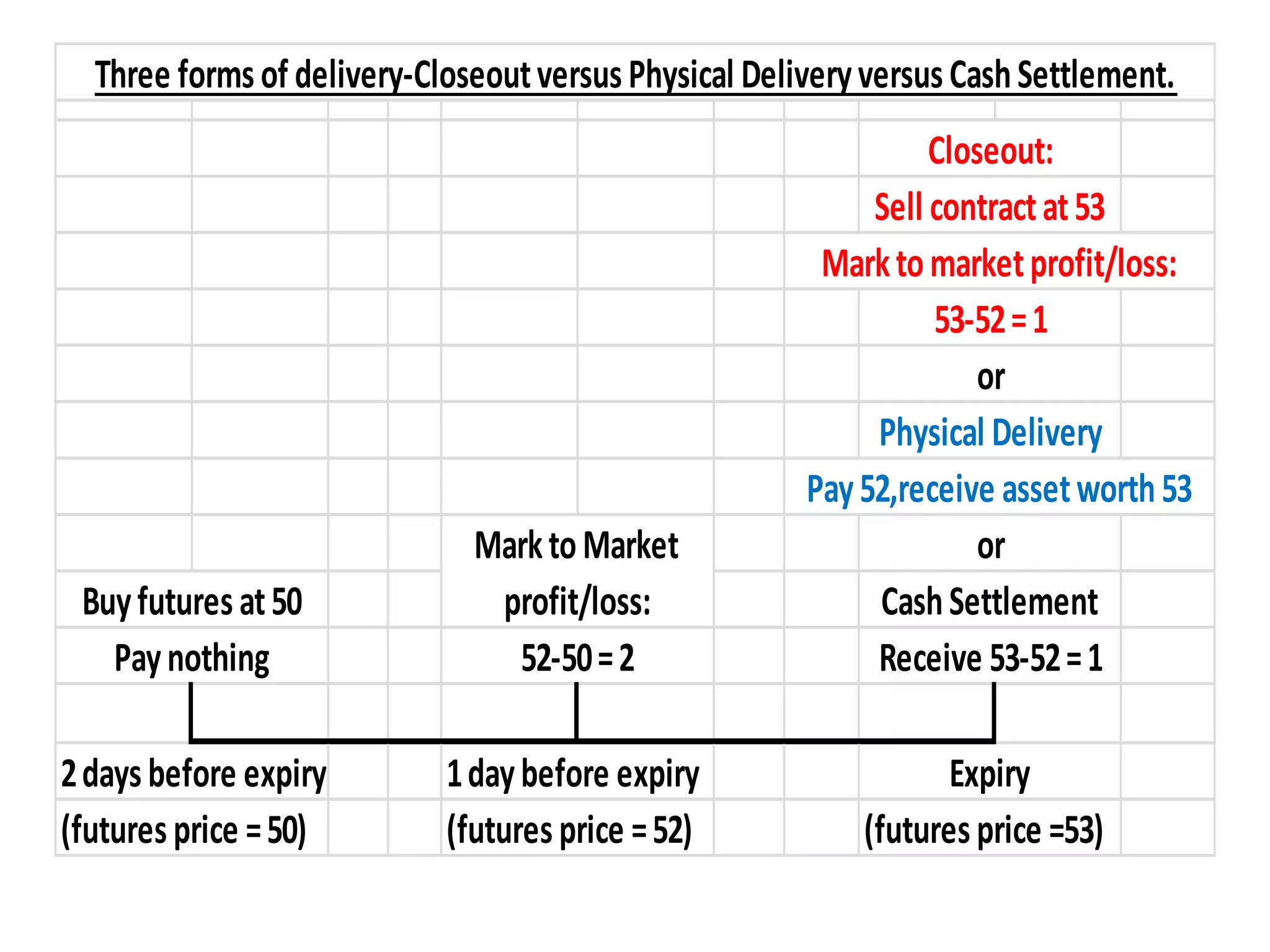

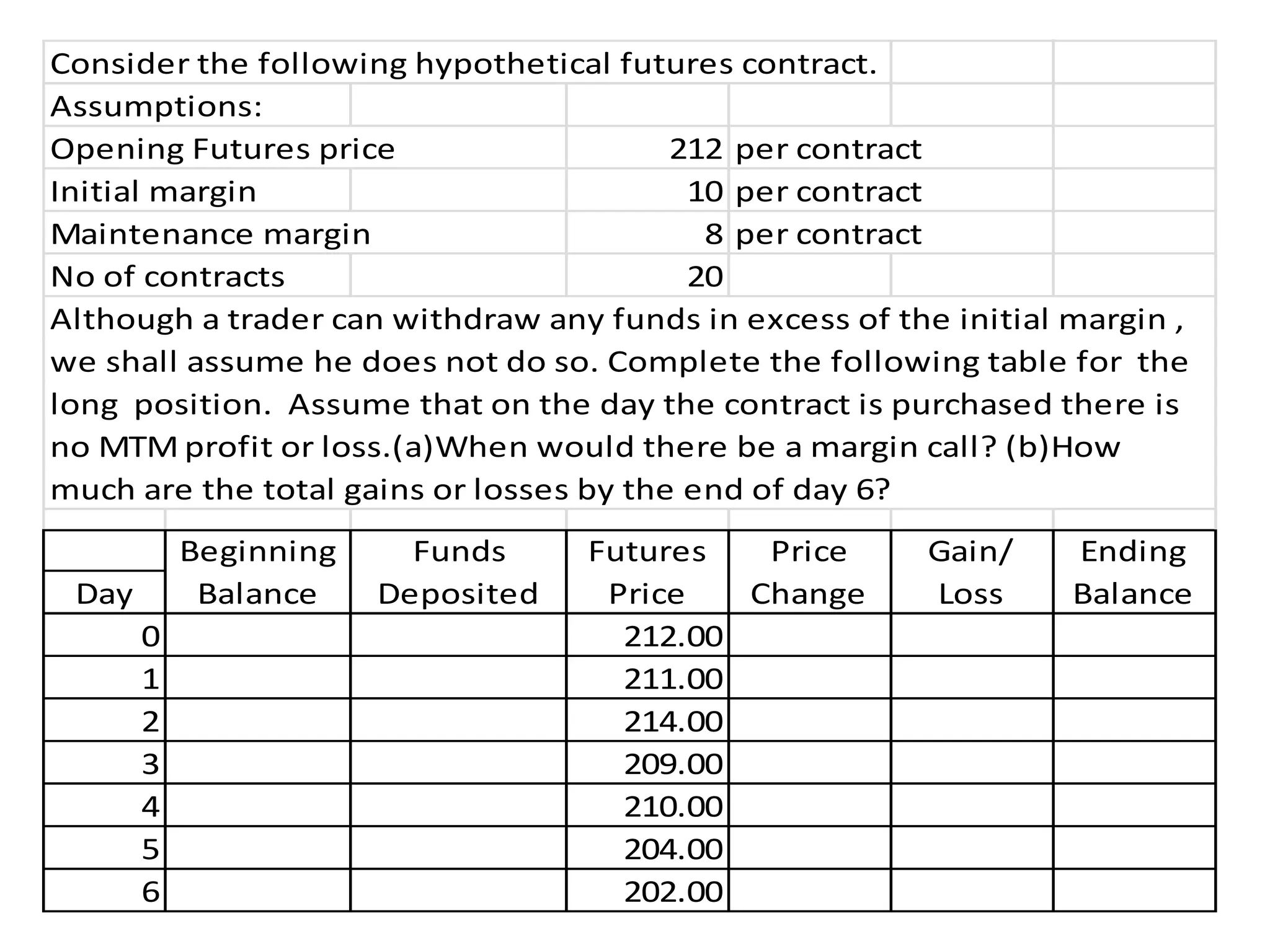

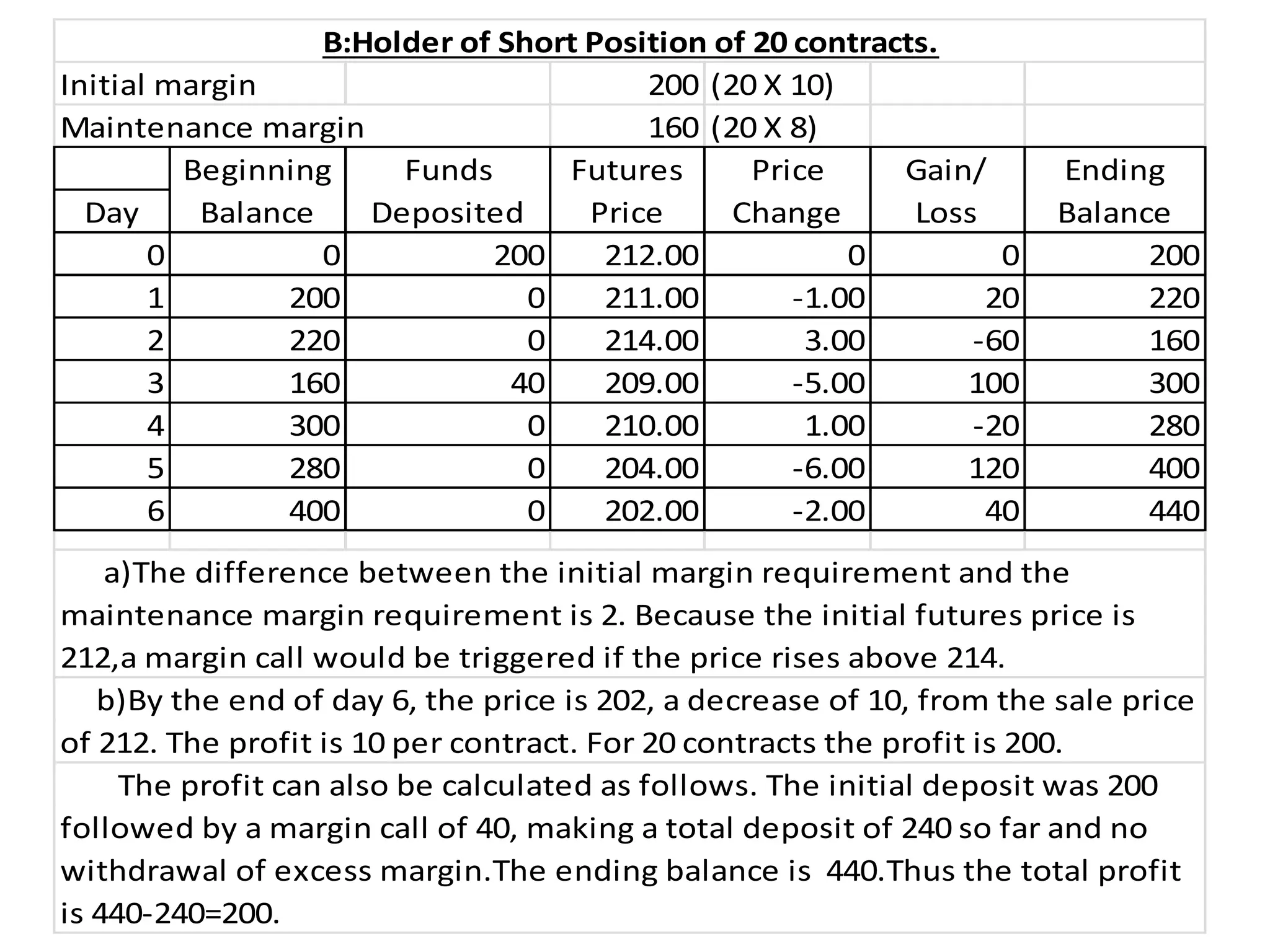

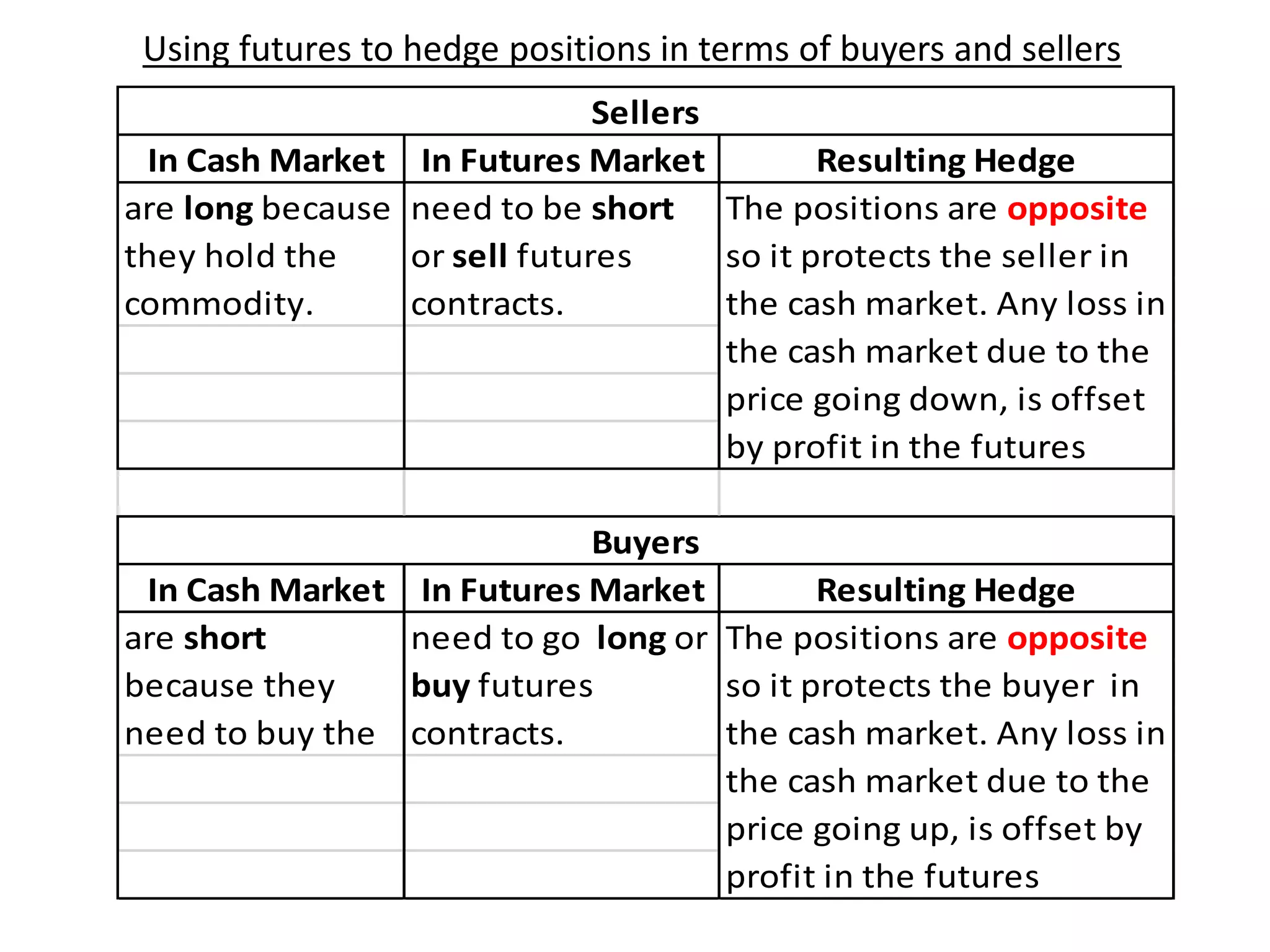

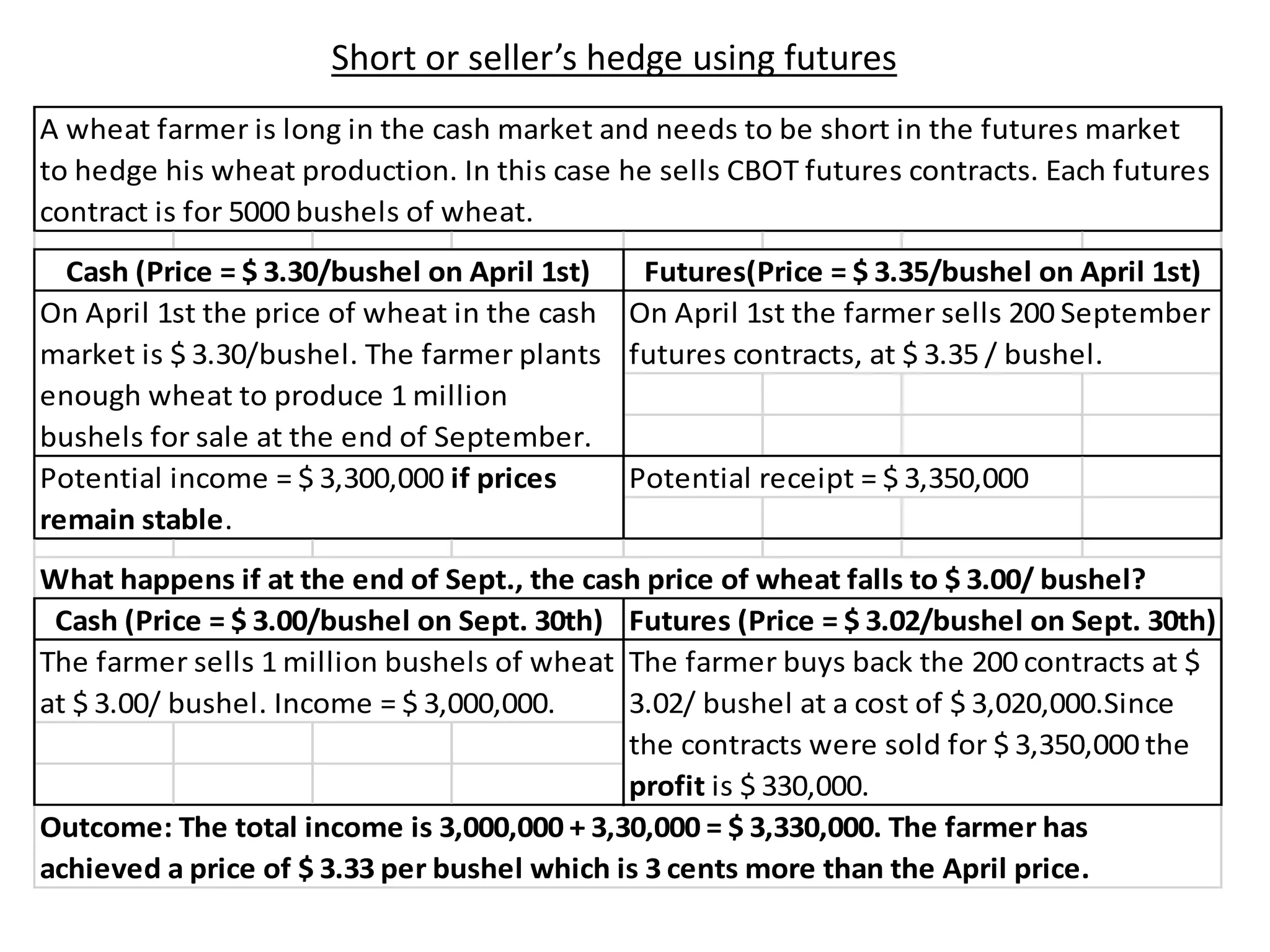

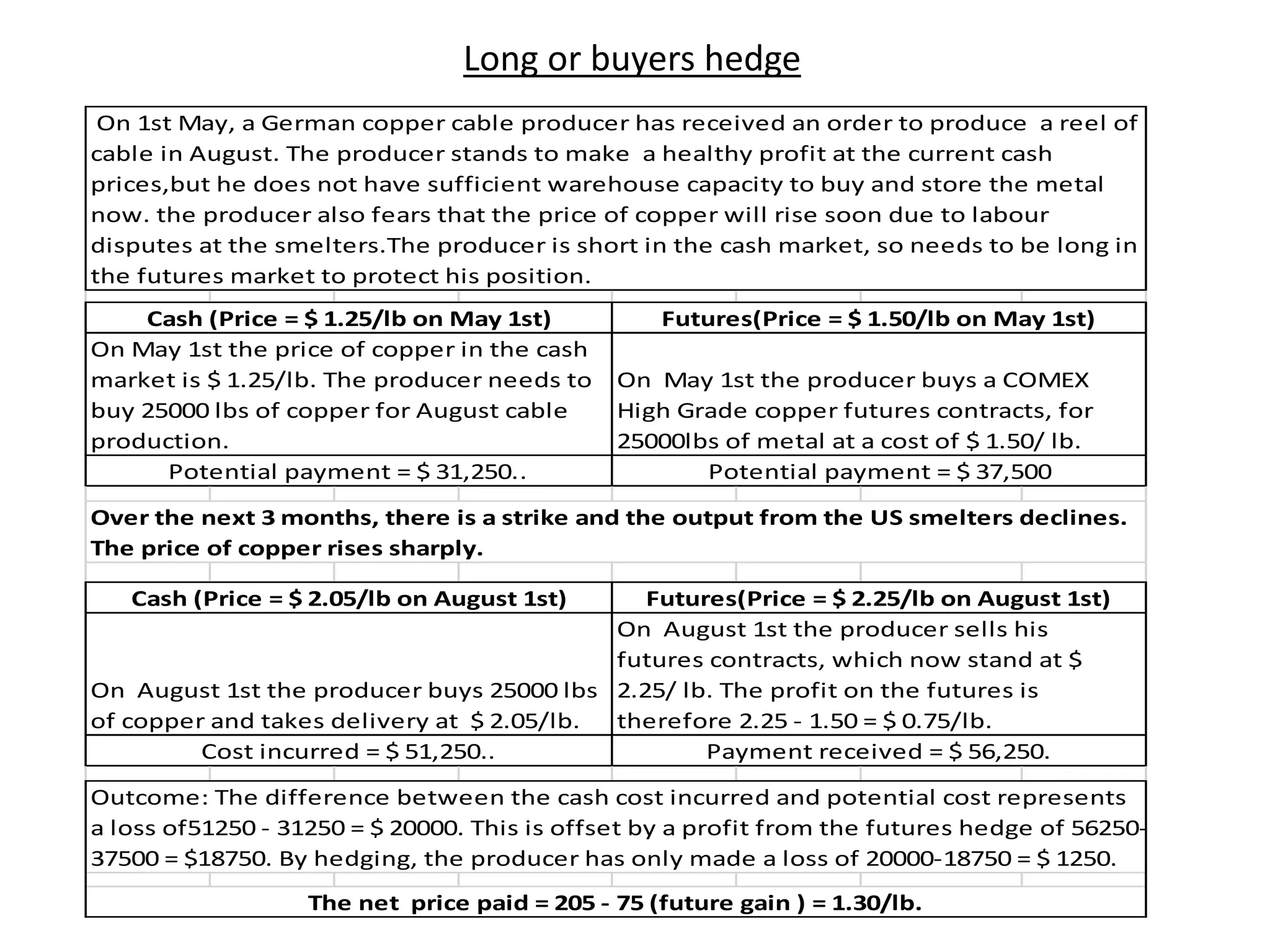

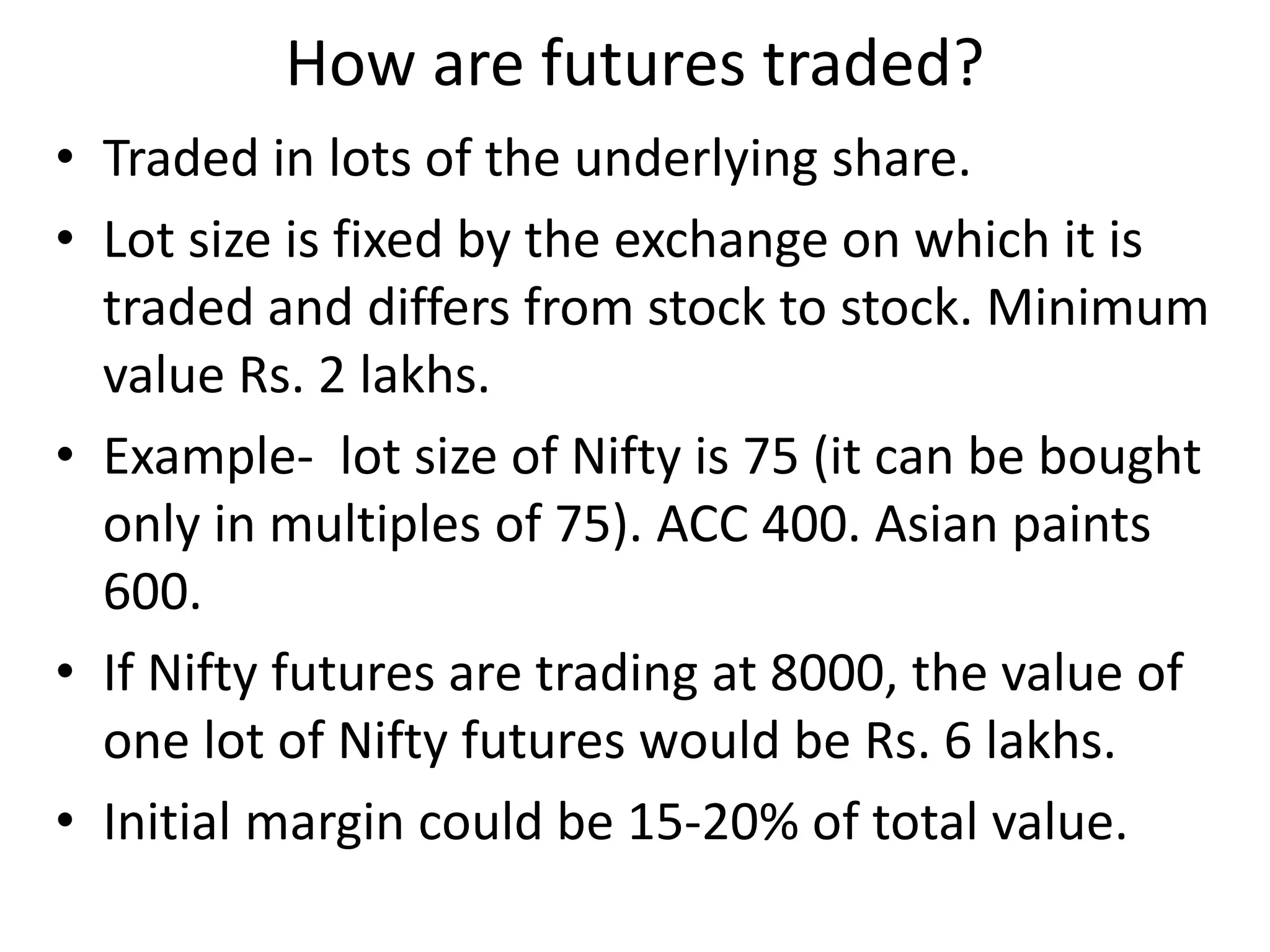

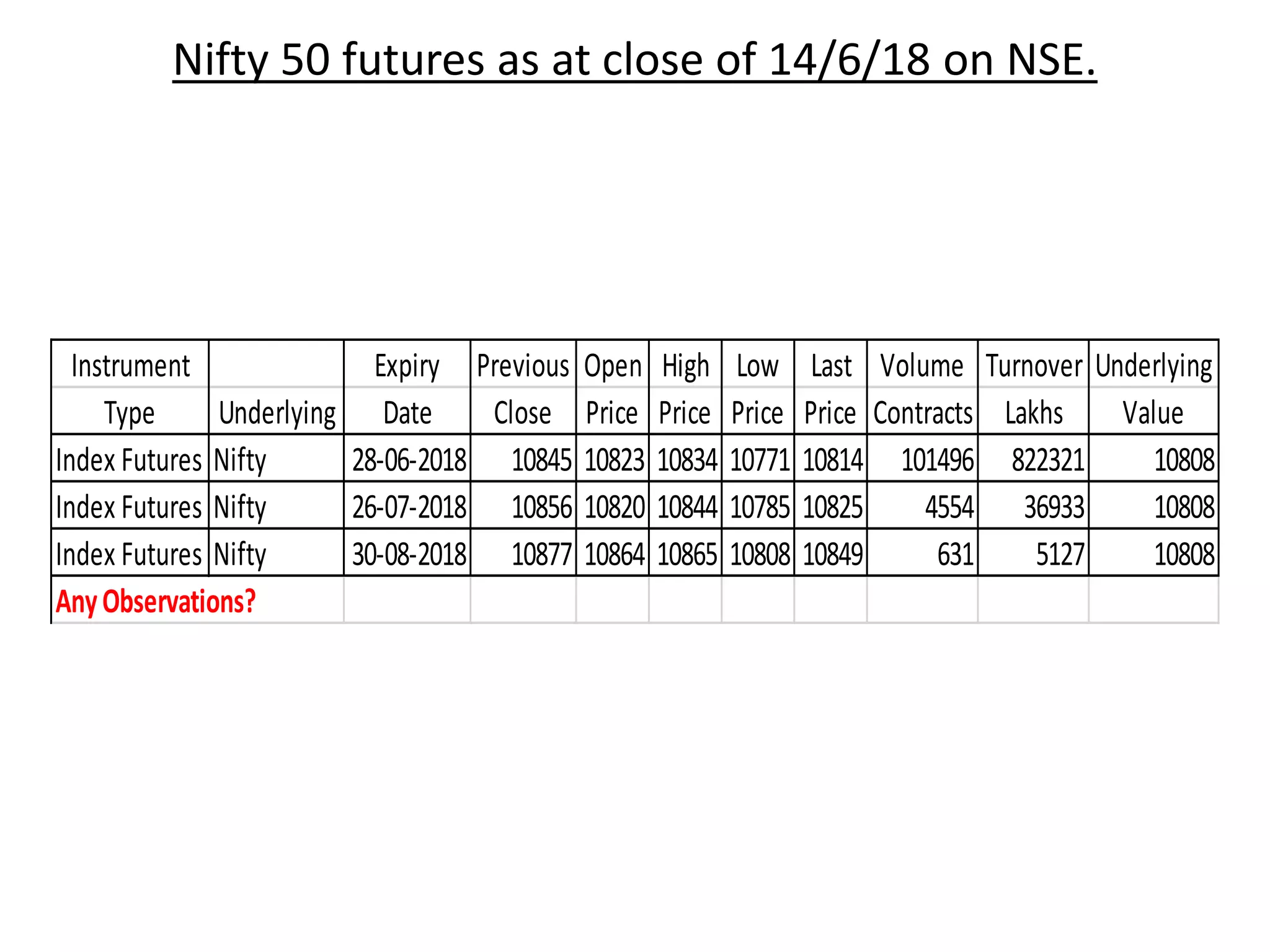

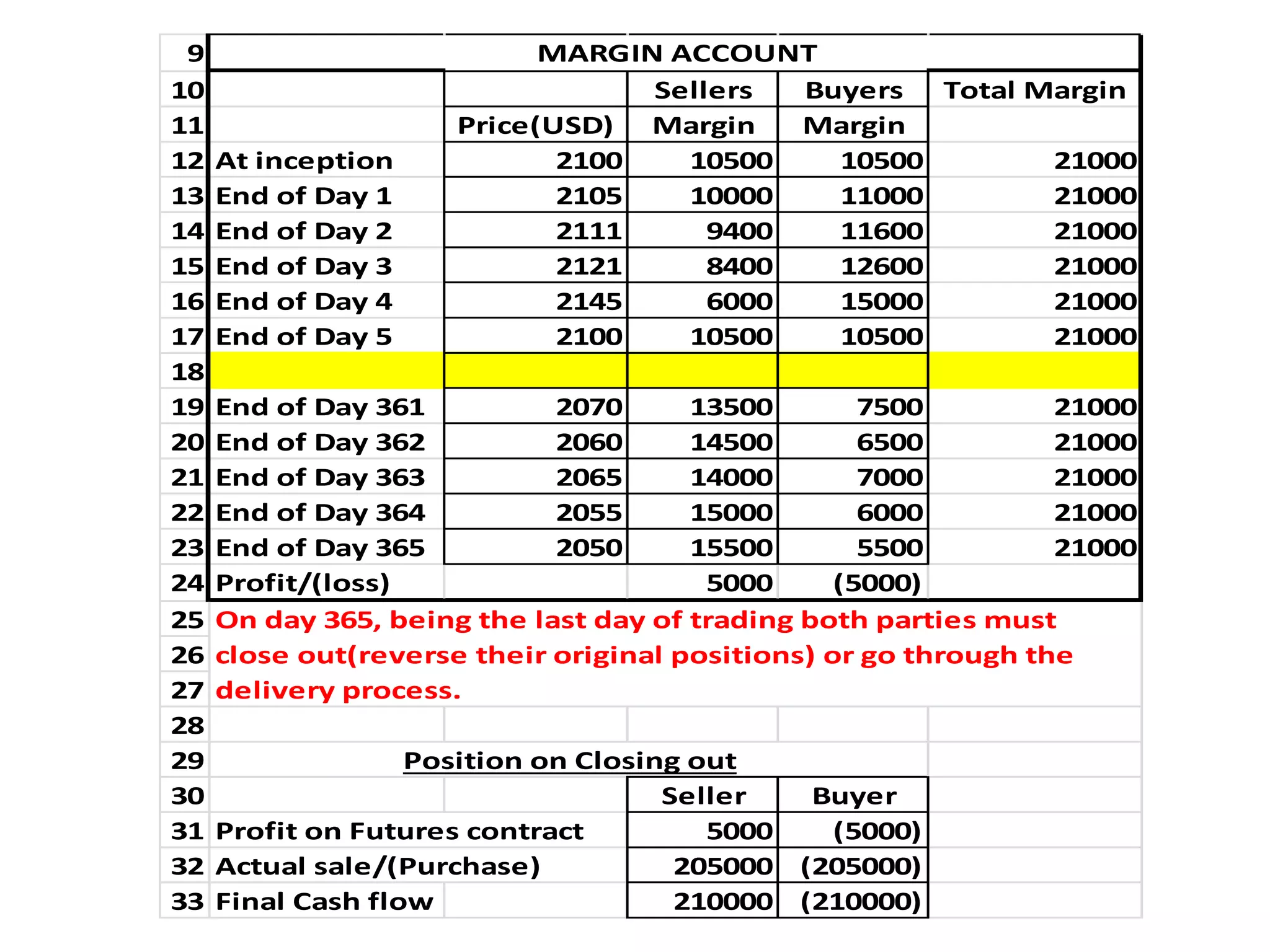

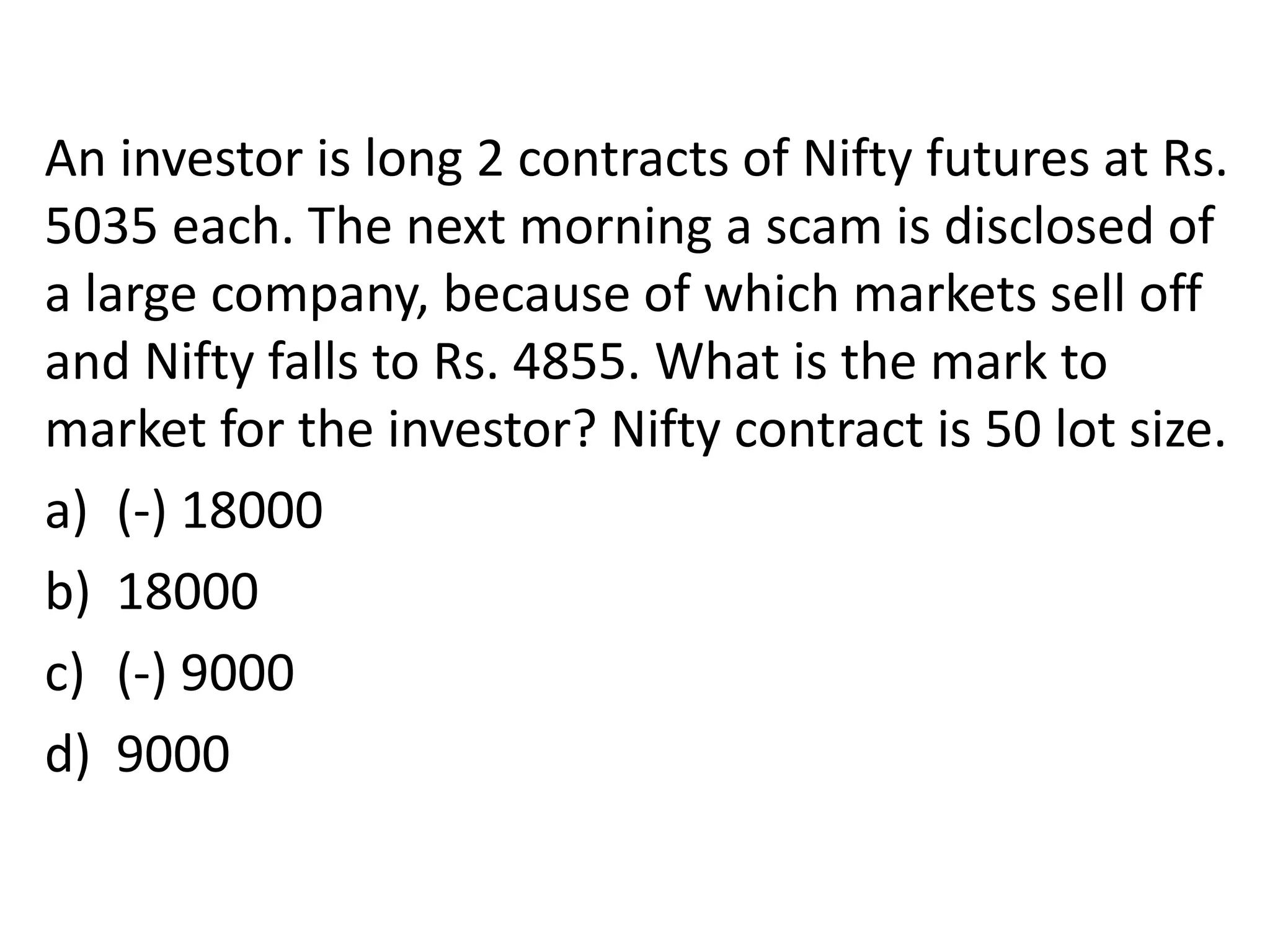

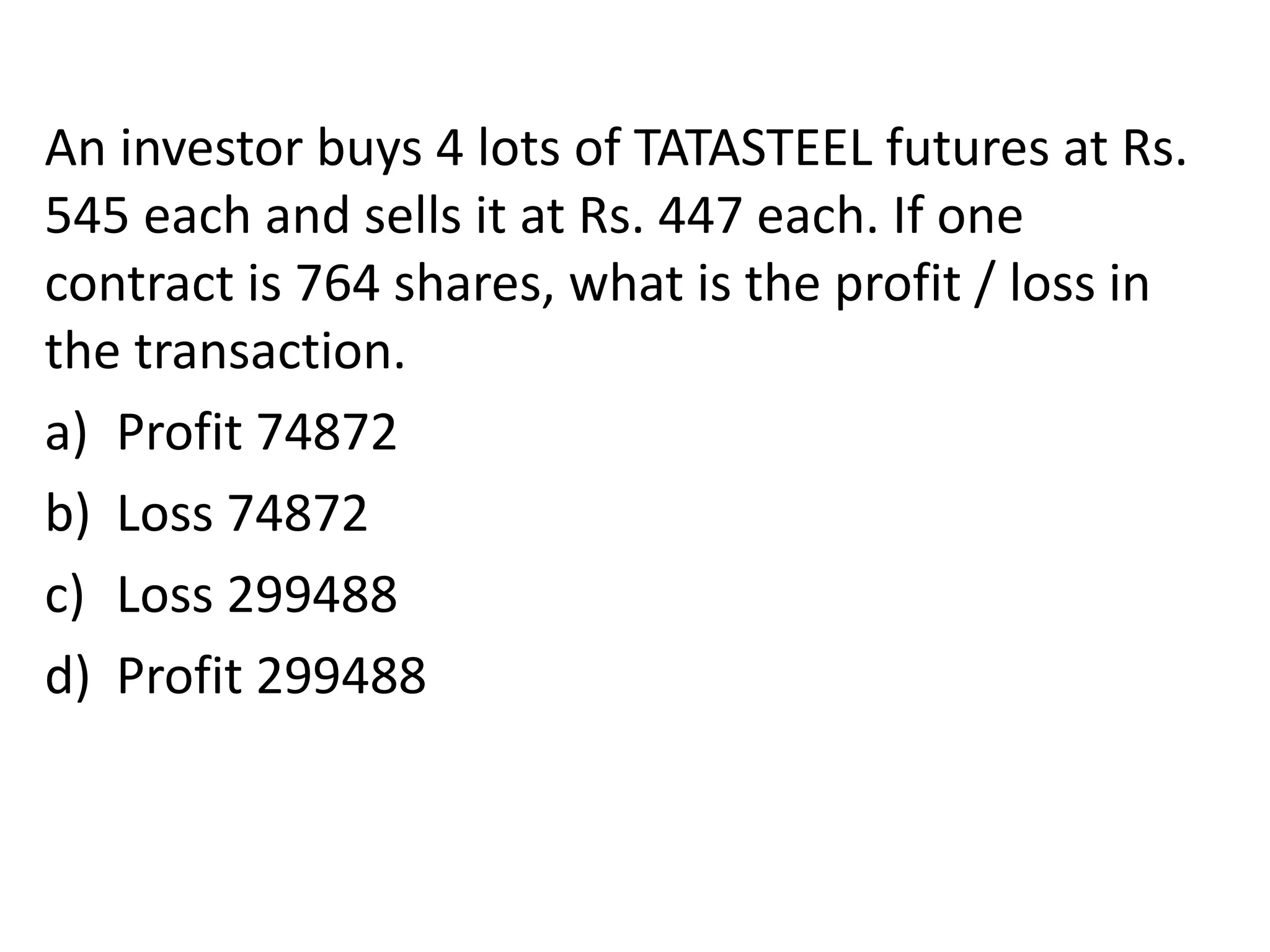

The document provides an overview of risk management with futures contracts, explaining key concepts like hedging, short and long positions, forwards versus futures, margins, mark-to-market process, and how taking opposite positions in the cash and futures markets can help reduce risk for buyers and sellers. Futures contracts standardize terms to allow for trading on exchanges, use a clearing house to minimize counterparty risk, require daily margin payments to settle profits and losses, and can be closed out before expiration.