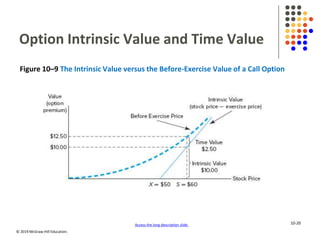

This document provides an overview of derivative securities markets. It defines derivatives as financial securities whose payoff is linked to another security. Derivatives allow parties to exchange risk. Common derivatives discussed include forwards, futures, options, swaps, and other instruments. The document also examines the characteristics and uses of various derivative contracts and the markets in which they trade.