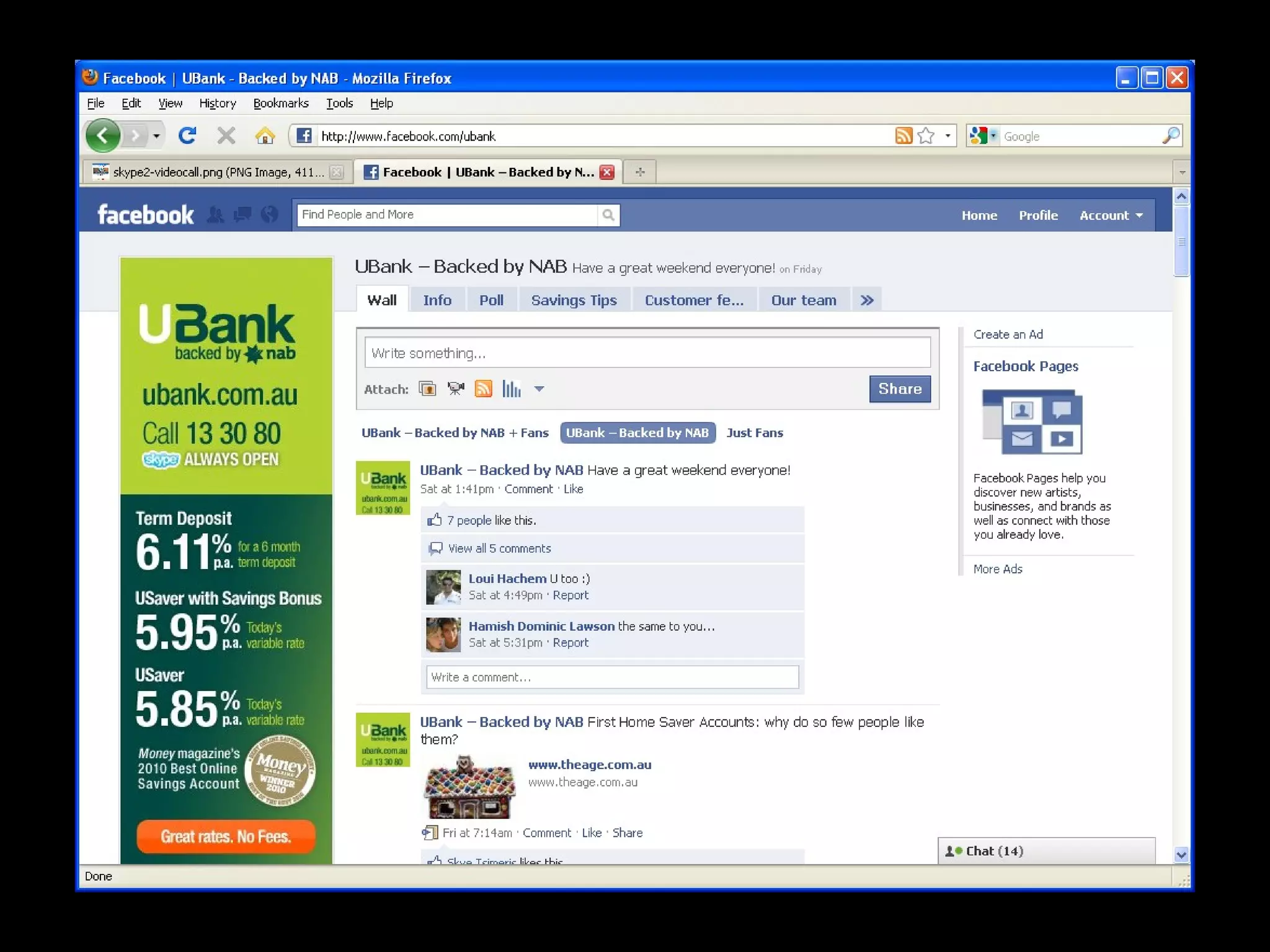

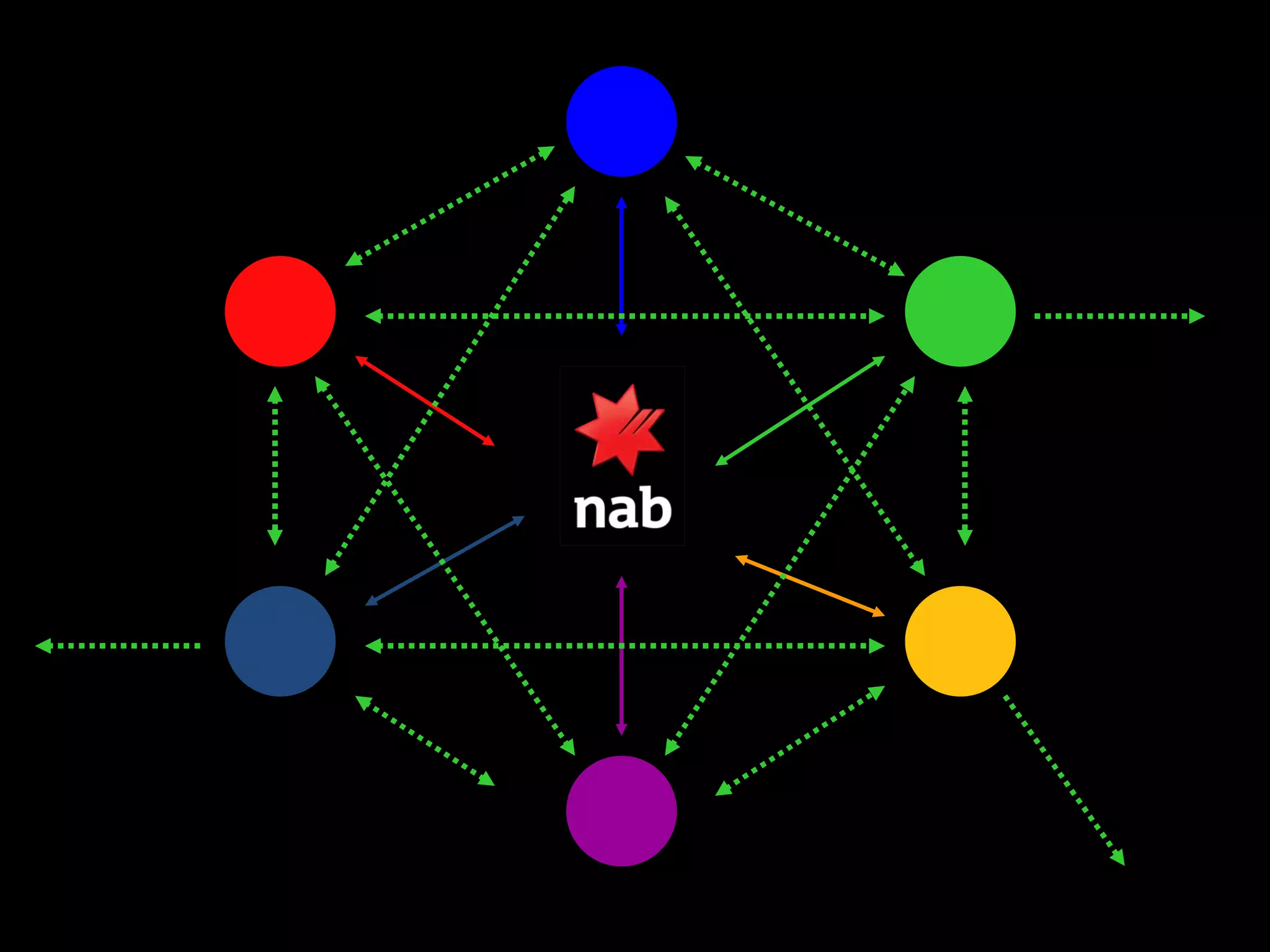

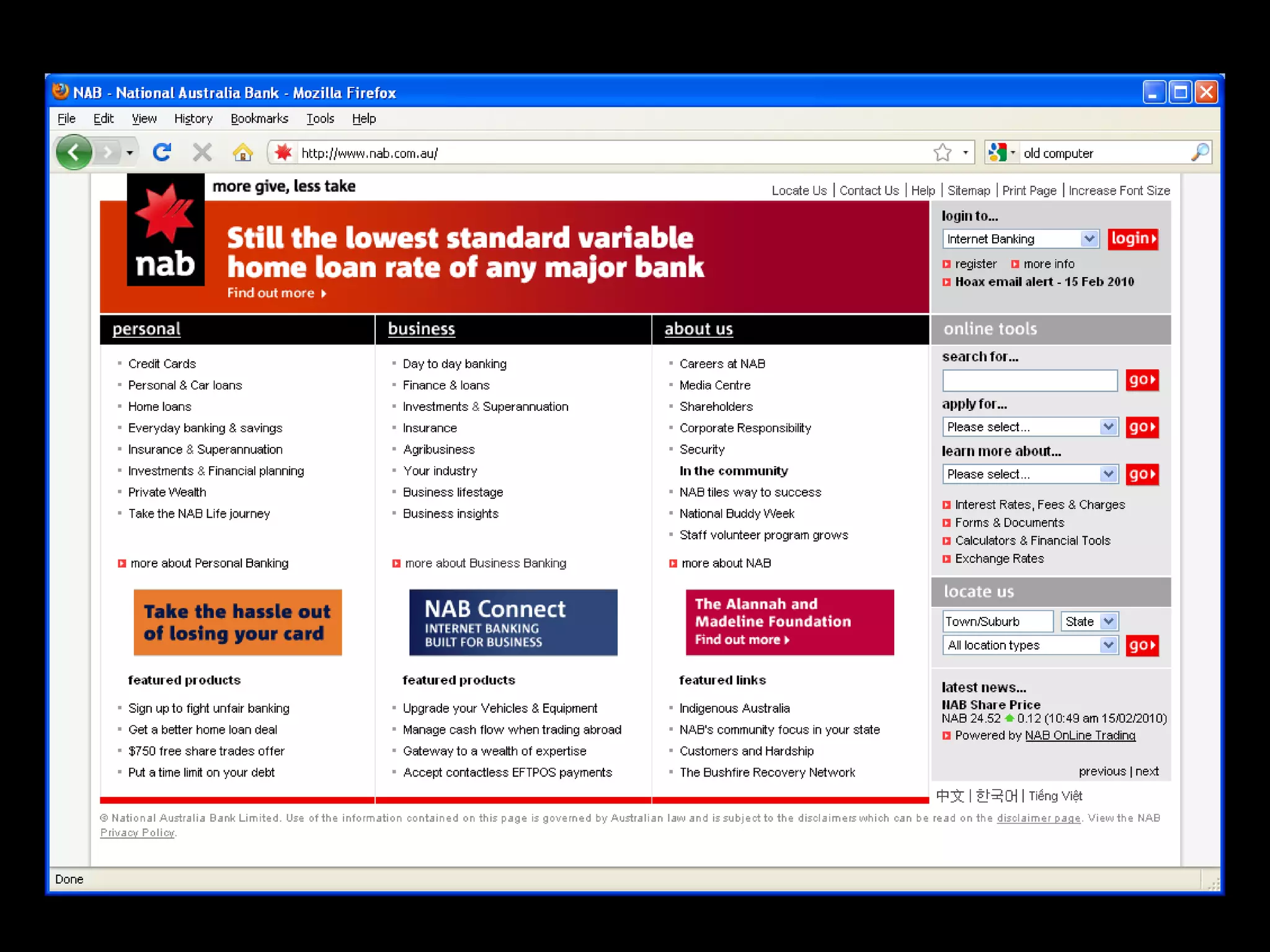

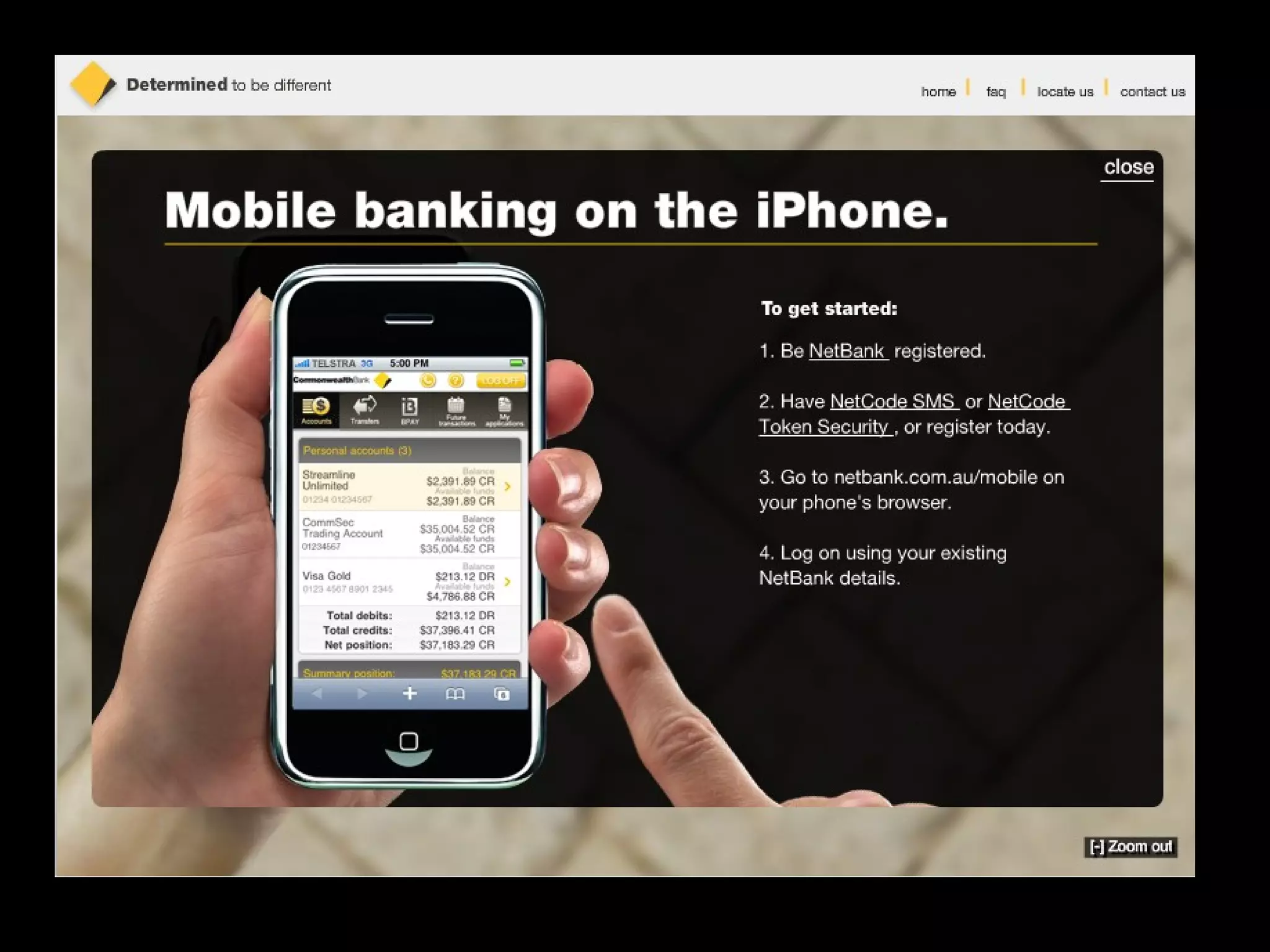

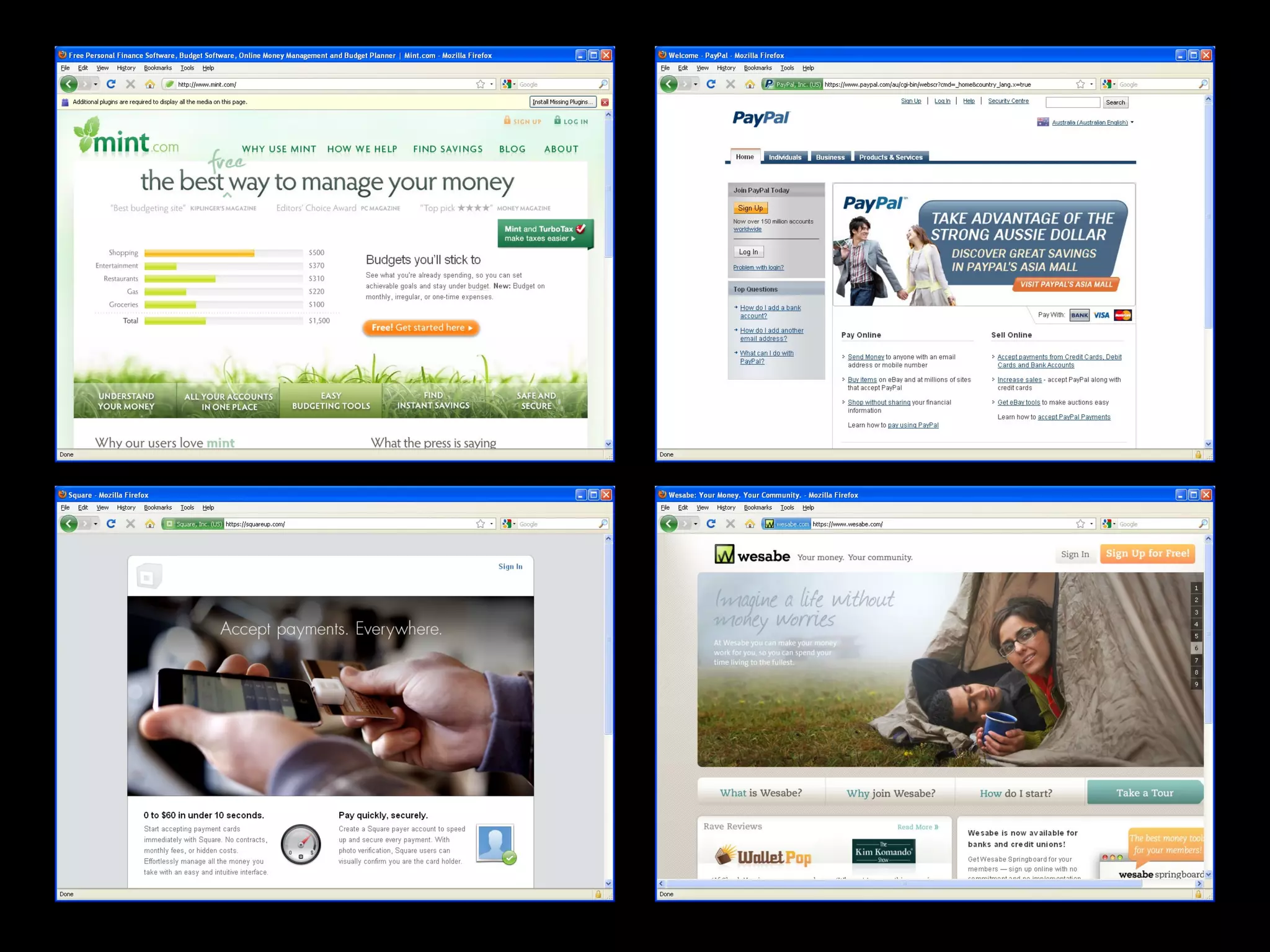

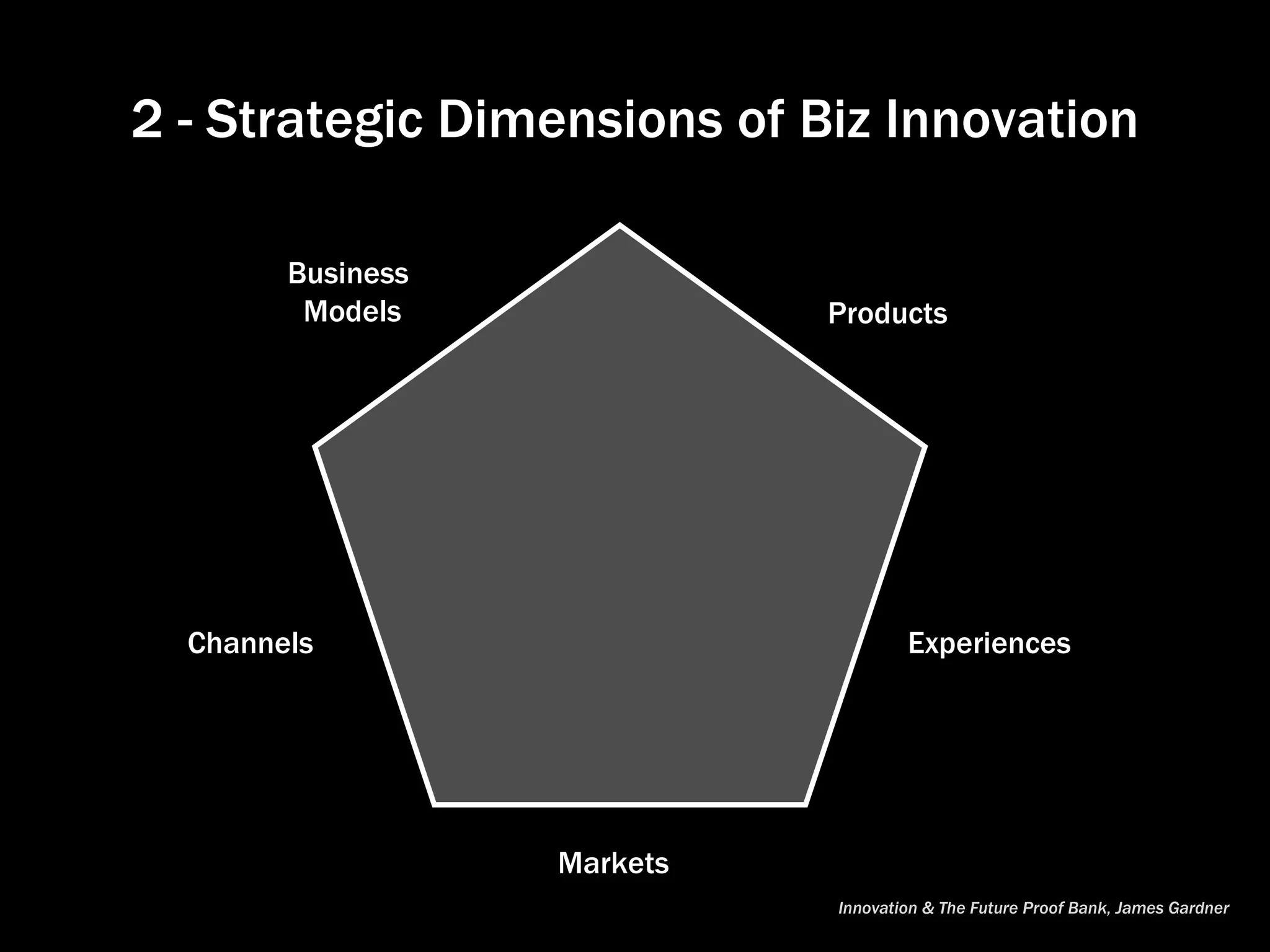

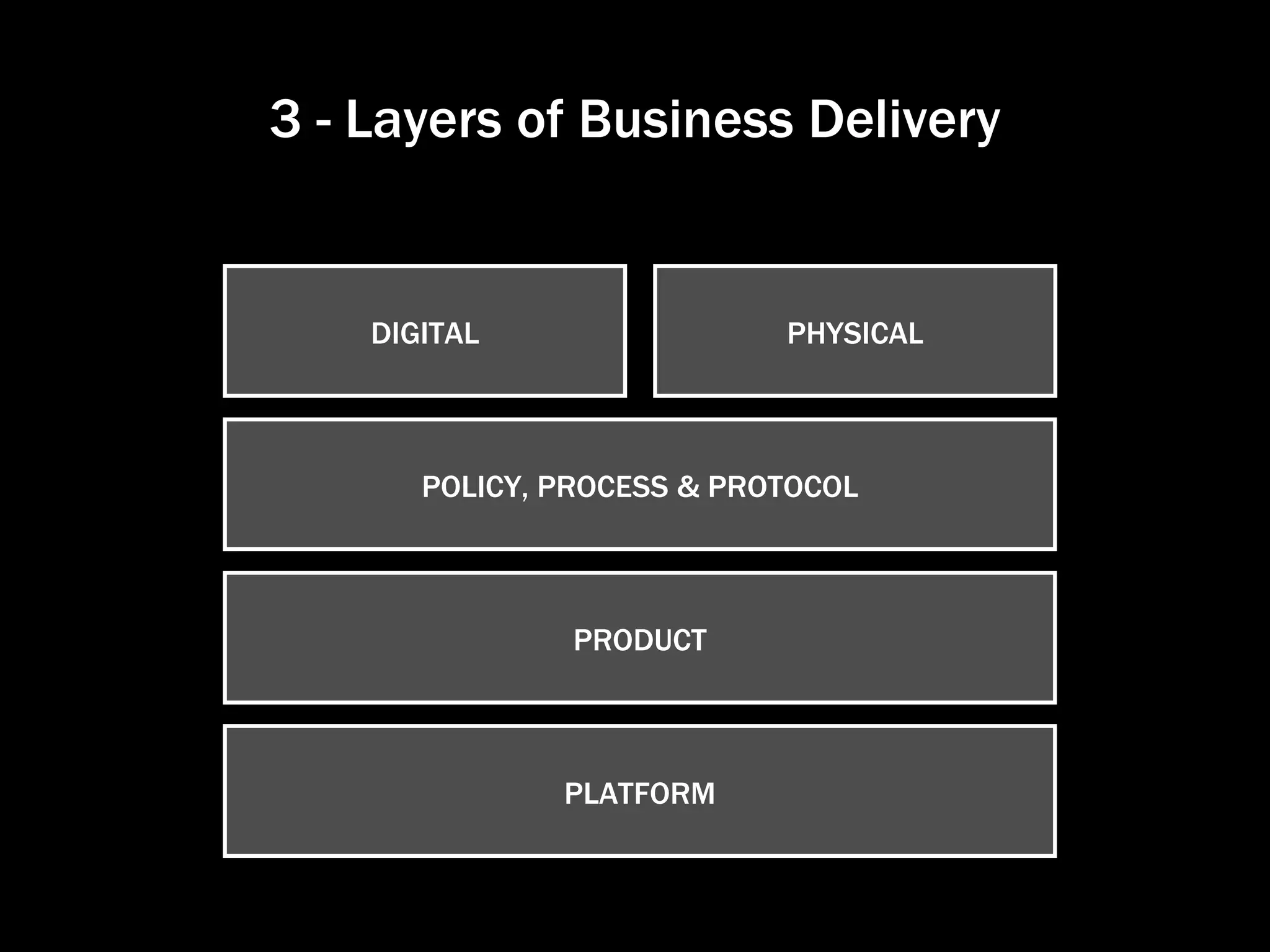

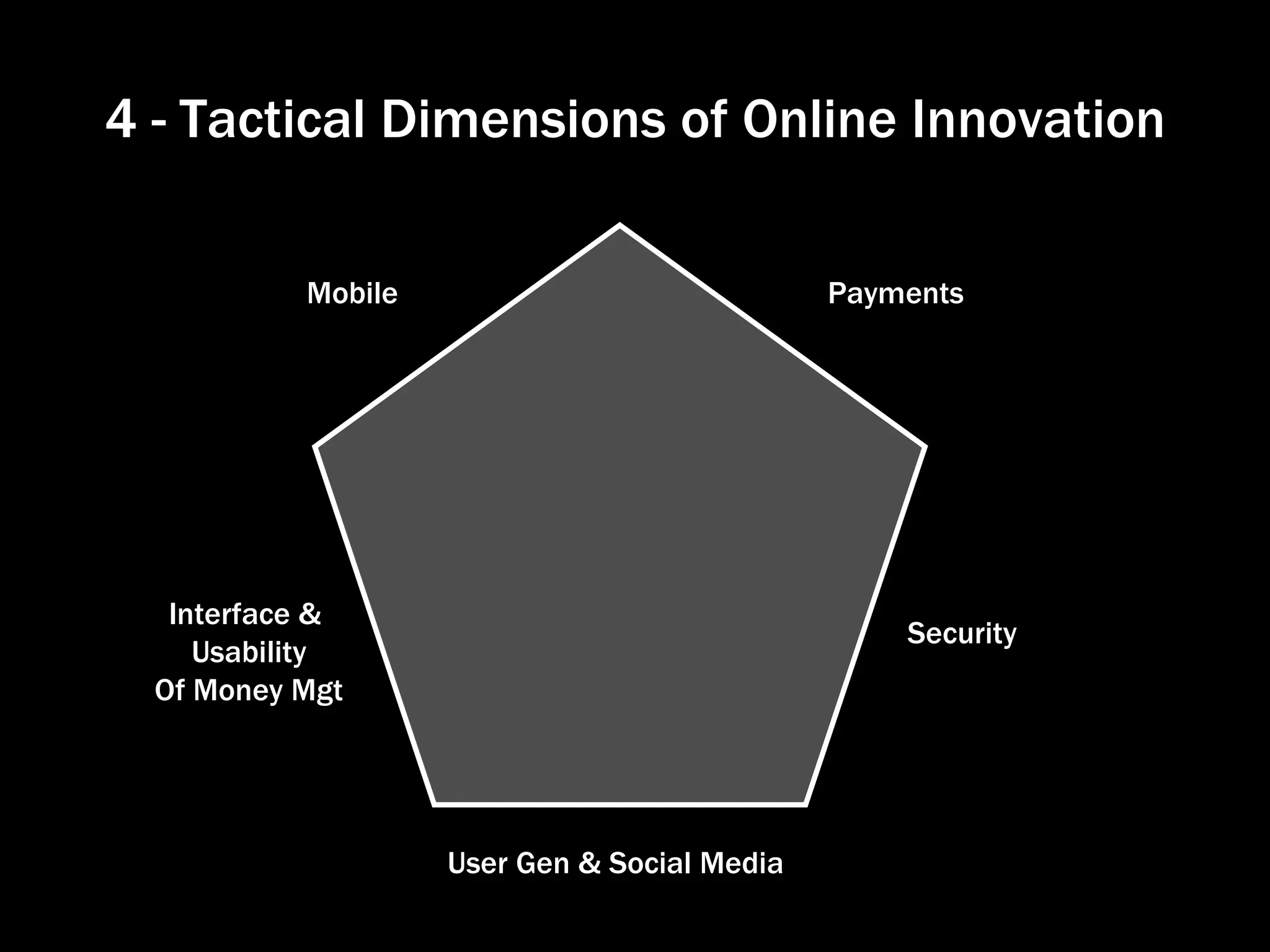

The document discusses innovation in online financial services. It begins by looking at the current state of customers managing their money and how big banks are faring. It identifies converging trends in the industry around economic conditions, customer behavior, technology capabilities, and changing business models. It then examines the competitive landscape for banks and how bank models and channels are shifting. The document outlines 10 insights for digital innovation and provides strategies for banks on multiple levels of business delivery and dimensions of online innovation to adapt and stay relevant in a changing digital landscape.