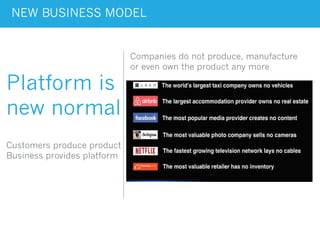

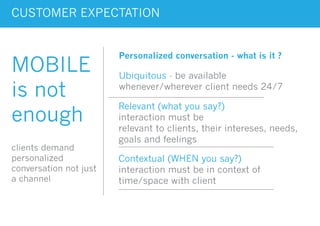

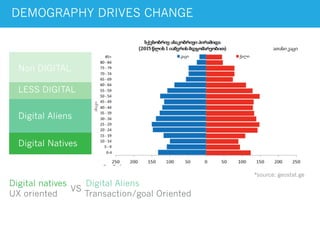

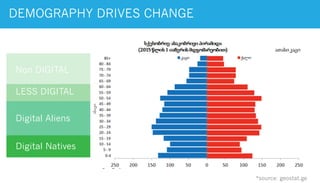

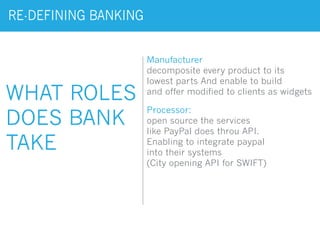

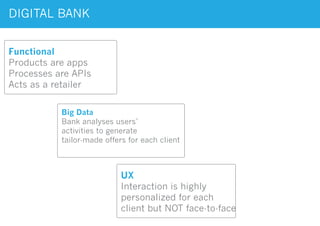

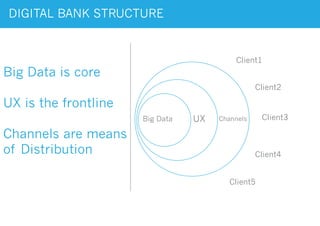

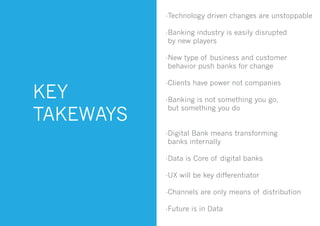

Digital banking involves transforming banks internally to focus on data, user experience, and personalization. New technologies and business models are disrupting traditional banking by empowering new market players, changing customer behavior and expectations. Customers now demand ubiquitous, relevant, and contextual interactions on mobile. To succeed, banks must redefine their roles around data management and open APIs, and stop thinking of channels as separate from the core bank. The future of banking lies in analyzing big data to generate personalized offers for each unique customer.