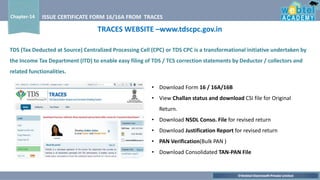

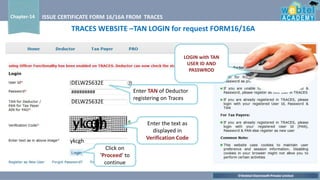

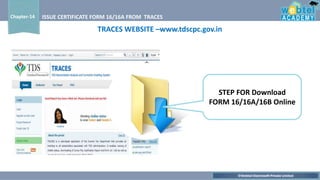

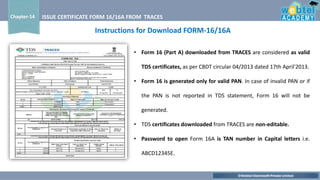

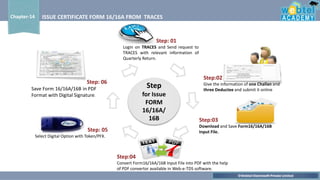

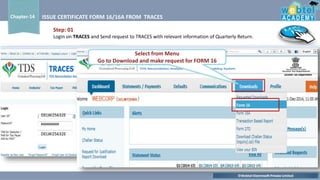

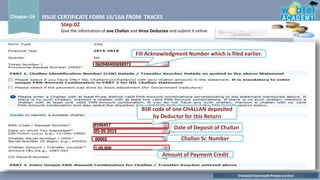

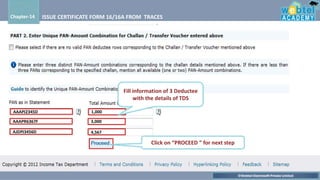

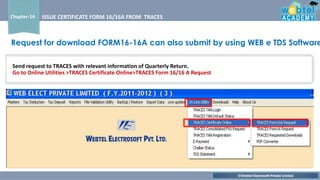

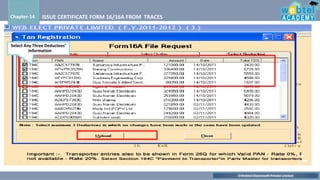

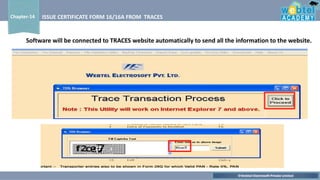

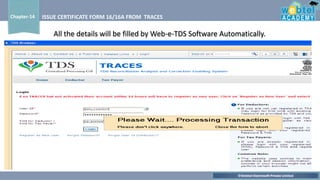

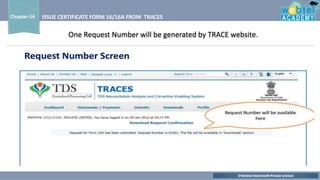

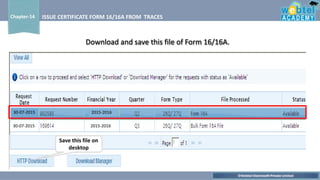

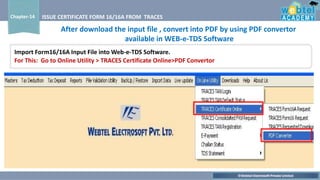

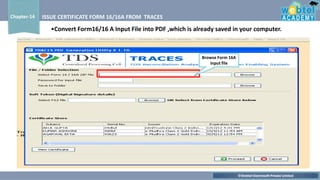

The document provides steps to issue Form 16/16A from the TRACES website. It involves logging into the TRACES website using the TAN number, selecting the appropriate financial year, providing details of one challan and three deductees, downloading and converting the input file to PDF, and digitally signing the PDF. The Form 16/16A generated from TRACES is considered a valid TDS certificate by the Income Tax Department.