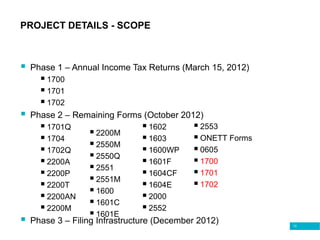

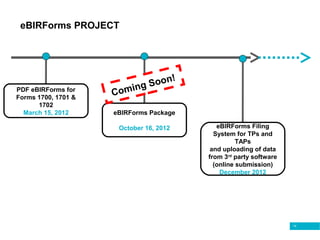

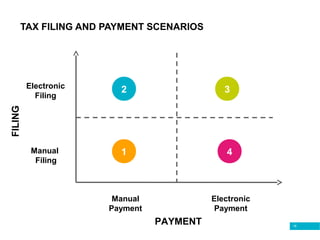

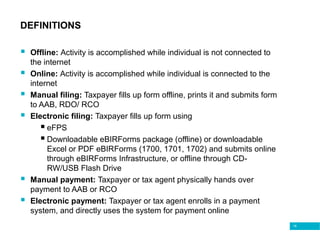

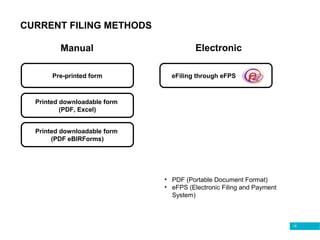

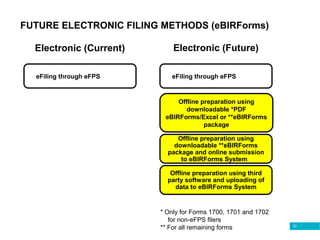

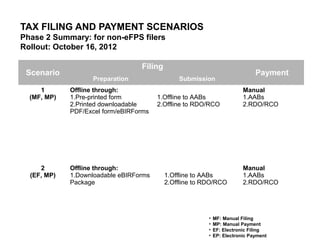

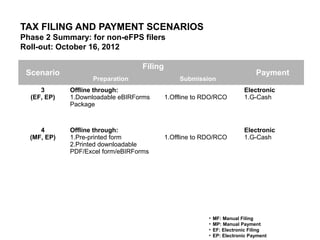

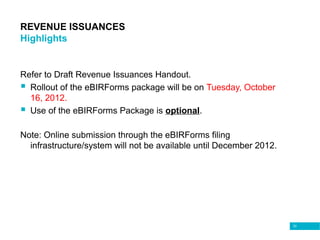

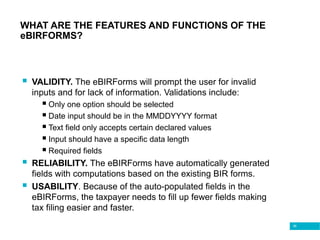

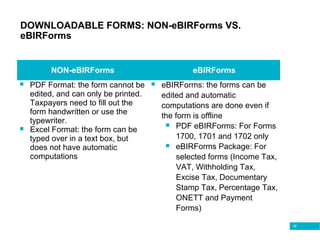

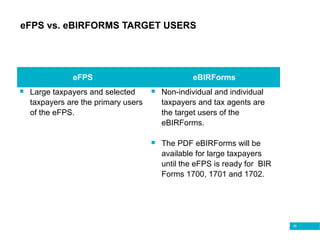

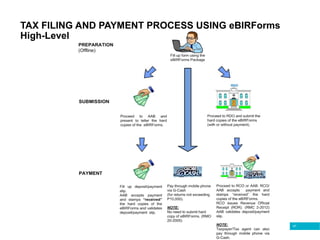

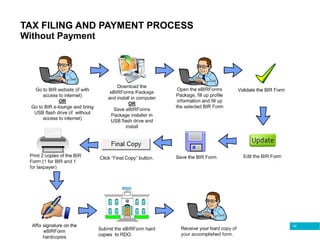

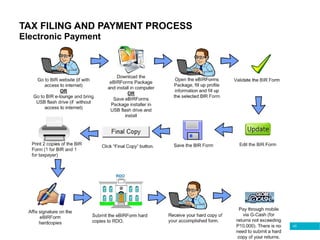

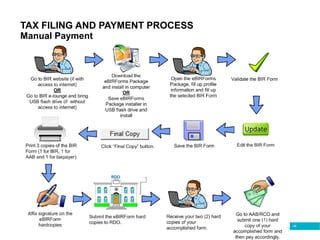

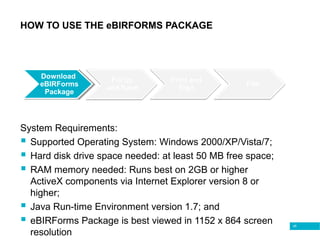

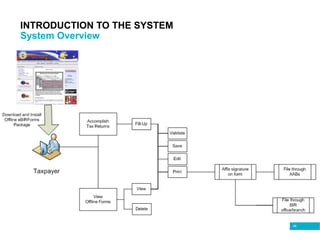

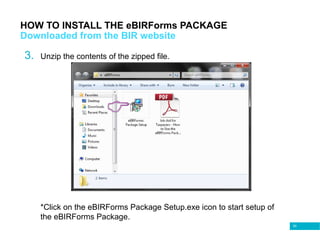

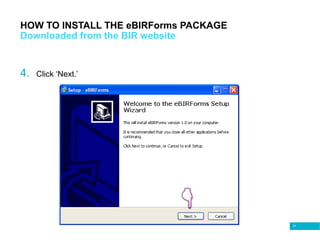

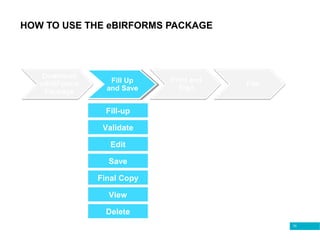

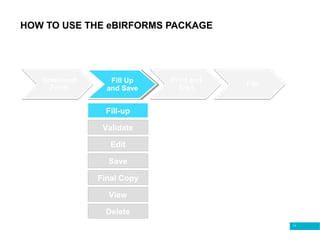

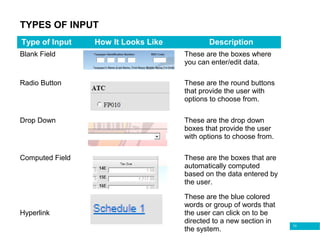

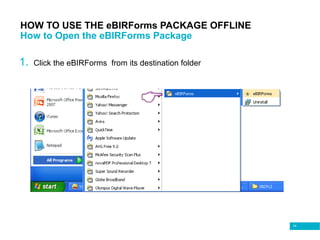

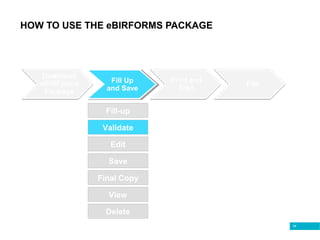

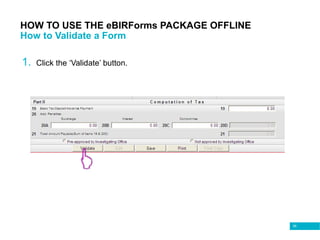

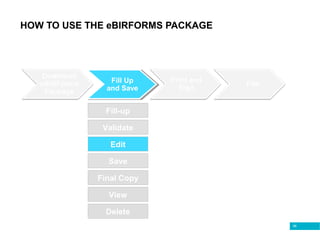

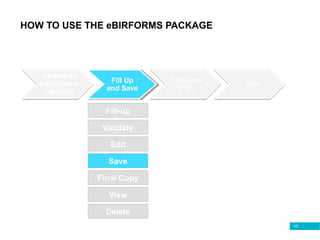

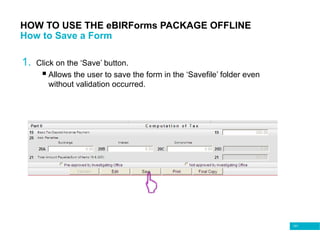

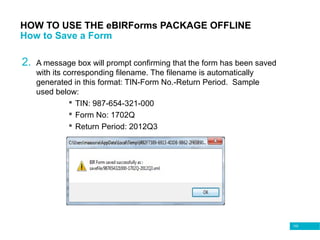

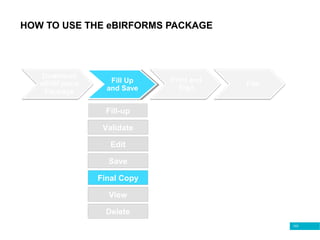

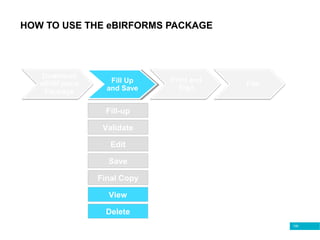

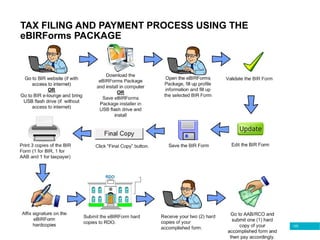

The document outlines a training for users on the Phase 2 rollout of the eBIRForms package. It discusses the project background, objectives, and timeline. Key features of the eBIRForms include automatic computations, validation of inputs, and usability. The training will cover an overview of the eBIRForms package and demonstration of how to use and submit tax returns electronically or manually.