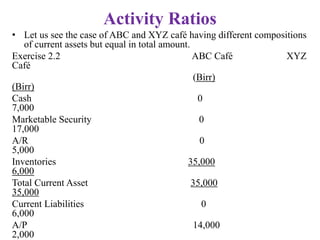

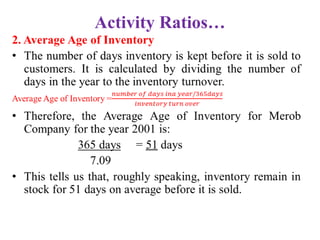

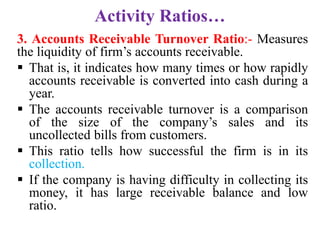

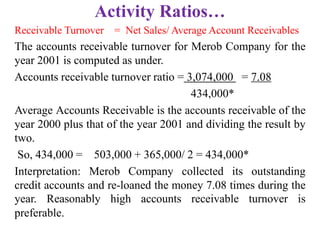

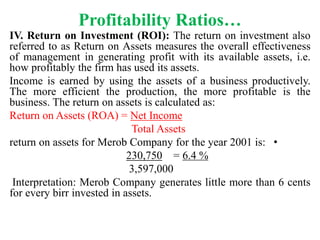

This document discusses financial analysis and planning. It provides information on sources of financial information including the balance sheet, income statement, and cash flow statement. It then discusses the need for and methods of financial analysis including ratio analysis. Ratio analysis involves calculating relationships between line items on financial statements to assess a firm's financial condition and performance. Different types of financial ratios are covered including liquidity ratios, activity ratios, leverage ratios, profitability ratios, and market value ratios. Liquidity and activity ratios are specifically discussed using an example company to demonstrate how they are calculated and interpreted.

![FINANCIAL FORECASTING…

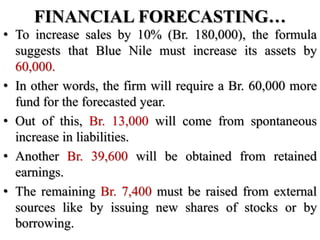

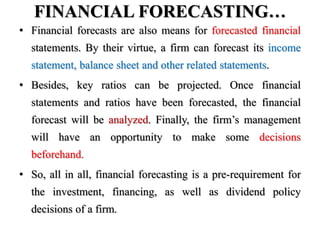

• Blue Nile’s forecasted total assets as shown above are Br. 660,000.

However, the forecasted total liabilities and equity amount to only

Br. 650,920. Since the balance sheet must balance, i.e. A = L + OE,

the difference must be covered by additional funds.

• Therefore, AFN = Br. 660,000 – Br. 650,920 = Br. 9,080.

Or AFN = Increase in normally assets – increase in generated funds

= [Br. 660,000 – Br. 600,000] – [(Br. 99,000 – Br.

90,000) + (Br. 44,000 – Br. 40,000) + Br. 37,920]

= Br. 60,000 – Br. 50,920

= Br. 9,080](https://image.slidesharecdn.com/fmchapter-2-221227184223-bbdf6877/85/FM-CHAPTER-2-pptx-72-320.jpg)