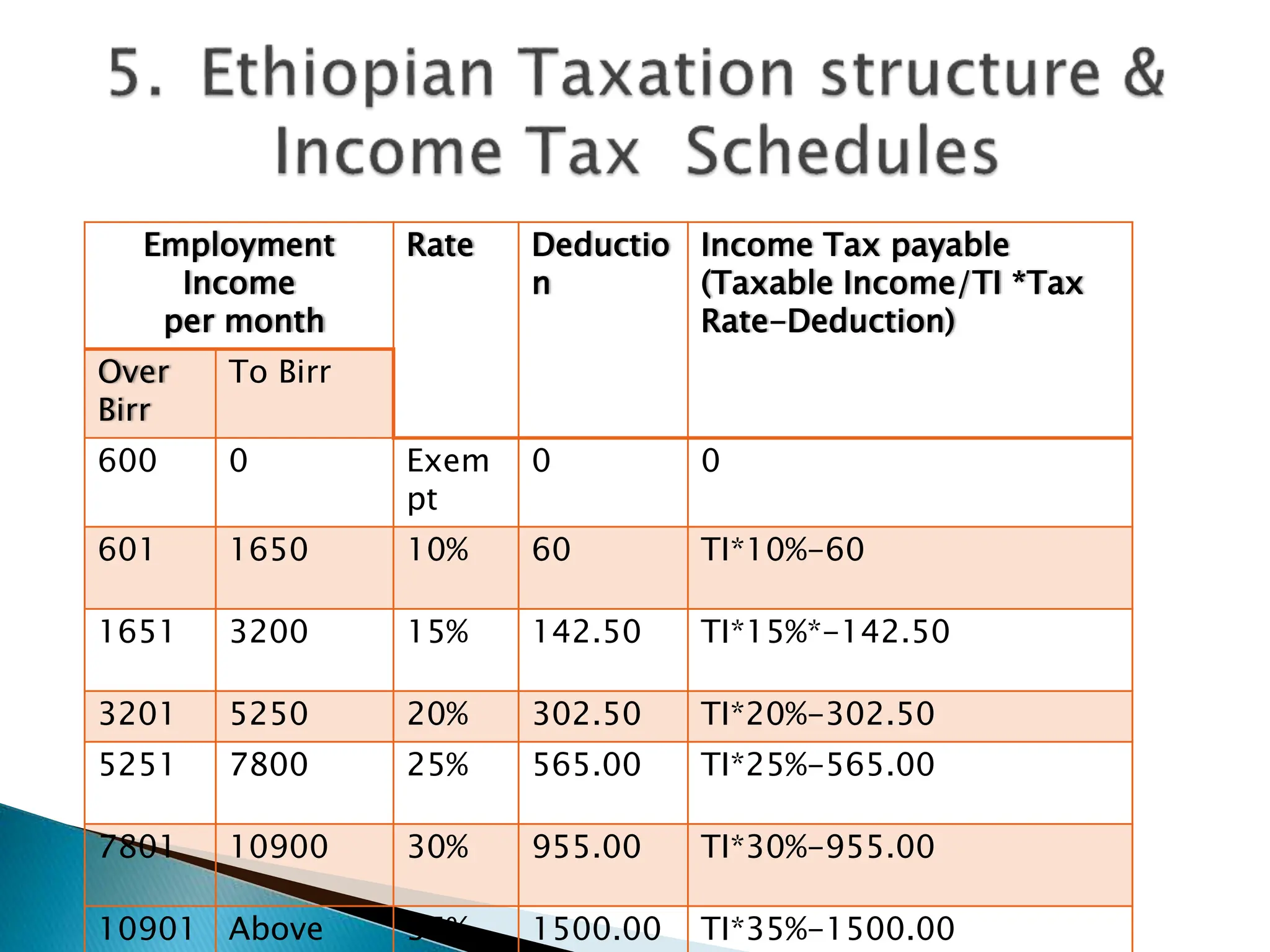

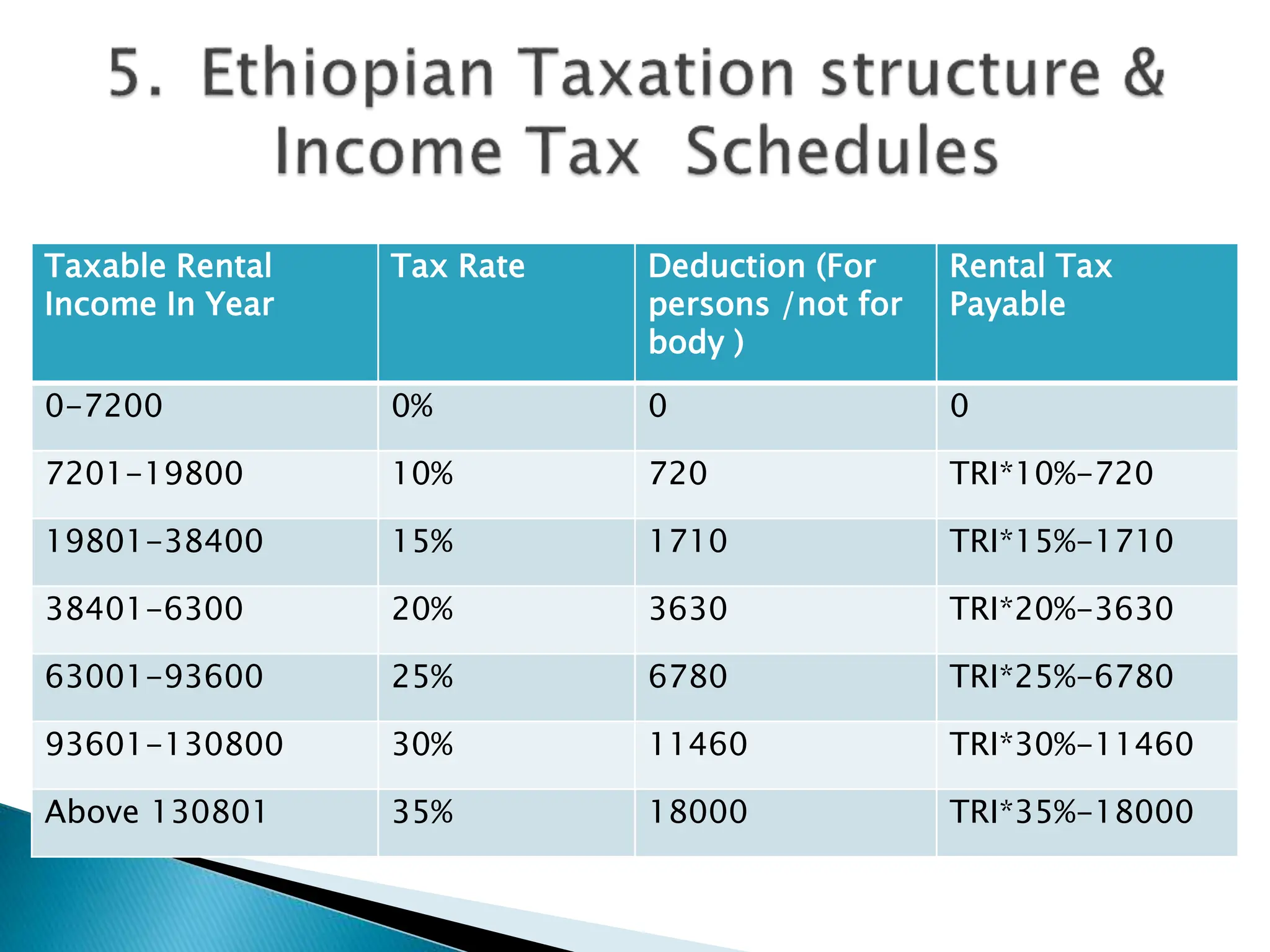

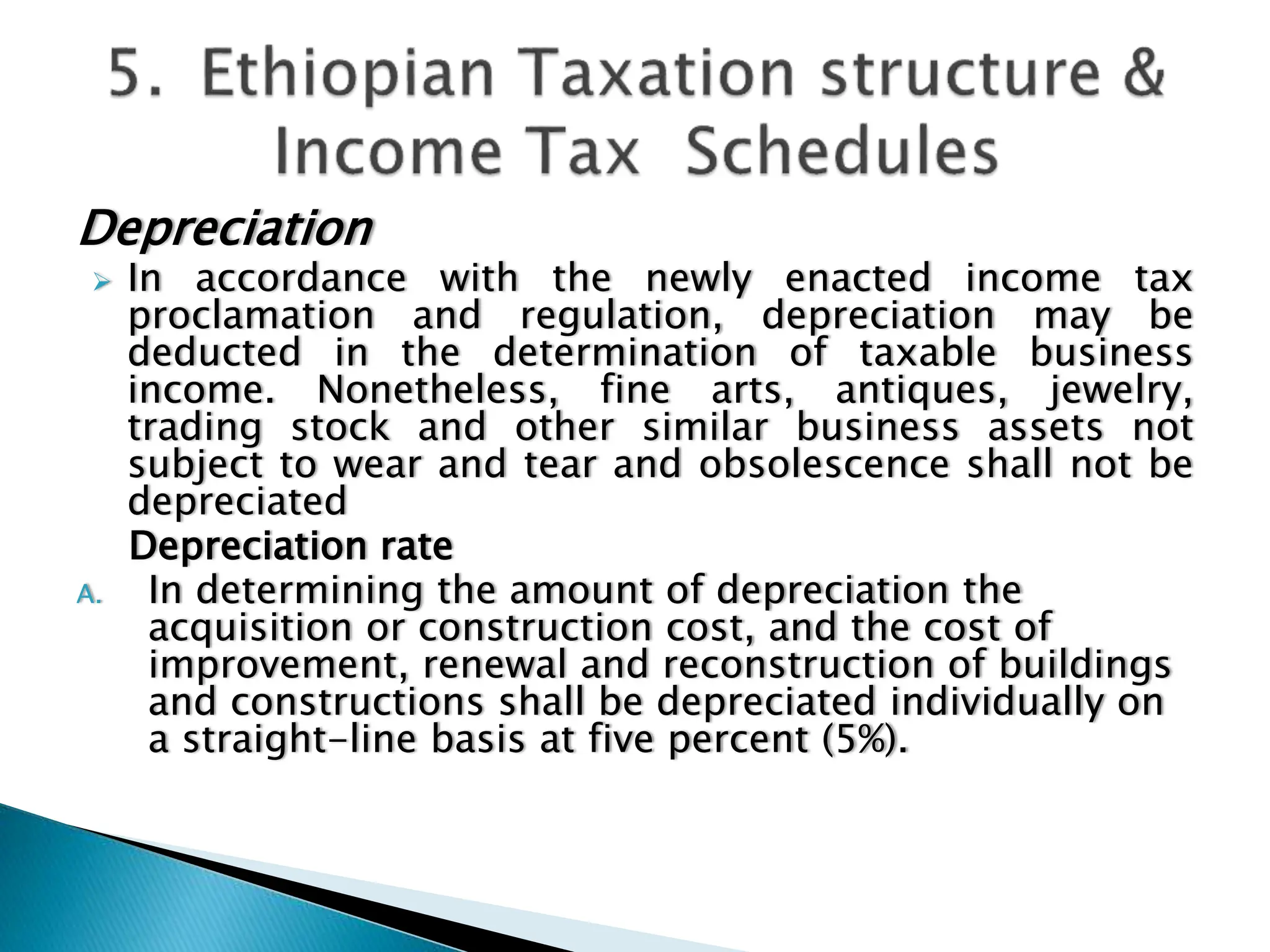

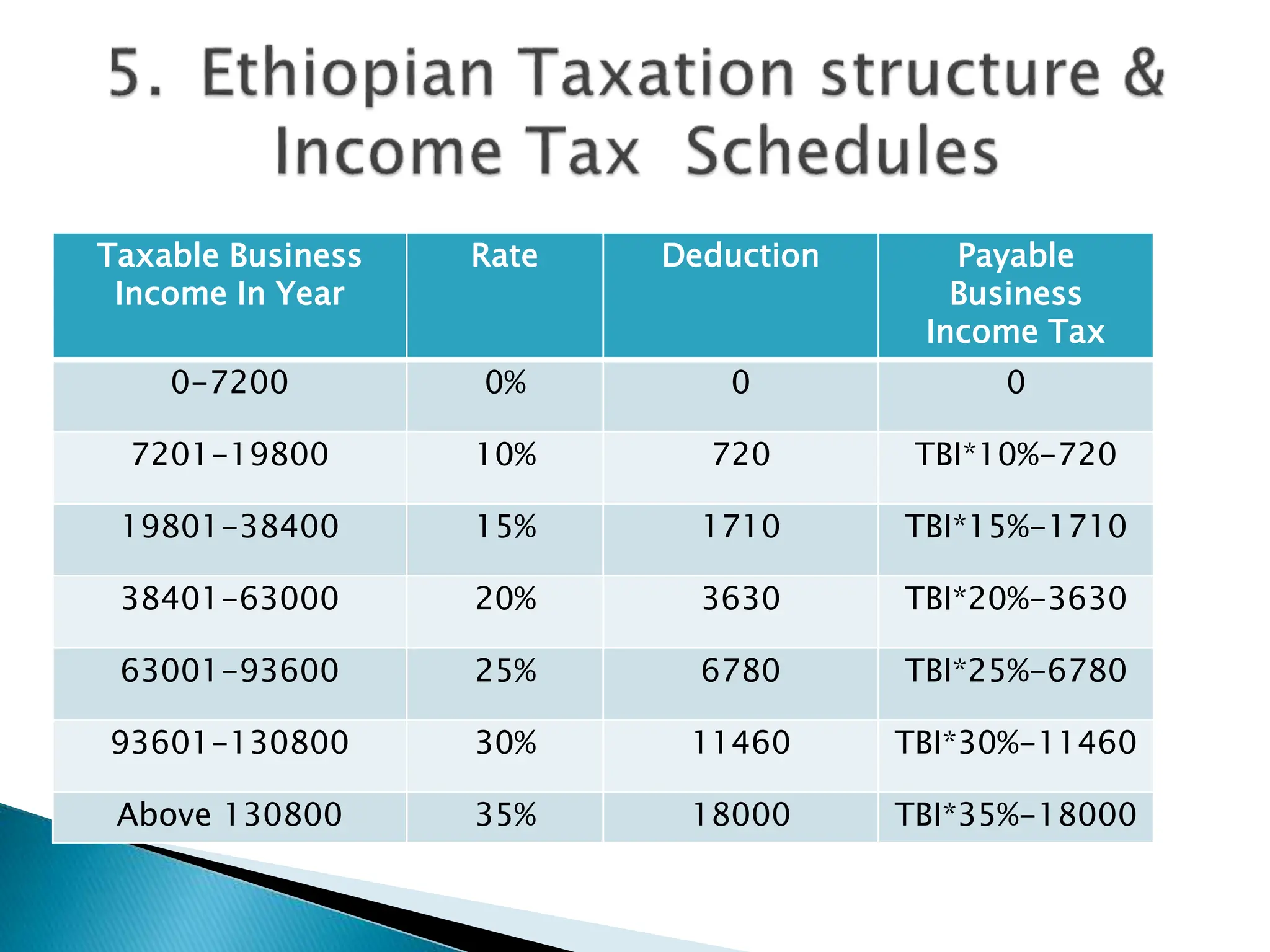

This document outlines Ethiopia's income tax schedules and structures. It discusses employment income tax (Schedule A), rental income tax (Schedule B), and business income tax (Schedule C). For employment income, tax rates range from 10-35% and the first Birr 600 is exempt. For rental income, tax rates range from 0-35%. Business income is taxed based on the business's annual turnover and categorization as A, B, or C. Allowable deductions and non-allowable expenses are defined for determining taxable business income.