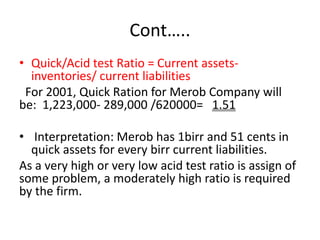

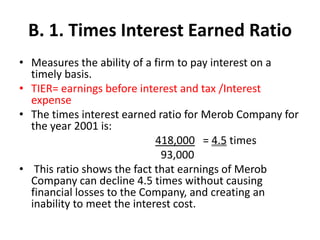

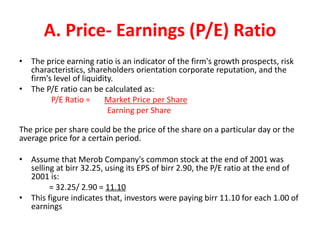

The document discusses the importance of financial management through analysis and planning, emphasizing decision-making based on accurate financial information from statements such as balance sheets and income statements. It details various financial analysis methods, including ratio analysis, horizontal analysis, and vertical analysis, to assess a firm's financial condition and performance, and identifies key financial ratios like liquidity, activity, leverage, profitability, and market value ratios. The document underscores the significance of interpreting these ratios to aid stakeholders in making informed decisions regarding a firm's financial health.