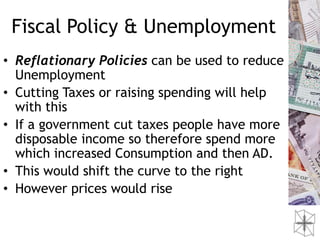

Fiscal policy involves government spending and taxation to achieve macroeconomic goals, with current UK national debt exceeding £1 trillion. Deficits occur when spending surpasses total revenue, and fiscal measures can target inflation, unemployment, and economic growth. The policy has advantages, such as significant economic impacts and equitable income distribution, but also drawbacks like unintended effects and time lags.