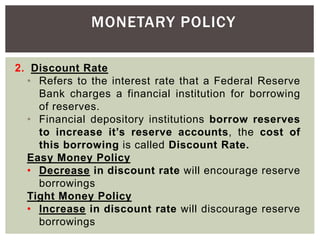

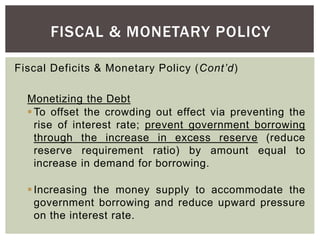

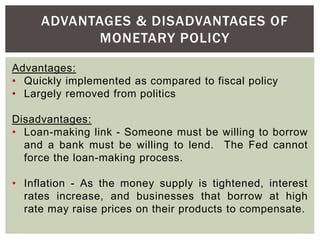

This document summarizes monetary policy tools used by the Federal Reserve to influence economic activity. It discusses three main tools: reserve requirements, the discount rate, and open market operations. Changing these tools can implement either an expansionary/easy money policy to increase spending and reduce unemployment, or a restrictive/tight money policy to reduce spending and inflation. The document also discusses how fiscal deficits can impact monetary policy through crowding out and monetizing the debt.