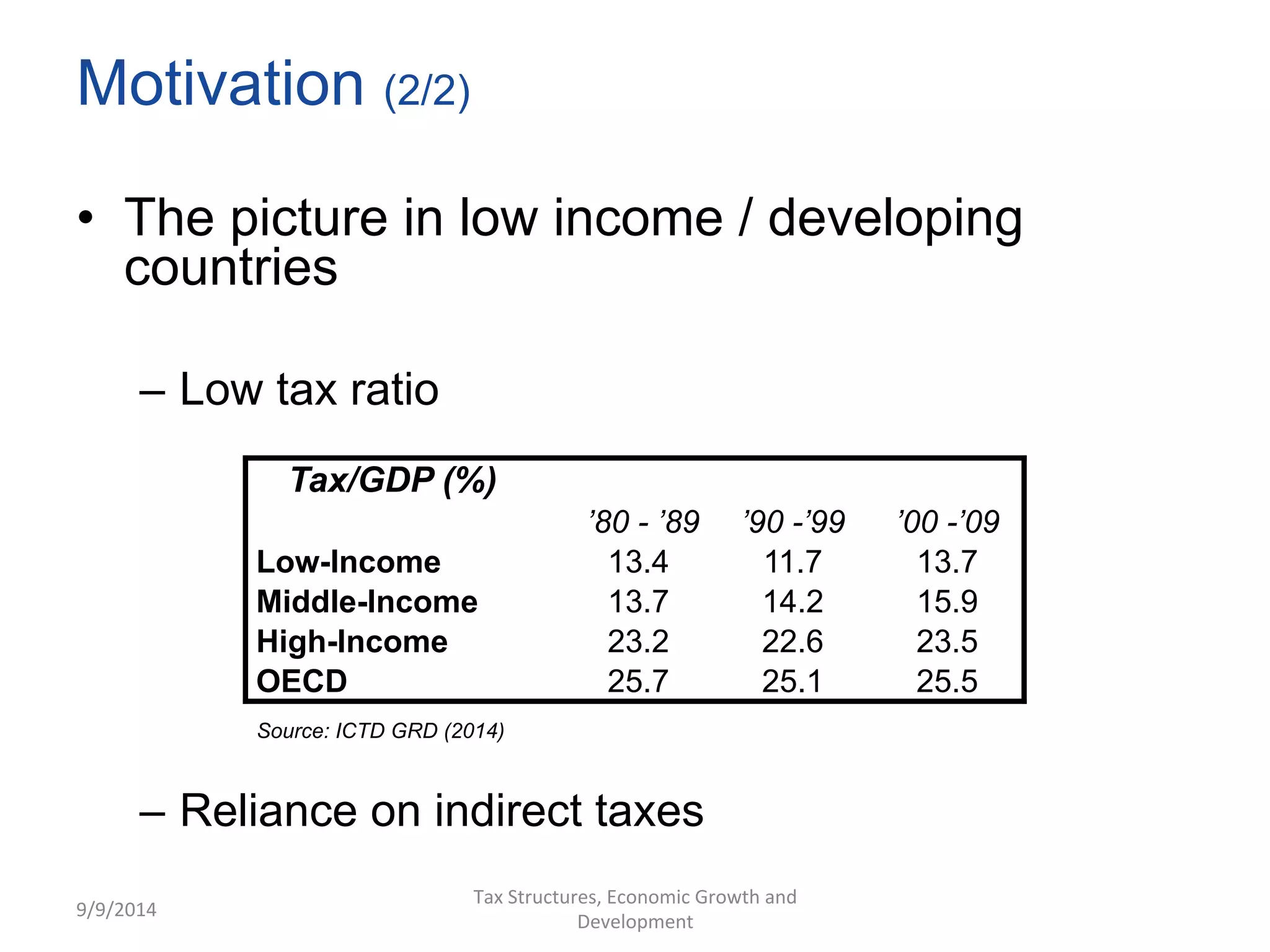

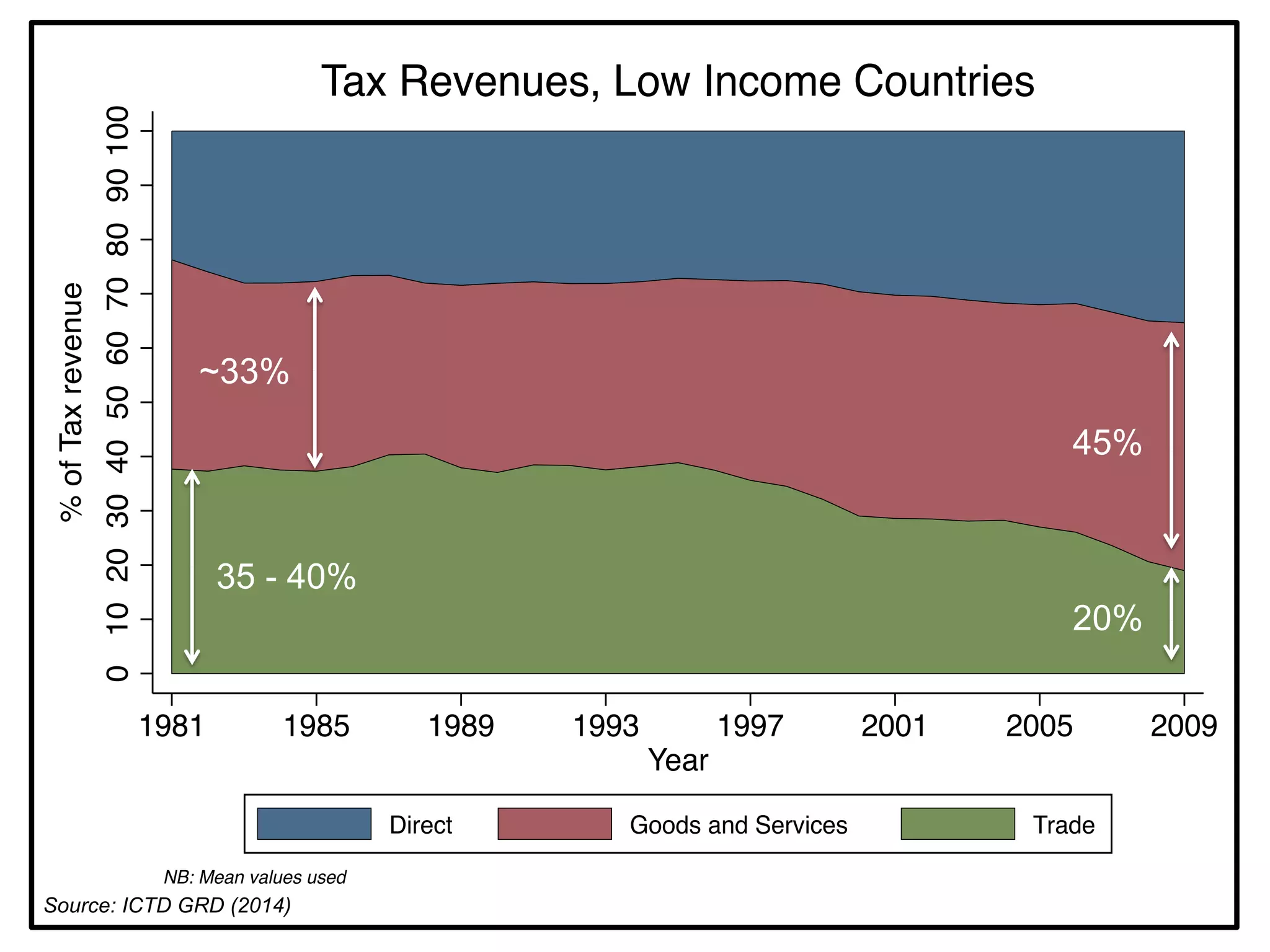

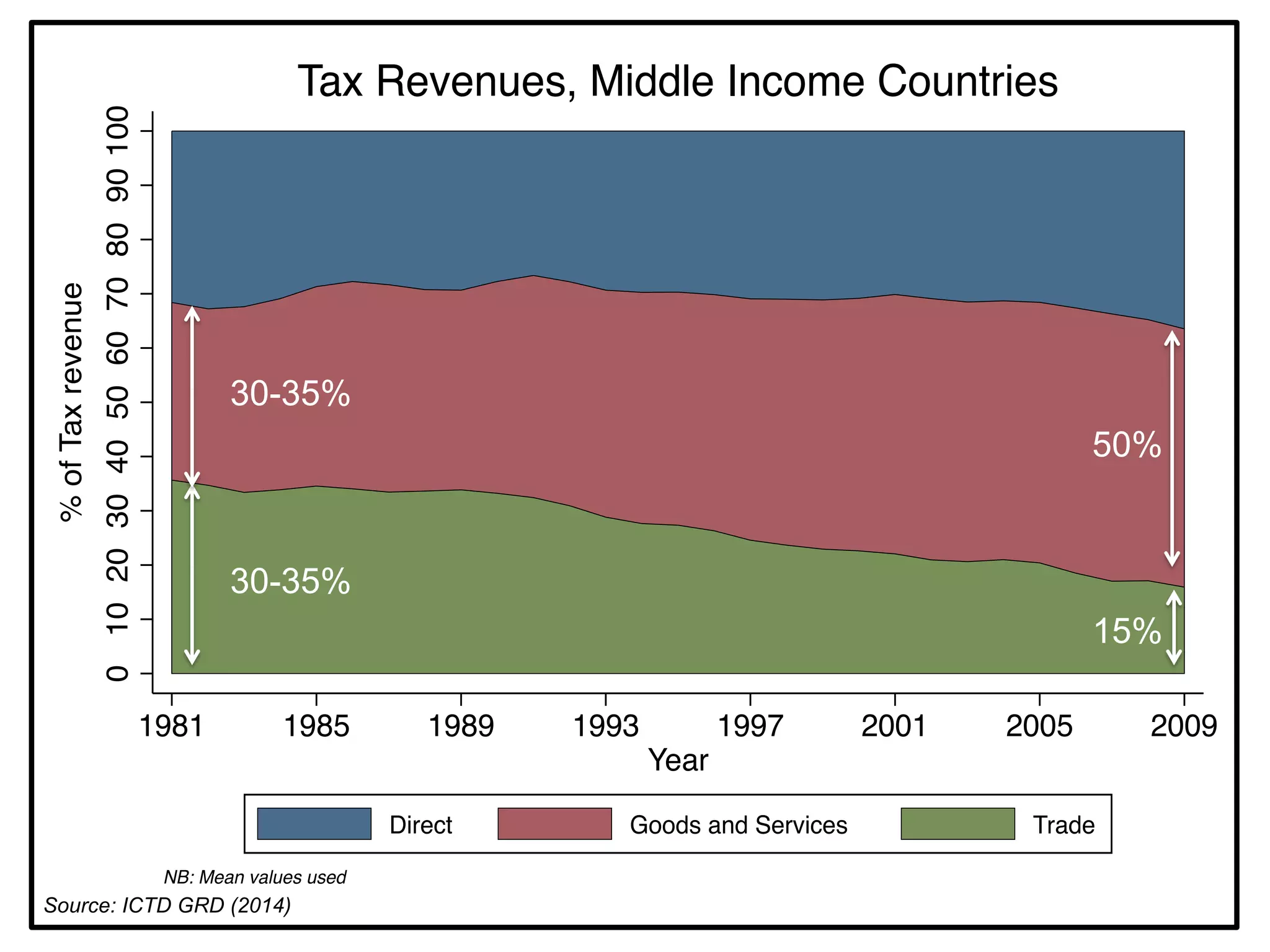

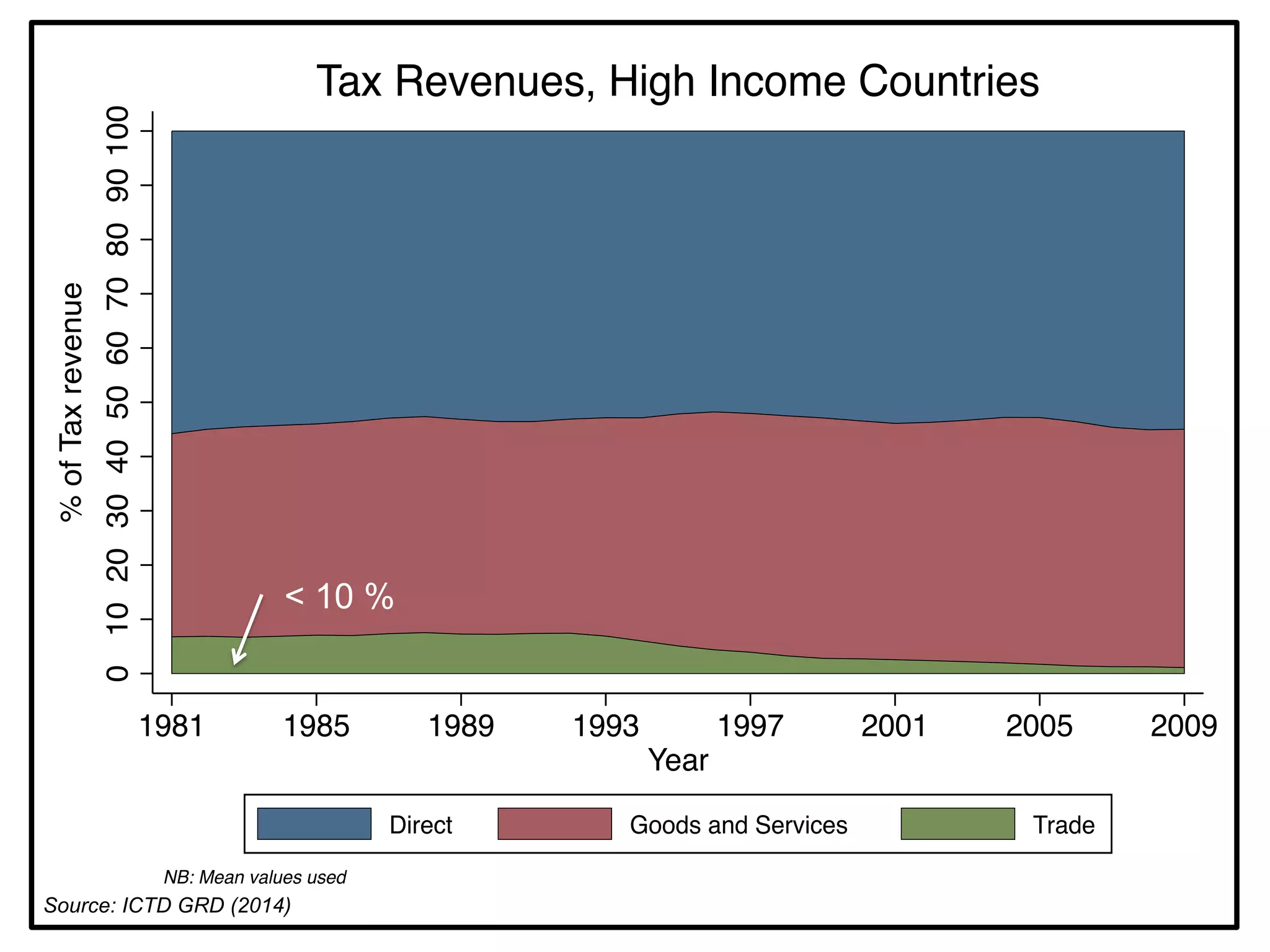

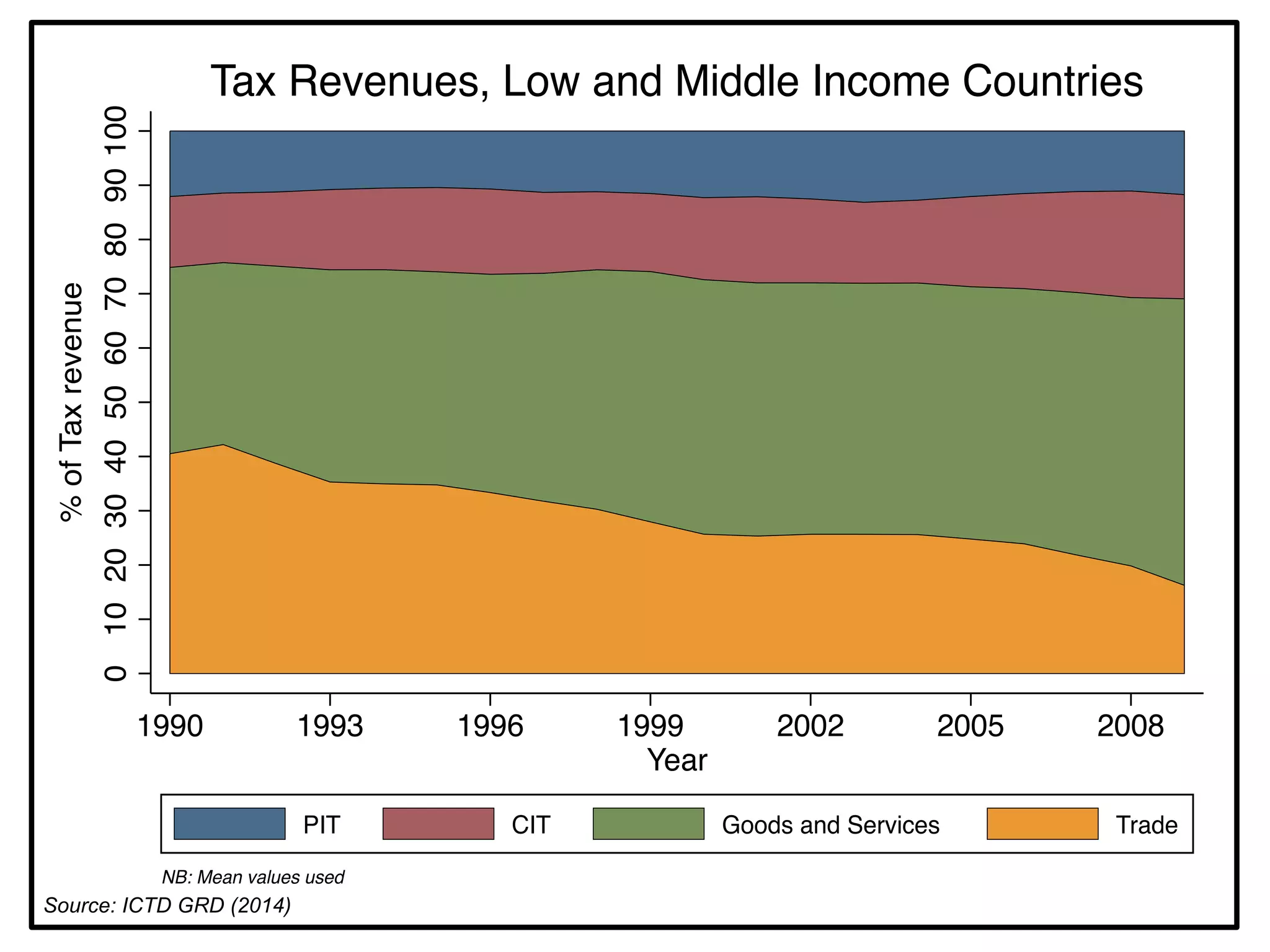

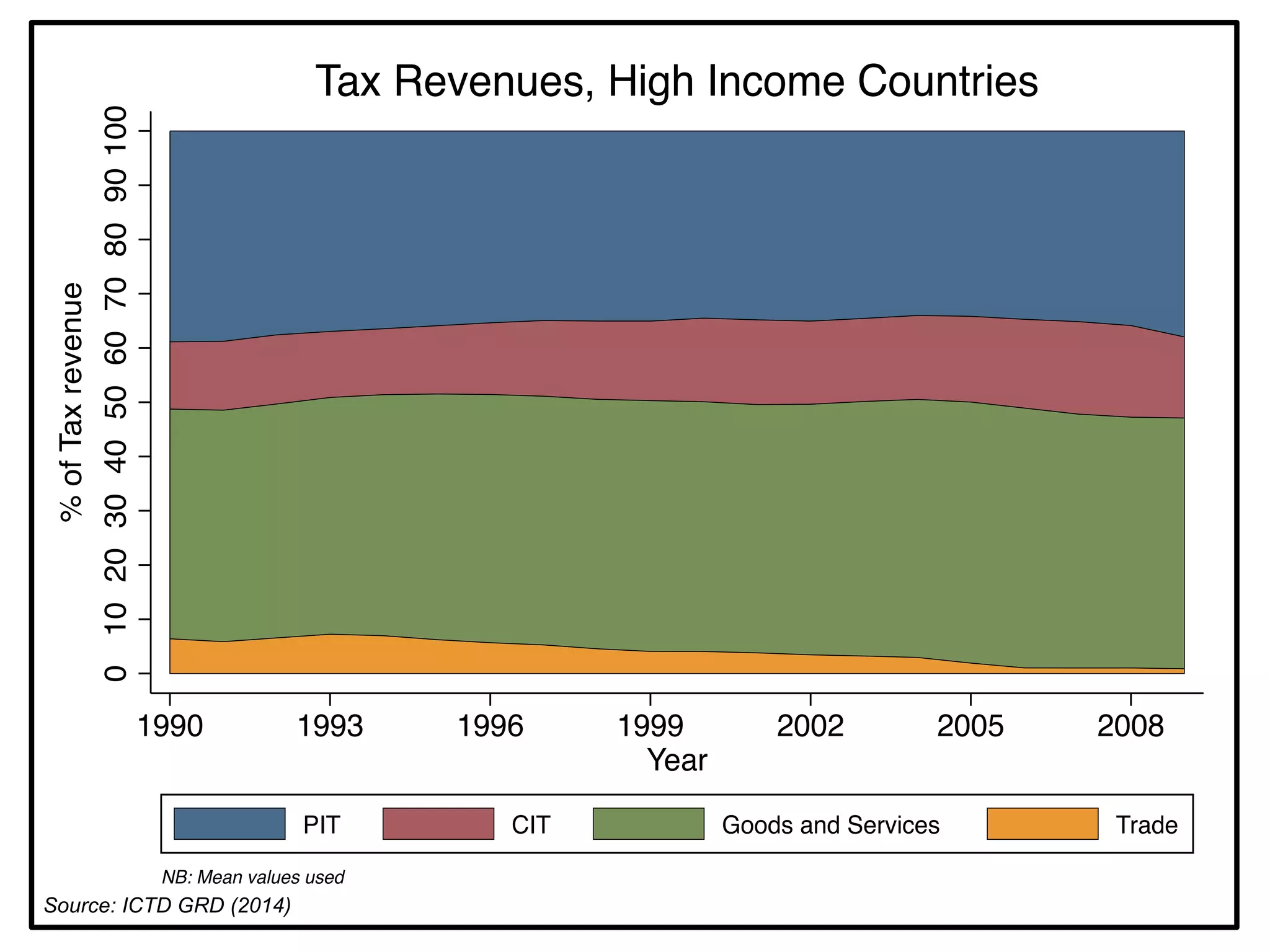

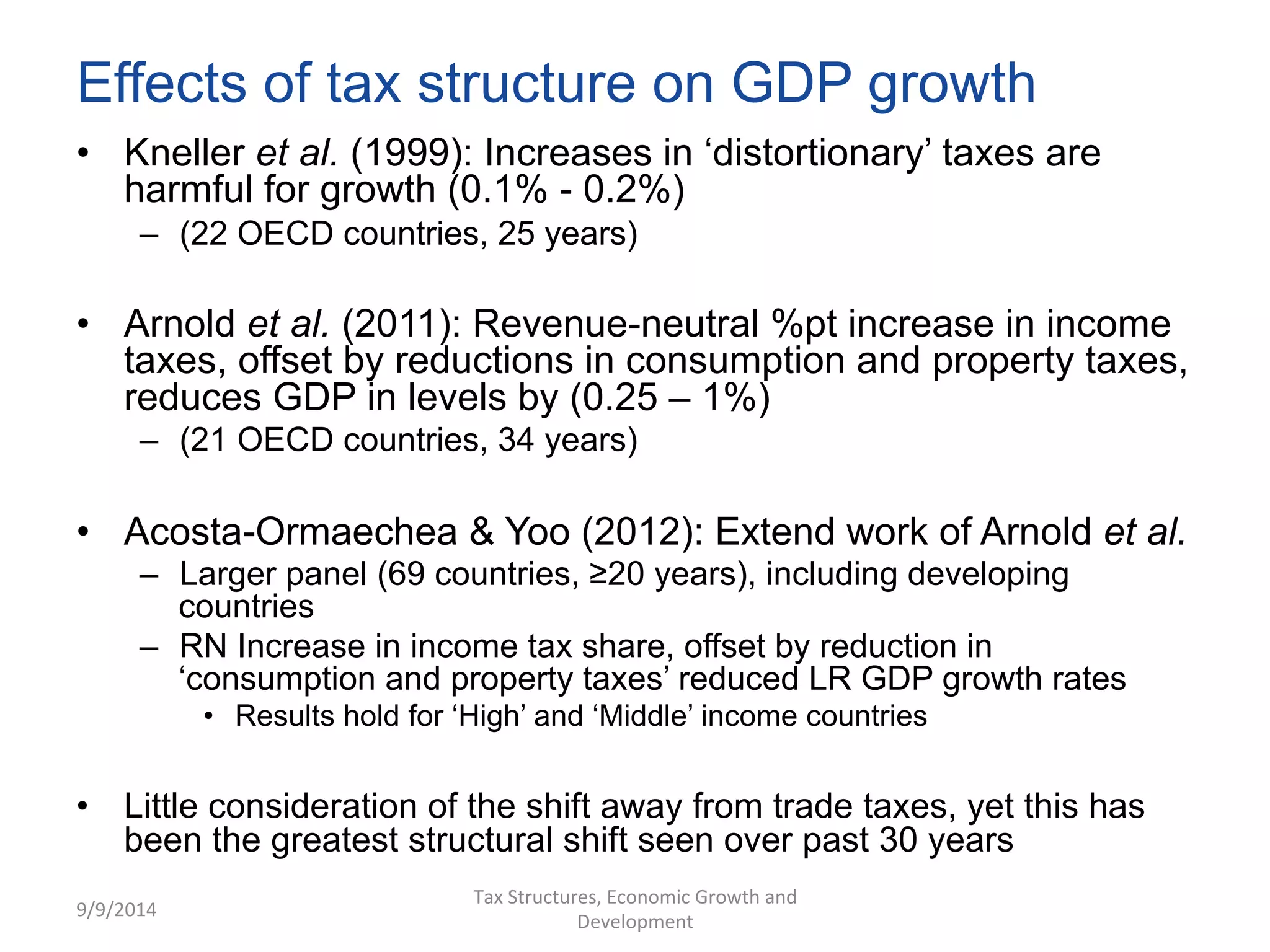

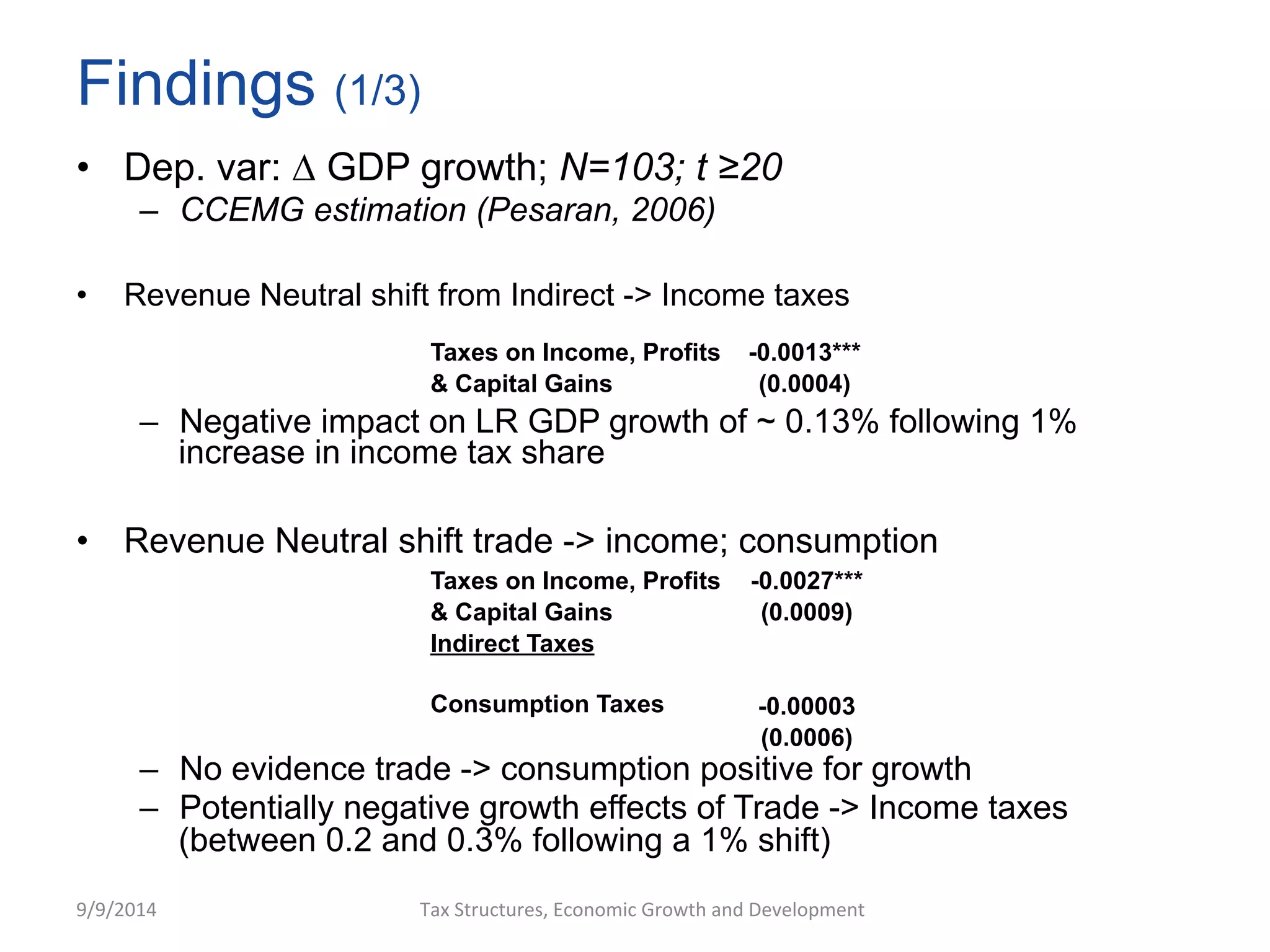

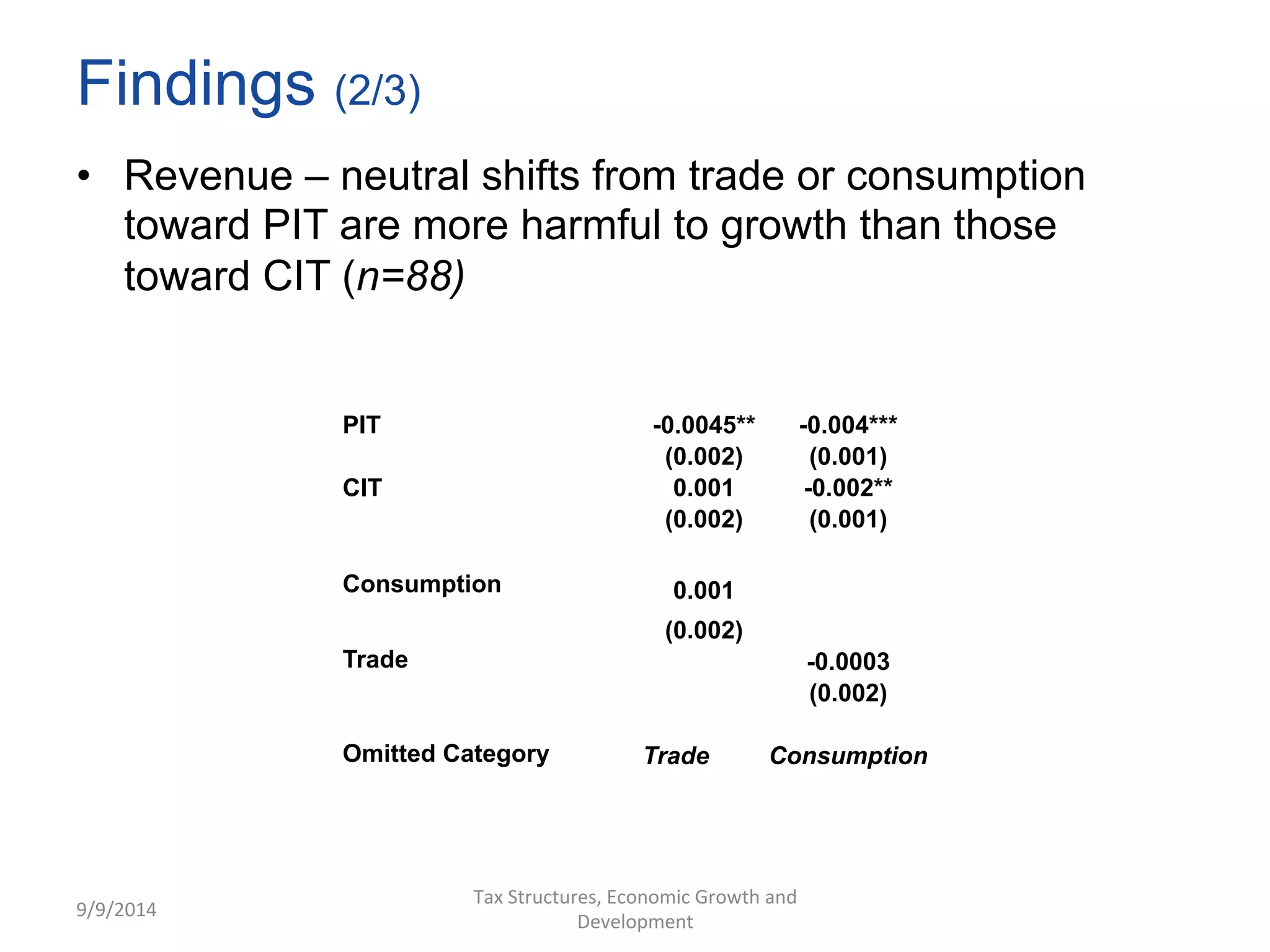

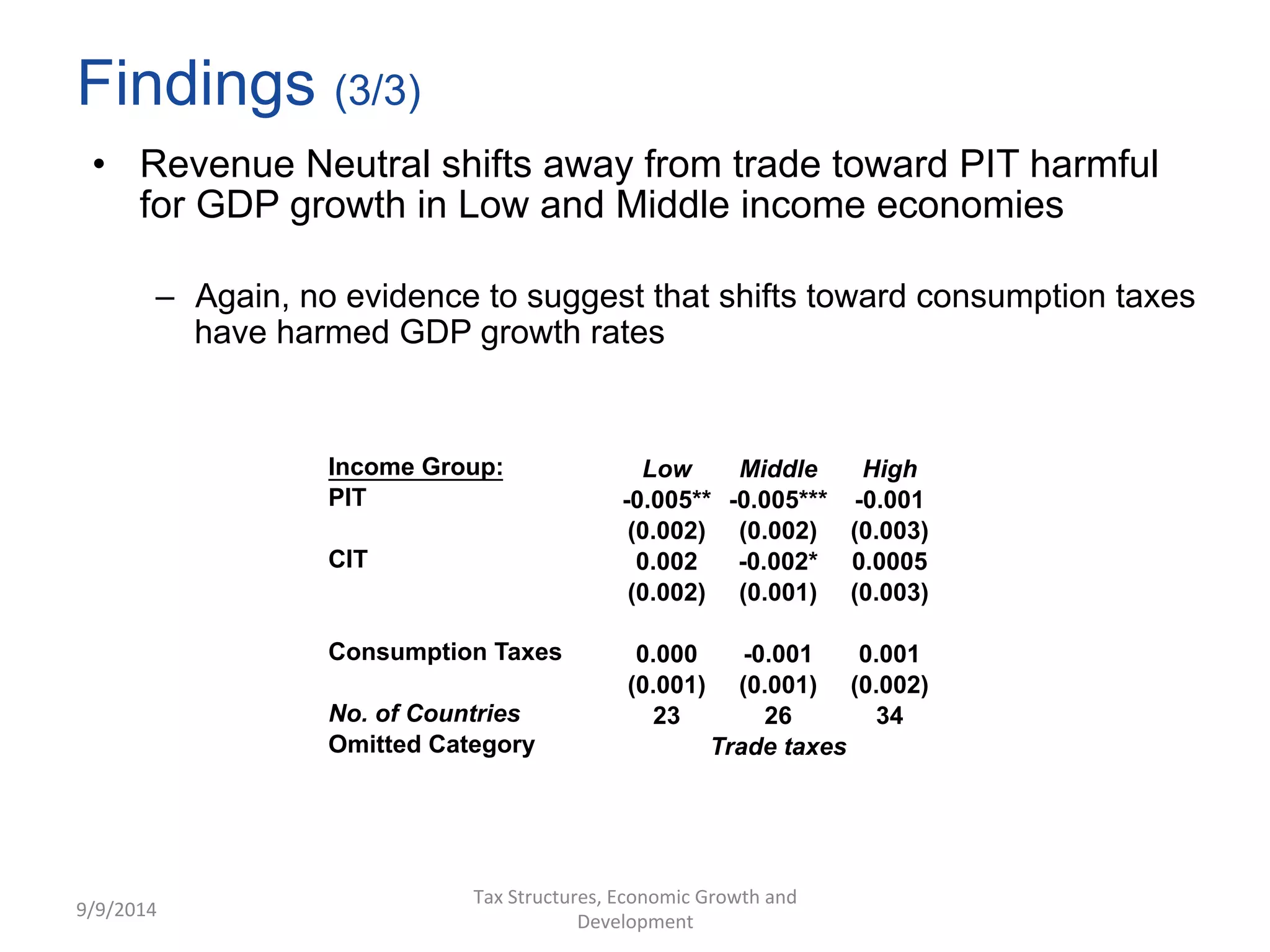

The document discusses tax structures and their implications for economic growth in low and middle-income countries, noting a shift from trade taxes to consumption taxes like VAT. It highlights that these shifts may not negatively impact growth, but increasing personal income taxes could harm GDP growth rates. Key findings underscore the complex relationship between tax composition and economic performance across income levels.