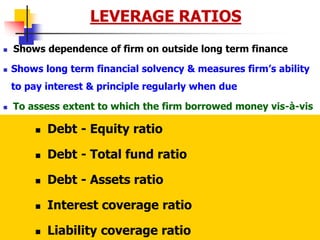

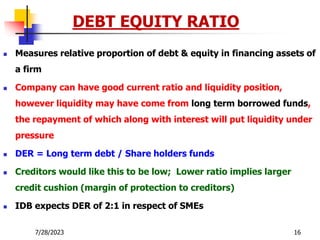

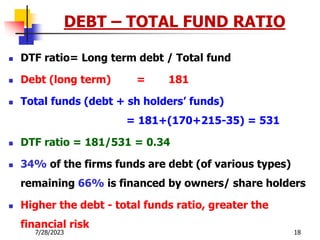

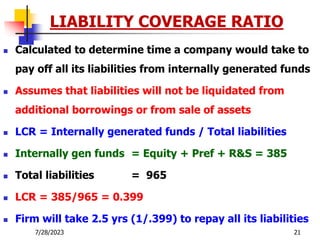

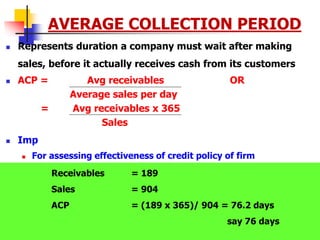

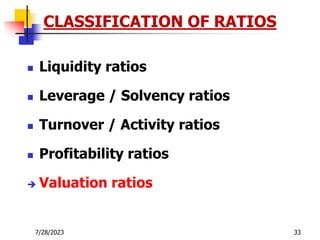

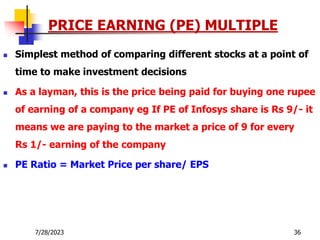

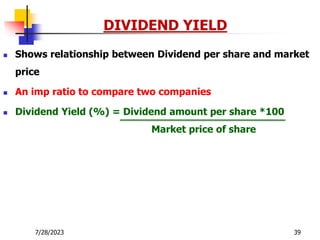

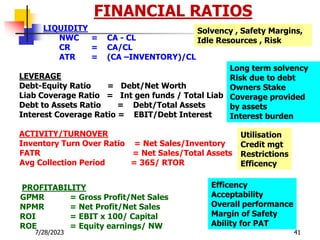

The document discusses various types of financial ratios used to analyze the financial performance and position of a company. It defines ratios and provides examples to calculate liquidity ratios like current ratio and acid test ratio, leverage ratios like debt-equity ratio, activity ratios like inventory turnover ratio, and profitability ratios like gross profit margin ratio and return on investment. The document emphasizes the importance of ratio analysis for comparing a company's performance over time, against industry benchmarks, and between peer companies.