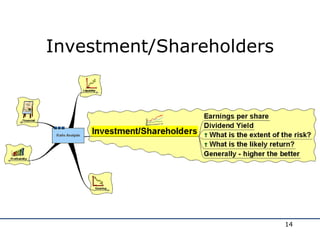

This document provides an overview of financial statement analysis and ratio analysis for assessing the financial health of a company. It discusses the different types of financial statements, including the balance sheet, income statement, cash flow statement, and statement of retained earnings. It then outlines various ratios that can be calculated from the financial statements to evaluate a company's liquidity, profitability, leverage, investment returns, and operating efficiency. Examples are provided of common liquidity ratios like the current ratio and acid test ratio, as well as profitability, leverage, and turnover ratios. The document emphasizes that ratio analysis allows for comparison of a company's performance over time, against industry benchmarks, and between peer companies. It concludes with exercises calculating various ratios from sample financial