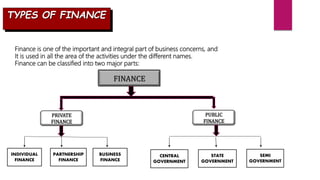

The document provides an introduction to financial management. It defines key terms like finance, business finance, and corporate finance. Financial management is described as integral to overall management and concerned with procuring and utilizing funds efficiently. The objectives of financial management are profit maximization and wealth maximization. Functions of a finance manager include forecasting requirements, acquiring capital, investment decisions, cash management, and interdepartmental coordination. Financial management is important for business concerns as it provides planning, funds acquisition, proper fund usage, value increase, and savings promotion.