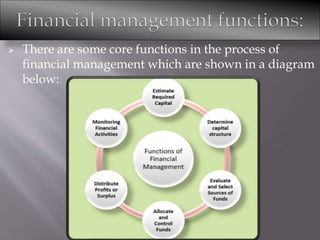

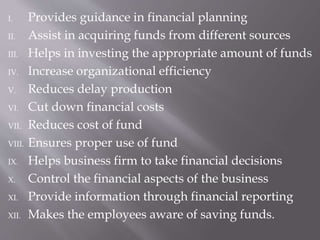

The document outlines the key functions and importance of financial management, emphasizing tasks such as estimating required capital, determining capital structure, and monitoring financial activities. Financial management is vital for planning, organizing, and controlling funds to achieve organizational goals. It aids in investment, financing, and dividend decisions while enhancing operational efficiency and ensuring proper fund utilization.