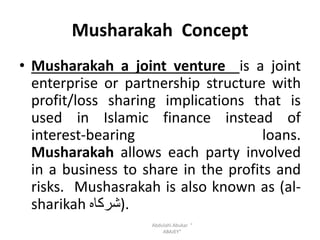

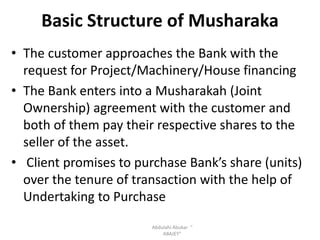

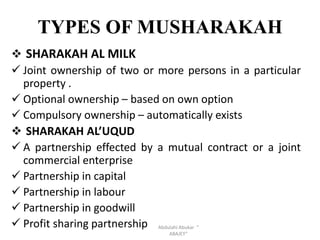

Musharakah is an Islamic financing structure that is an alternative to interest-bearing loans. It allows parties to share profits and risks of a business venture, with the ratio of profit distribution determined in advance. There are several types of Musharakah partnerships depending on the nature of contributions and shares. The key principles are that losses are shared based on capital contribution ratios, while profit shares can be predetermined but not based on capital amounts. An example shows how capital contributions and profit shares are calculated for a project co-financed by an Islamic bank and customer.