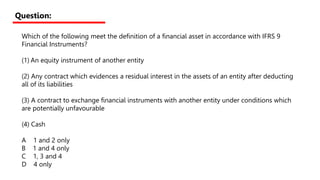

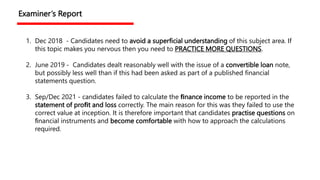

This document discusses financial instruments and provides learning objectives related to defining and accounting for various types of financial instruments including:

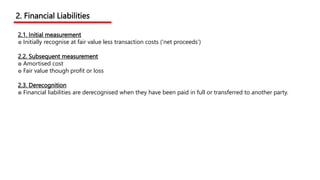

1. Defining financial assets and liabilities and outlining their initial recognition and measurement.

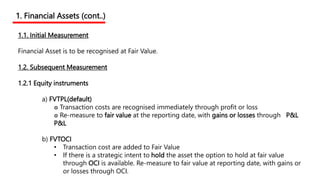

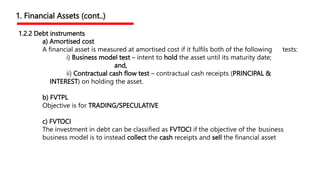

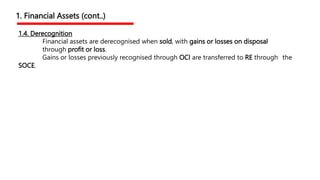

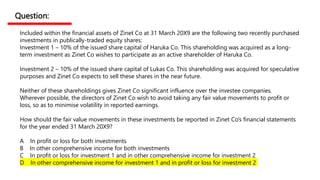

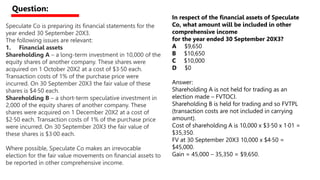

2. Discussing the classification and subsequent measurement of financial instruments at amortized cost, fair value through other comprehensive income (FVTOCI), and fair value through profit or loss (FVTPL).

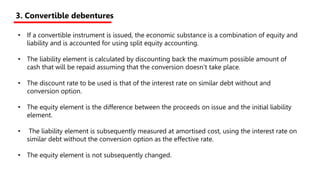

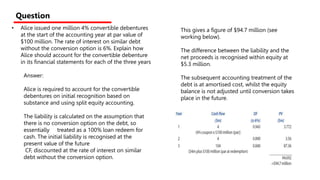

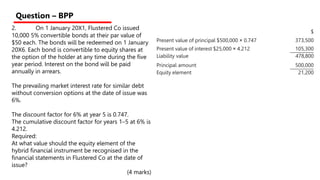

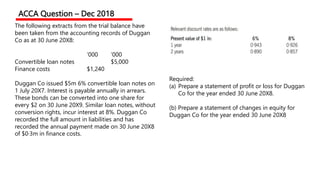

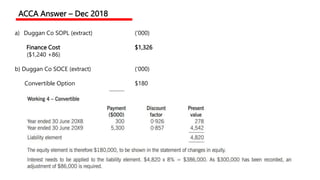

3. Distinguishing between debt and equity instruments and outlining the accounting for convertible debt instruments using the split accounting method.