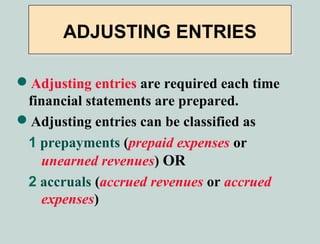

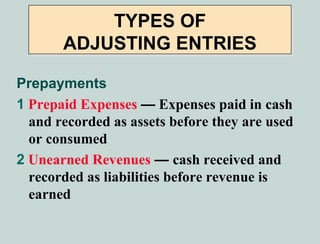

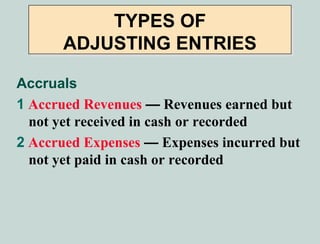

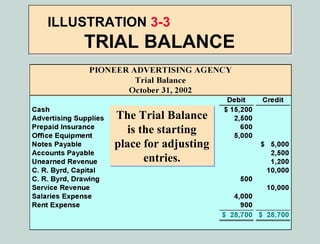

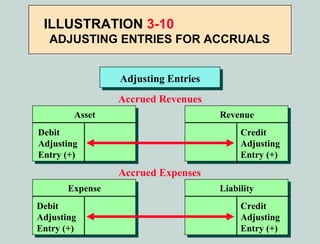

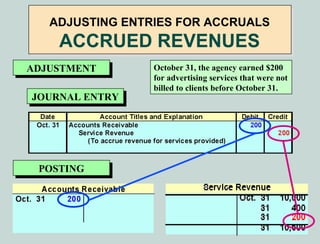

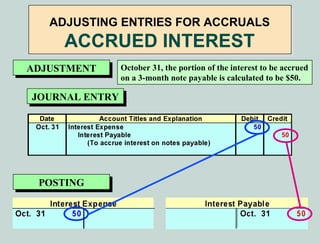

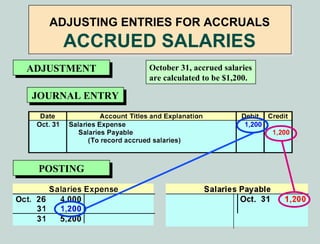

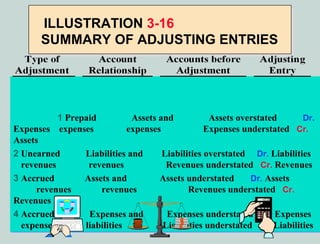

The document discusses key accounting principles such as revenue recognition, matching principle, and adjusting entries. It defines different types of adjusting entries including prepaid expenses, unearned revenues, accrued revenues, and accrued expenses. Examples are provided for journal entries to record accrued revenues and expenses. The summary identifies the major concepts covered in the document which are the different types of adjusting entries and how to prepare adjusting entries for accruals.