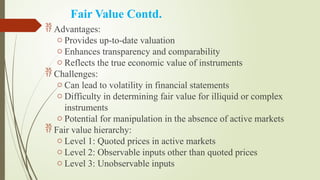

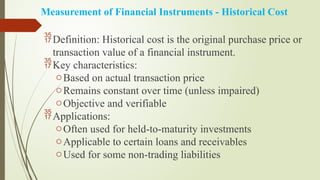

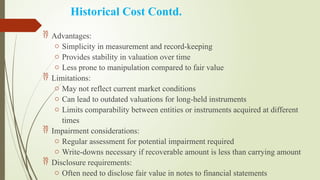

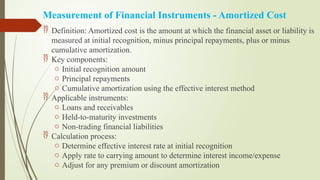

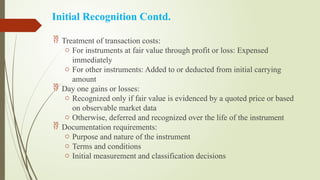

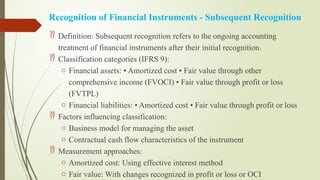

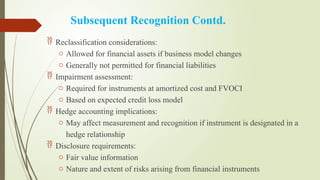

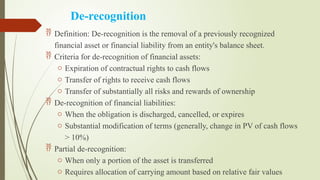

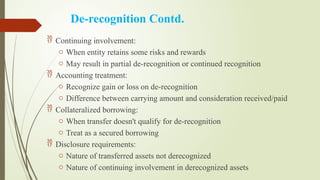

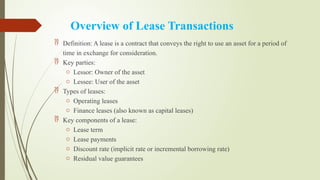

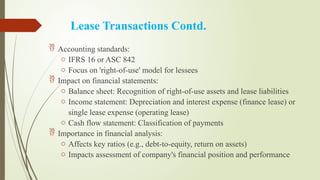

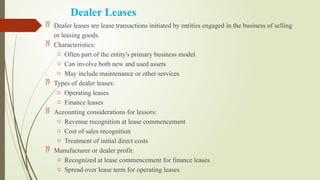

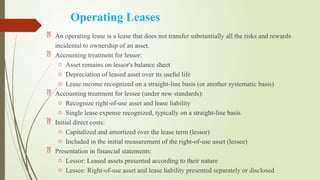

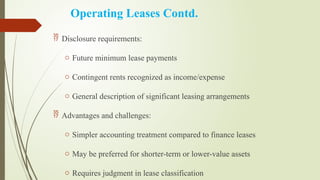

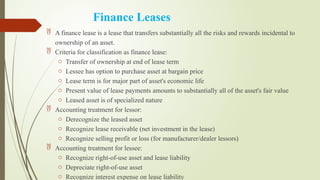

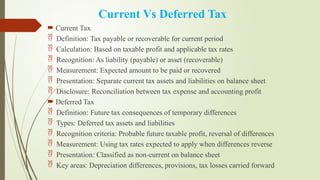

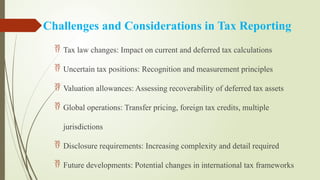

The document outlines the reporting, measurement, and recognition of financial instruments, highlighting their importance in financial reporting and stakeholder decision-making. It covers various measurement methods, including fair value, historical cost, and amortized cost, while detailing the accounting treatments for initial and subsequent recognition, de-recognition, and lease transactions. Additionally, it discusses tax reporting, including current and deferred tax implications, emphasizing the need for transparency and consistency in financial statements.