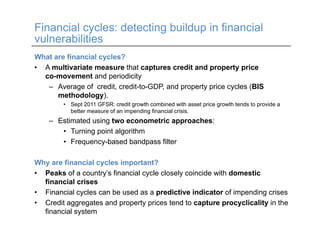

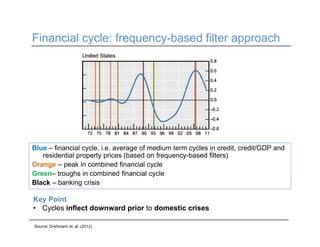

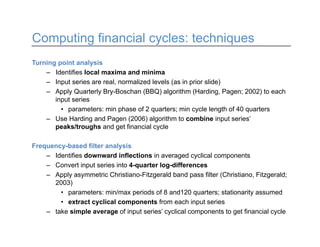

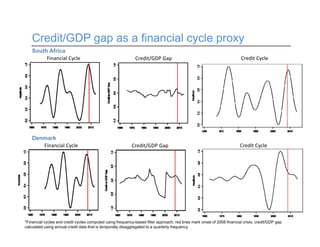

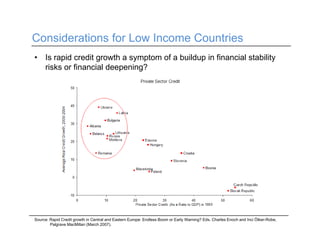

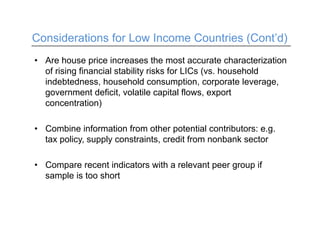

The document discusses the concept of financial cycles, highlighting their importance as predictive indicators of financial crises based on the co-movement of credit and property prices. It outlines methodologies for computing financial cycles, such as turning point analysis and frequency-based filtering, and presents stylized facts about their characteristics compared to traditional business cycles. Additionally, it provides guidance on challenges faced by low-income countries in measuring these cycles and offers recommendations for effective financial monitoring.