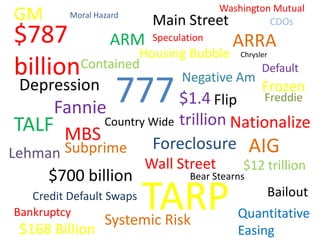

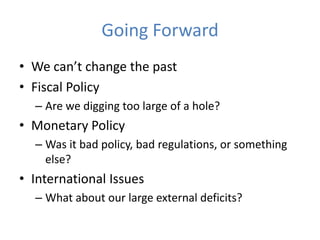

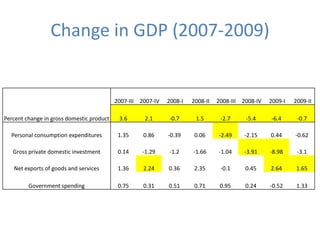

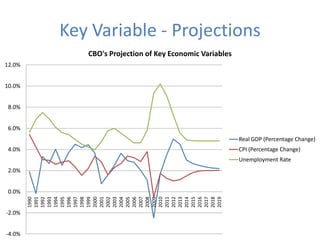

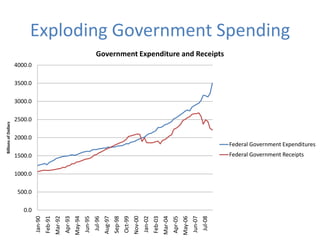

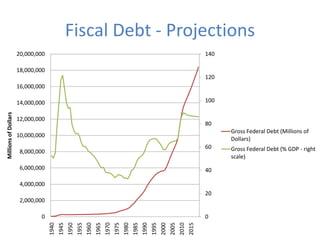

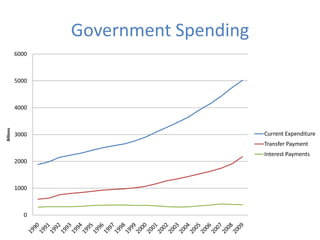

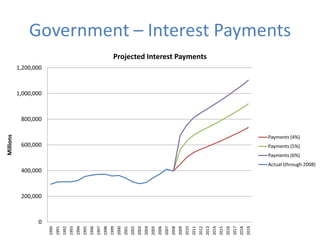

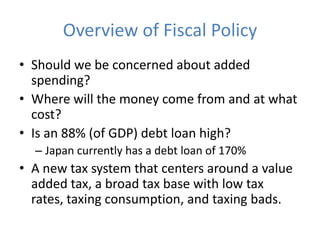

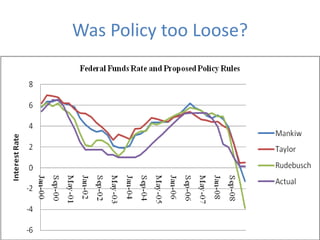

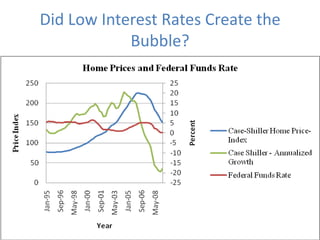

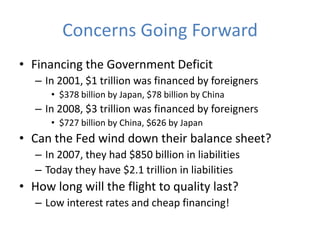

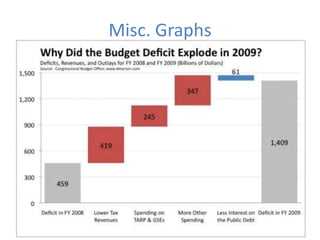

The document discusses the future economic environment in the United States following the recent financial crisis and recession. It analyzes key factors like fiscal policy, monetary policy, government spending and debt levels, and projections for GDP, inflation, and unemployment. The large increase in government spending and debt in response to the crisis is not sustainable long-term and interest payments on the debt will grow substantially if rates rise modestly. Overall fiscal policy may be exacerbating the government's long-term budget problems.