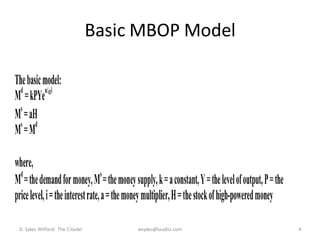

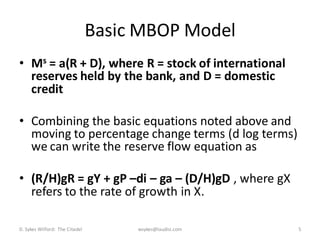

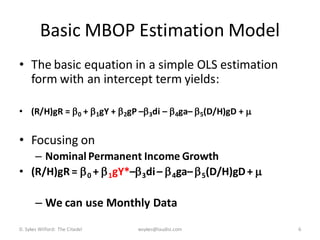

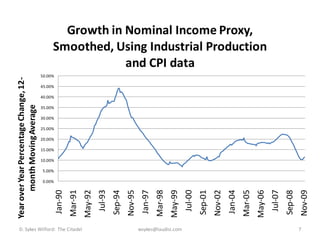

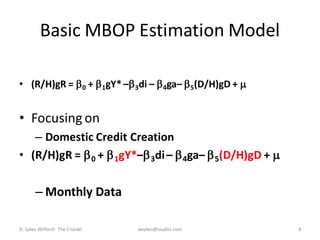

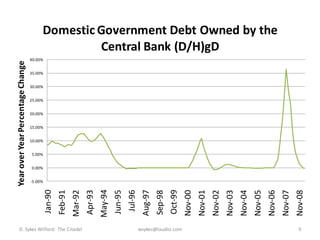

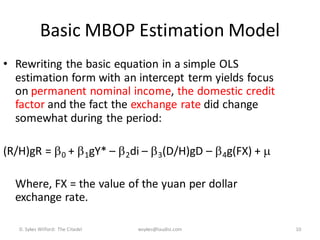

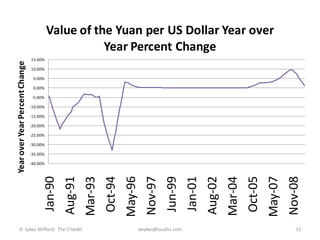

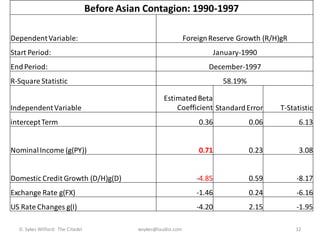

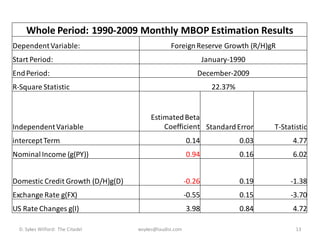

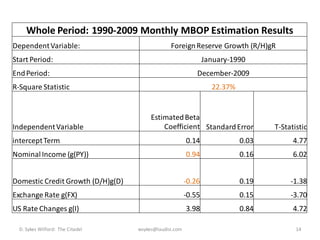

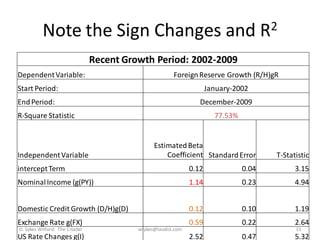

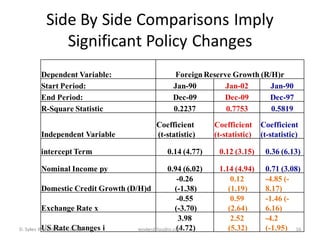

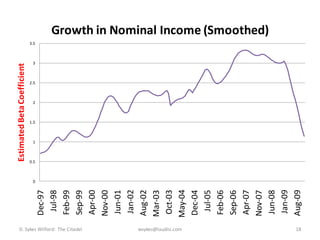

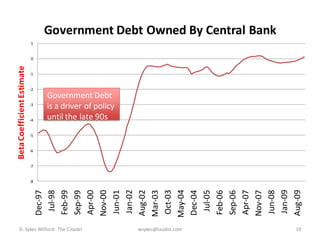

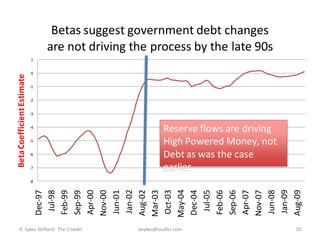

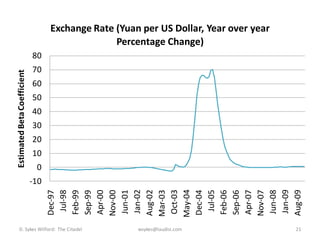

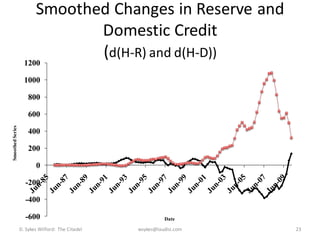

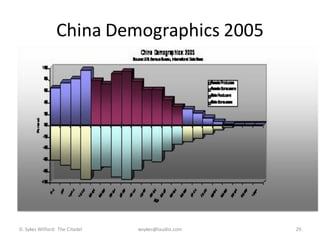

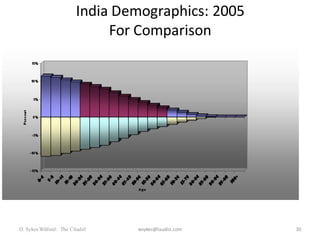

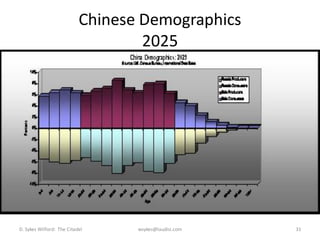

The document discusses the Chinese exchange rates and reserves from a monetary approach perspective, emphasizing the accumulation of reserves as a key policy outcome. It highlights the relationship between reserve growth, domestic credit, and nominal income, illustrating the shifts in central bank policy following the Asian financial crisis. Additionally, it addresses potential risks and implications associated with revaluation and the impact of Chinese demographic changes on future monetary policy.