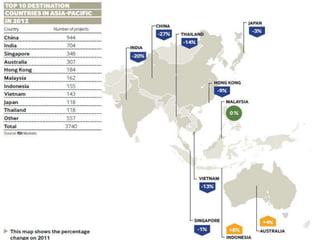

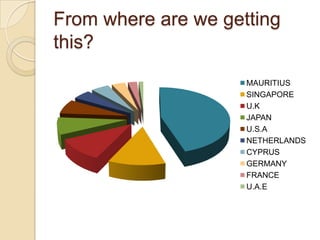

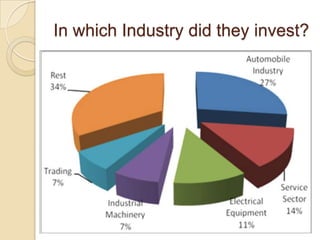

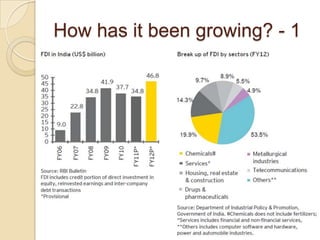

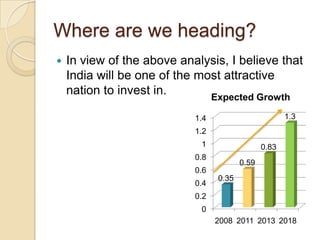

Foreign direct investment (FDI) involves a company from one country making a direct investment into business operations in another country. FDI began in India in 1991 under economic reforms. India ranked second globally for FDI in 2010 and is expected to remain among the top five destinations through 2014, with major investing countries including Mauritius, Singapore, the UK, Japan, and the US. FDI in India has grown, increasing about 35% in the first half of 2013 alone. India encourages FDI to stimulate economic activity and employment while bringing best practices, though it may also face more competition challenging local businesses. Overall India is seen as an attractive nation for further investment and FDI growth.