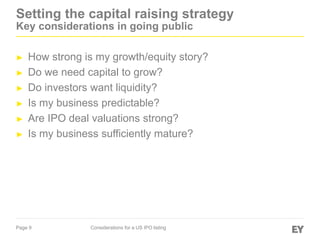

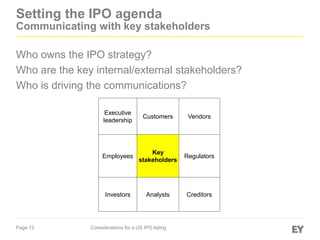

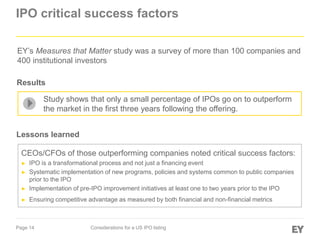

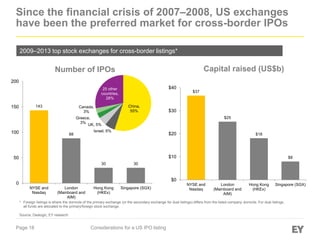

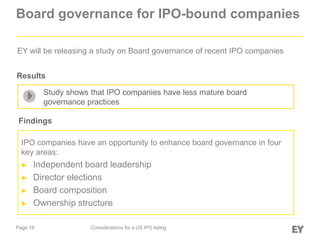

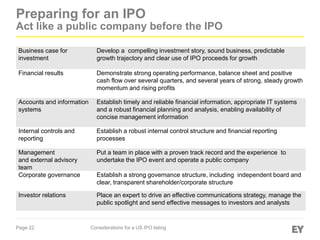

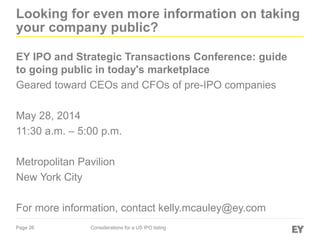

The document discusses key considerations for companies planning to go public through an IPO in the U.S., emphasizing the importance of a clear growth story, strong governance, and effective communication with stakeholders. It outlines the current state of the U.S. IPO market, benefits of listing in the U.S., and critical success factors for a successful IPO process. Viewers are encouraged to assess their IPO readiness and consult with professional advisors for tailored guidance.