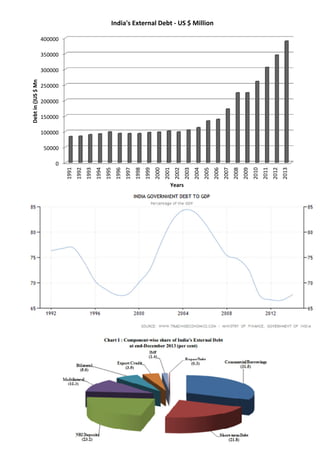

India's external debt increased from $404.9 billion to $426 billion between March and December 2013. This was mainly due to a rise in long-term debt, particularly an increase in NRI deposits under a special swap window. Long-term debt accounted for 78.2% of total external debt. Short-term debt declined slightly. The ratio of short-term debt to foreign exchange reserves fell to 31.5% while the ratio of concessional debt to total debt declined to 10.6%. Key factors contributing to the rise in external debt in recent times include increases in both long-term and short-term debt components.