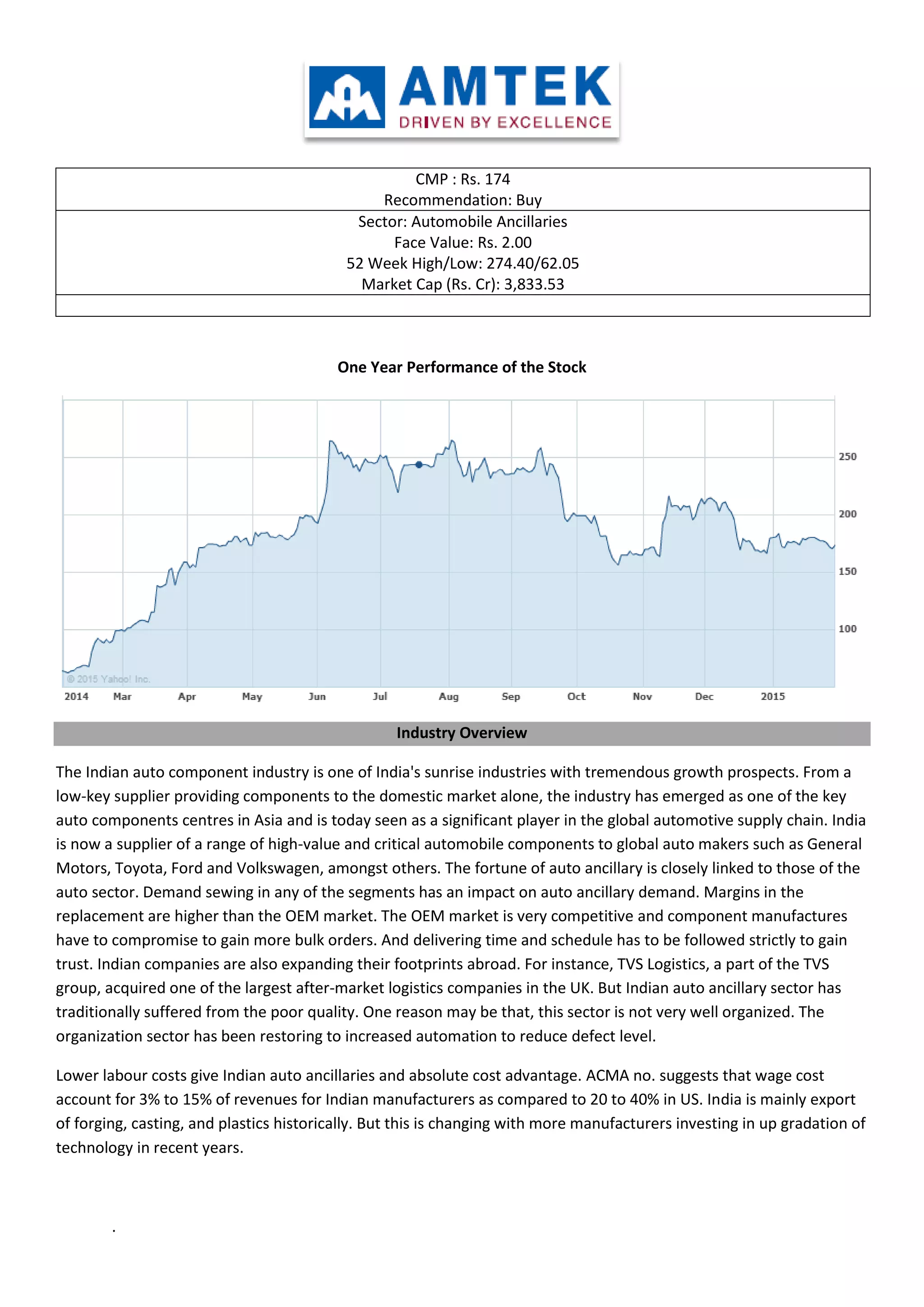

The document discusses an automobile ancillary company trading at Rs. 174 per share. It is recommended as a buy. The industry overview notes that the Indian auto components industry has emerged as a significant global supplier. The company has a market cap of Rs. 3,833.53 crore and 52-week high/low of Rs. 274.40/62.05. Analysis of the company's financials shows increasing debt due to acquisitions, though debt/equity remains below 2:1. Sales have grown at a 33% CAGR from 2010-2014. Valuation ratios such as PE of 4x and EV/Sales of 1.44x present the stock as a bargain.