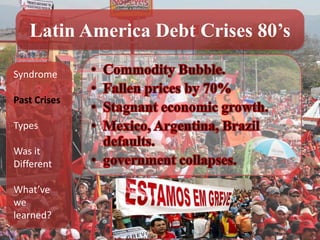

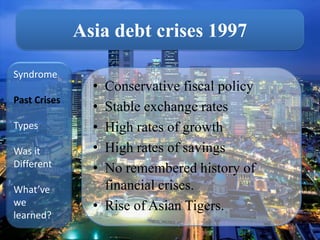

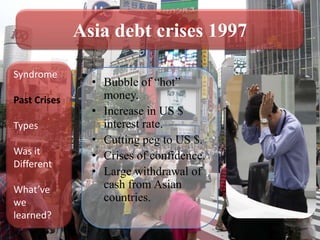

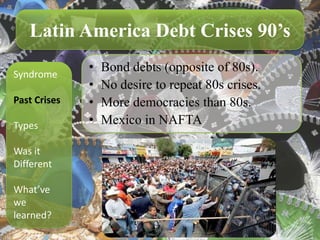

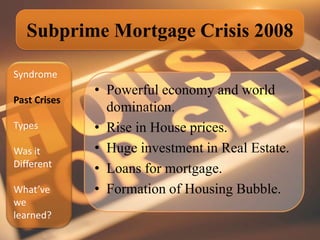

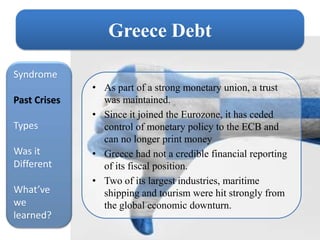

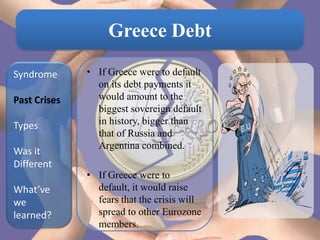

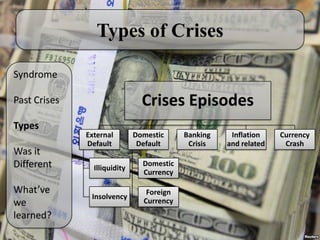

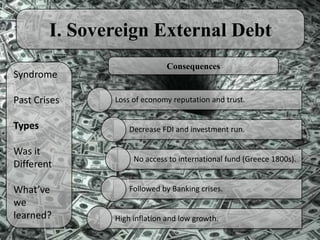

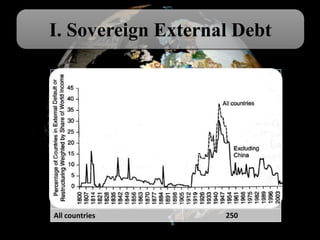

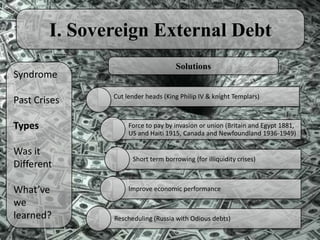

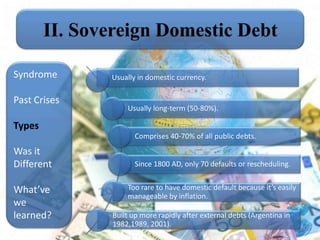

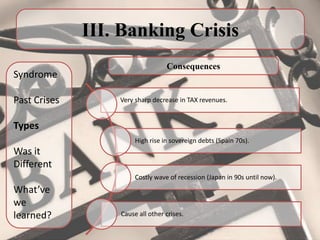

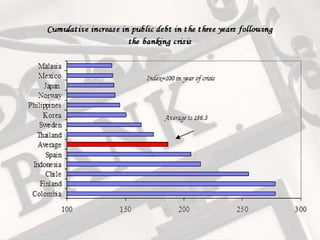

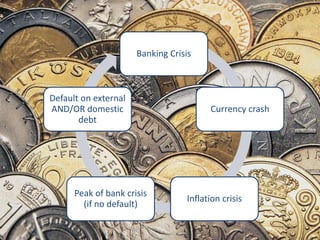

This document discusses the concept of "This Time is Different Syndrome" where people believe that financial crises will not affect their country. It then summarizes several past financial crises including the Great Depression, Latin American debt crises in the 1980s and 1990s, the Asian Financial Crisis of 1997, the US Subprime Mortgage Crisis of 2008, and the Greek debt crisis. Each crisis had its own causes but shared themes of excessive debt, asset bubbles, and overconfidence in continued economic growth. The key lesson is that while the form of crises may change, economic crises are a recurring feature and believing "this time is different" is a syndrome that often precedes severe crises.