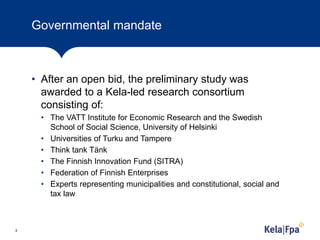

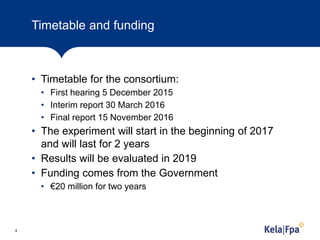

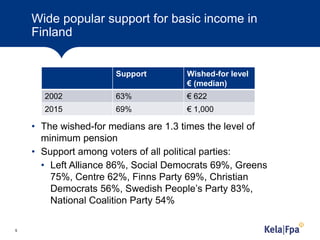

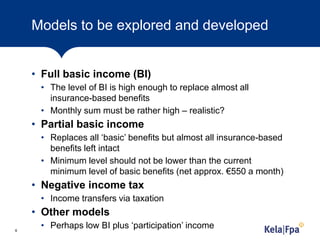

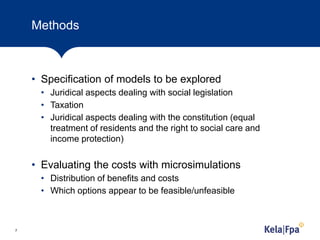

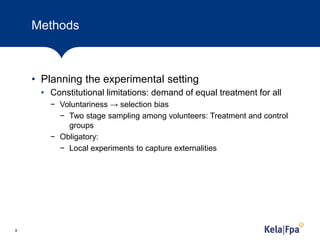

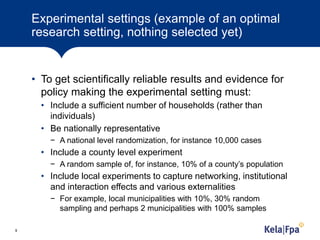

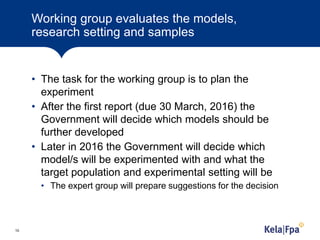

The document outlines a basic income pilot study in Finland, initiated under Prime Minister Juha Sipilä's government to reform social policy. A research consortium led by KELA will implement the experiment over two years starting in 2017, aiming to evaluate its results by 2019 with a budget of €20 million. The pilot has significant political support, with various models of basic income being explored to assess their feasibility and effectiveness.