The document provides an overview of the Ethiopian textile industry and its present status and future growth prospects. It discusses the history and development of cotton production, textile mills, and the garment sector in Ethiopia. It also analyzes the challenges facing the industry and provides recommendations to strengthen these sectors through improved quality standards, marketing, access to export markets, and attracting foreign investment. The overall aim is to outline Ethiopia's ambitious plans to boost textile and apparel exports to $1 billion in the next five years through concerted industry development efforts.

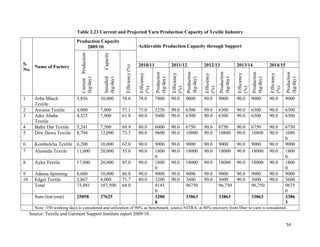

![3.7 Essential quality parameters for cotton grading

According to the Universal Cotton Standards of United States Department of Agriculture

(USDA), it is essential to test and standardize the following cotton quality parameters for cotton

grading using High Volume Instrument (HVI).

1. Fibre length (Upper Half Mean [UHM] length in inches)

2. Length Uniformity Index (UI %)

3. Fibre strength (g/tex)

4. Micronaire (HVI micronaire)

5. Color (HVI color Rd, +b)

6. Trash (HVI trash area %)

Instruments required

The indispensable instrument required for quality testing and grading of cotton is High Volume

Instrument (HVI) for determination of 6 quality parameters listed above. In addition,

analytical balances for sample weighing, drying oven for moisture measurement and hygrometer

for humidity measurement will be essential. The list of essential instruments and their use is

given in Table 3.1

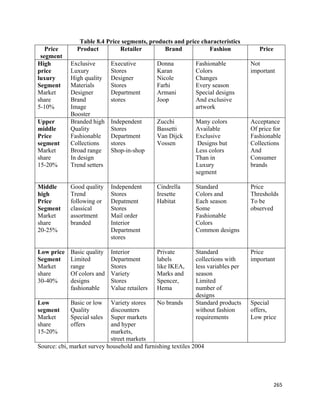

Table 3.1 List of essential instruments

S.No. Instrument Purpose

1. HVI Testing of cotton quality grading parameters

2. Analytical balance Weighing of samples up to 200 gm, accuracy 0.0001 gm

3 Electronic balance Weighing of samples up to 2 kg, accuracy 0.01gm

4. Moisture balance Moisture measurement

5. Hygrometer Humidity measurement

3.8 Expected outcome of the project phase I

The major outcome of Phase I of the project will be:

a. The HVI evaluation of quality parameters of lint cotton.

b. Grading of cotton according to quality parameters

c. Preparation of standard samples of graded cotton for national and international

acceptance

69](https://image.slidesharecdn.com/ethiopiantextileindustryfinal-110711075248-phpapp02/85/Ethiopian-textile-industry-final-81-320.jpg)

![ii) The inherent variation existing in all these properties among the fibers.

Cotton grading therefore outline briefly those aspects of fiber quality which will enable the

spinner to choose the material most suited from a wide range of cottons that differ in their

physical properties.

Although all cottons can be spun into yarns, the quality requirements of these yarns vary

depending upon their specific end uses. Whereas a warp yarn is expected to be strong and

extensible, the hosiery yarn should be uniform and reasonably free from imperfections. To

facilitate the characterization of cotton, it is necessary to synthesize the important physical

characteristics into a single index.

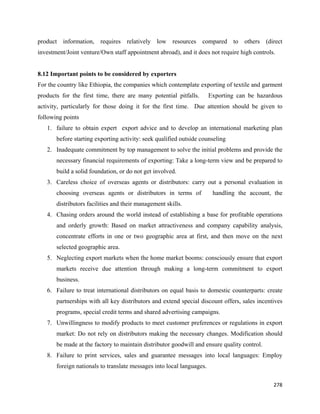

Fiber Quality Index (FQI)

The different cotton quality characteristics are synthesized into a single index called Fiber

Quality Index (FQI) defined as follows:

LSm

FQI =

f

Where L = 50% span length in mm

S = Fibre bundle strength (g/tex)

m = Maturity coefficient and

f = Fiber fineness (micronaire value)

The achievable yarn CSP (Count Strength Product) for a given FQI of cotton under optimum

Twist Multiplier is given by the expression:

Lea CSP = 320 ( FQI + 1) − 13C............................(1)

( for carded counts )

= [320( FQI + 1) − 13C ] (1 + W / 100).........(2)

( for combed counts )

Where C = Count spun

W = % waste extracted during combing

Twist for maximum strength can be expressed by the following formula:

50 − L + f

T max =

9

77](https://image.slidesharecdn.com/ethiopiantextileindustryfinal-110711075248-phpapp02/85/Ethiopian-textile-industry-final-89-320.jpg)

![Cotton grading parameters

USDA classification currently consists of HVI determination of the following cotton quality

parameters.

1. Fibre length (Upper Half Mean [UHM] length in inches)

2. Length Uniformity Index (UI %)

3. Fibre strength (g/tex)

4. Micronaire (HVI micronaire)

5. Color (HVI color Rd, +b)

6. Trash (HVI trash area %)

A brief description of these quality parameters will be useful.

Fiber length

Fibre length is defined as the average length of the longer one-half of the fibres (upper half mean

length). Fibre length is basically an inherited/genetic character of the seed variety. However,

weather, nutrient deficiencies, as well as excessive cleaning and/or drying at the gin may also

affect the fibre length which in turn affect yarn strength and evenness, and the efficiency of the

spinning process. The length of the fibre has a great influence on quality and price.

There are the following length classes for cotton species: short staple, medium to short staple,

long staple and extra-long staple.

According USDA’s classing methodology, length measurement of American upland cotton is

performed by HVI in accordance with standard test methods. The length of staple, measured in

inches and fractions of an inch, is classed as 32nds and given different codes. e.g. code 24=

24/32 in. According to the following codes, the upland cotton length conversion chart is given in

Table 3.8

89](https://image.slidesharecdn.com/ethiopiantextileindustryfinal-110711075248-phpapp02/85/Ethiopian-textile-industry-final-101-320.jpg)

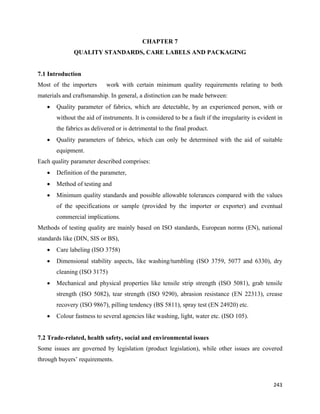

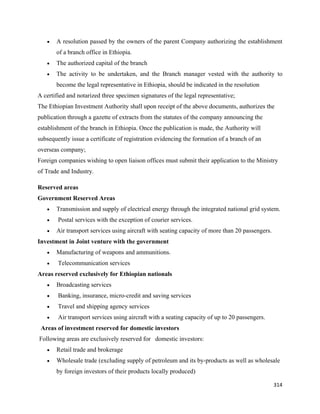

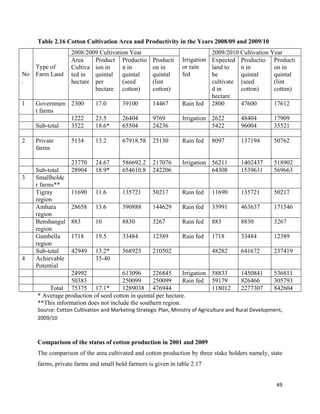

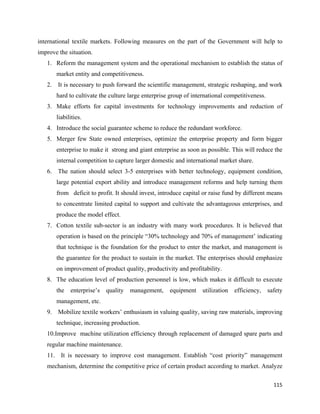

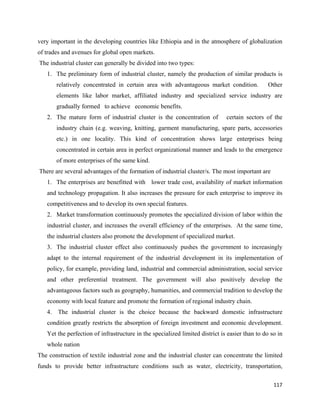

![Table 4.23 Import duty on textile & clothing imports

Material / tariff Import Excise VAT WHT Surcharge

duty duty [%] [%] [%] [%]

[%]

Cotton lint 10 0 15 3 10

Man made fibers 5 0 15 3 10

Yarn (cotton & MMF) 20 0 15 3 10

Fabric (grey & finished) 35 10 15 3 10

Made–ups 35 10 15 3 10

Apparels 35 10 15 3 10

Source: Ethiopian customs (Cited in Benchmarking of the Ethiopian textile industry, UNIDO

draft report April 2010

The above table shows the tariffs applicable to import of various textile inputs. The government

policy provides a higher level of import duties to protect the local industry.

The import duties and other taxes on various textiles and articles thereof in Ethiopia are twice as

high compared to even other African countries. The fabrics, made-ups and garments attract

excise duty in addition in addition to basic import duties to bring parity between locally

produced and imported fabrics. No distinction is made between intermediate products such as

unfinished (grey) fabric and finished (dyed & printed) as both are subject to same tariff

percentage (35%).

4.13 Other issues affecting the competitiveness of Ethiopian textile industry

Macro level

Ownership

Textile is a highly entrepreneurial industry by nature requiring a lot of commercial management

inputs. The predominance of state owned mills is perceived as a major limitation for the future

development of the industry. Experience of major textile producing countries in Asia shows that

this industry flourished where private entrepreneurs were encouraged through consistent

150](https://image.slidesharecdn.com/ethiopiantextileindustryfinal-110711075248-phpapp02/85/Ethiopian-textile-industry-final-162-320.jpg)