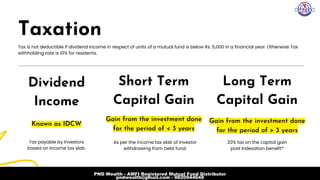

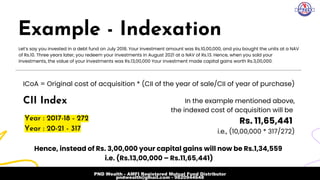

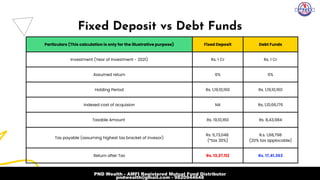

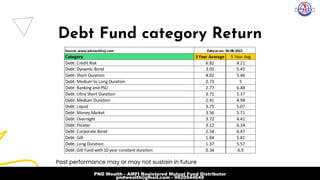

The document compares fixed deposits and debt mutual funds, highlighting that debt funds are increasingly favored for their higher returns and tax benefits. It explains the types of debt funds, their investment characteristics, taxation rules, and the advantages of indexation over traditional fixed deposits. Additionally, it includes examples illustrating potential returns and tax implications for investors in both investment options.