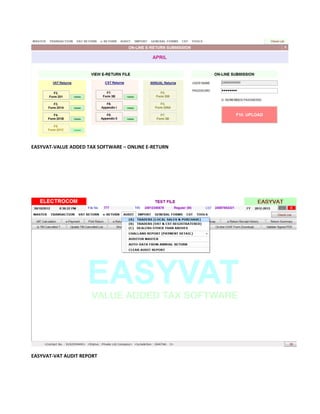

Easyvat is a software specifically designed for managing VAT processes in Gujarat, aligned with the state's commercial tax regulations. It offers user-friendly tools for VAT calculations, audits, e-returns, and registrations, making it popular among tax professionals. The software features multi-dealer management, extensive reporting capabilities, and an e-services facility for efficient tax management.