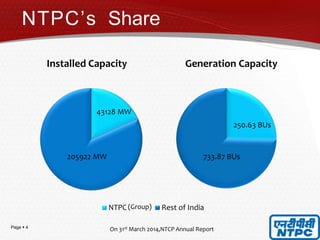

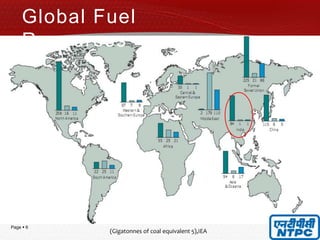

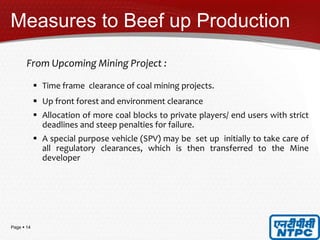

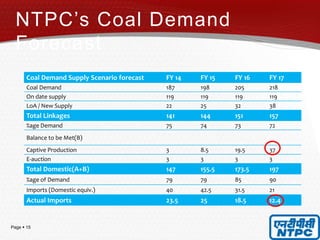

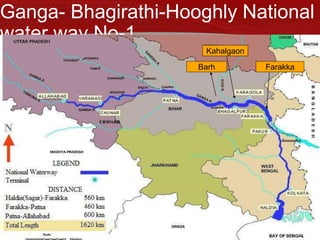

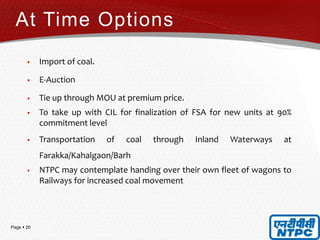

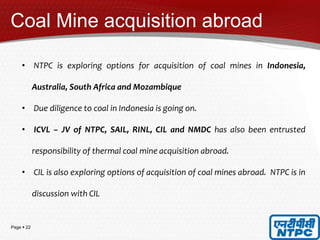

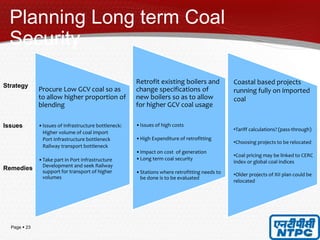

This document outlines fuel security issues facing NTPC and proposes solutions. It notes that NTPC is facing shortfalls in coal availability and affordability due to low domestic production, outdated mining technology, and fluctuations in the rupee. It proposes an integrated approach for NTPC's energy portfolio that emphasizes renewable energy, nuclear power, gas, and small hydro to reduce imported coal dependence. Near-term solutions include developing allotted coal blocks, acquiring overseas coal mine assets, and improving domestic coal transportation infrastructure. Long-term strategies involve procuring lower quality coal and retrofitting plants to support a more diverse, secure fuel supply.