Eivind Thomsen presented on paywalls and charging for news content. Some key points:

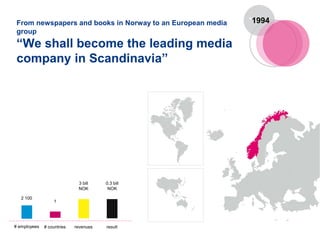

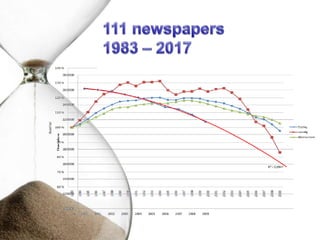

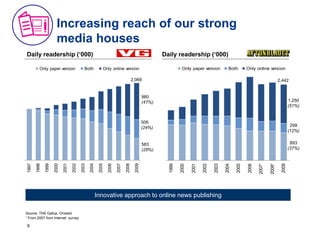

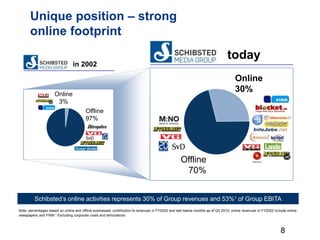

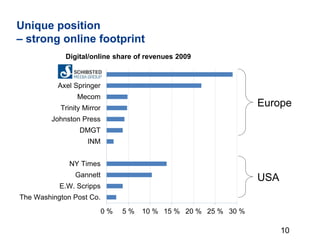

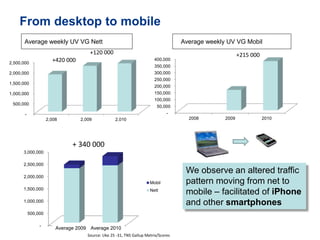

1) Schibsted has transitioned from newspapers and books in Norway to a leading European media group with strong online traffic and revenues. It has pioneered approaches to online publishing.

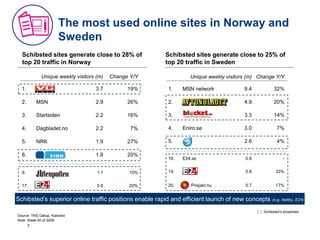

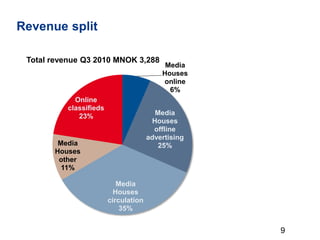

2) Schibsted's online activities now represent 30% of revenues and 53% of EBITA, with classifieds being a major revenue driver. It has a unique position with strong online traffic.

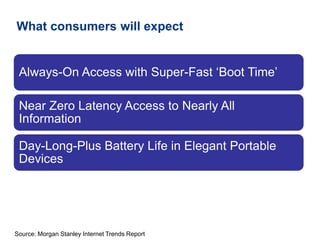

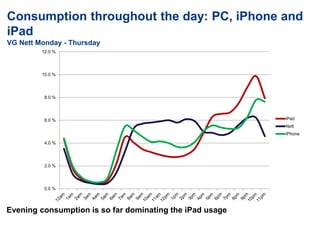

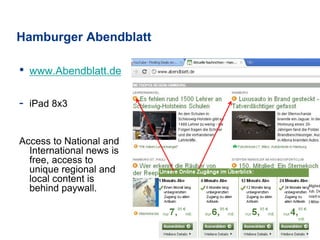

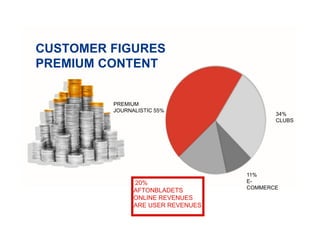

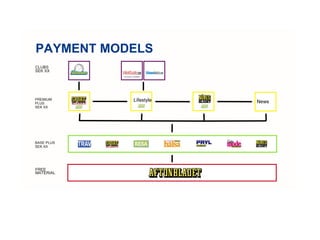

3) Successful online news businesses need multiple revenue streams to sustain high-quality journalism, including various forms of payments, subscriptions, advertising and services. Packaging content for mobile is important to drive willingness to pay.