The document discusses the Efficient Market Hypothesis (EMH). Some key points:

- EMH proposes that market prices fully reflect all available information and investors cannot consistently earn abnormal returns. It originated from the Random Walk Hypothesis.

- There are three forms of EMH (weak, semi-strong, strong) based on the information reflected in prices. Research initially supported weak and semi-strong forms but questioned strong form.

- Over time research identified anomalies like momentum and mean reversion that appear to allow abnormal returns, bringing EMH into question. Behavioral finance emerged examining psychological factors.

- While still debated, EMH is no longer considered the sole determinant of market behavior.

![Concept of Efficiency in EMH

• 1st proposition of FAMA (1965,1970)

▫ Informational Efficient

Which breeds

Allocational Efficiency

▫ Means money will go to the best return provider

▫ Later on diluted to

Informational Efficiency only

▫ Latest

There might be anomalies like Momentum, Mean-reversion,

etc. [Tactical Avoidance of Inefficient Word]

But not possible to earn superior return](https://image.slidesharecdn.com/efficientmarkethypothesis-13535761852856-phpapp01-121122032729-phpapp01/75/Efficient-Market-Hypothesis-4-2048.jpg)

![Lets hear from Horse’s Mouth

• Fama (Jan. 1965: ‘The behaviour of stock-market prices’):

‘…an “efficient” market for securities, that is, a market where, given the available information,

actual prices at every point in time represent very good estimates of intrinsic values.’

[Intrinsic Implies Fundamental]

▫ Echoes Samuleson “When stock prices equal the present expected value of their payoffs (their

fundamental value given a discount factor) they are unpredictable.

• Fama (1970):

‘A market in which prices always “fully reflect” available information is called “efficient.”’

• Jensen (1978):

‘A market is efficient with respect to information set θt if it is impossible to make economic profits

by trading on the basis of information set θt’ [‘By economic profits, we mean the risk adjusted

returns net of all costs.’]

• Fama (1991):

‘I take the market efficiency hypothesis to be the simple statement that security prices fully reflect

all available information. A weaker and economically more sensible version of the efficiency

hypothesis says that prices reflect information to the point where the marginal benefits of acting on

information (the profits to be made) do not exceed marginal costs (Jensen (1978).’

• Fama (1998):

‘…market efficiency (the hypothesis that prices fully reflect available information)...’

‘…the simple market efficiency story; that is, the expected value of abnormal returns is zero, but

chance generates deviations from zero (anomalies) in both directions.’](https://image.slidesharecdn.com/efficientmarkethypothesis-13535761852856-phpapp01-121122032729-phpapp01/75/Efficient-Market-Hypothesis-5-2048.jpg)

![Foundations of EMH

• There is an intrinsic value of financial assets

• The huge army of traders keep prices near that intrinsic value

• No Arbitrage Opportunity

▫ Sophisticated traders keep the value near to its intrinsic value

▫ Though chance of noise, dependence and bubbles

The sophisticated traders will move to take benefit and keep bubbles to burst

before they build up to a sizeable extent.

• Price change will be subject to flow of new information which was not earlier

anticipated

• Information shall be absorbed immediately

▫ If there is a lag (delay) in absorption, that will be random

Sometimes before the news, sometimes after the news

• Joint Hypothesis

▫ As information absorption and its efficiency can be determined only with

reference to equilibrium pricing

▫ A test of efficiency will always be a joint test of

Market Efficiency

Pricing Model [CAPM, APT etc]

▫ So one can never be sure which one to blame](https://image.slidesharecdn.com/efficientmarkethypothesis-13535761852856-phpapp01-121122032729-phpapp01/75/Efficient-Market-Hypothesis-6-2048.jpg)

![Forms of EMH –Fama (1970)

[Taxonomy (Naming) suggested by Roberts(1967)

• Weak-Form [later on Dubbed as “Test for Return Predictability” – Fama 1991]

▫ the information set includes only the history of prices or returns themselves

▫ A capital market is said to satisfy weak-form efficiency if it fully incorporate the information in

past stock prices.

▫ If true, past prices alone would not be useful in making money. Technical analysis is of no use.

• Semi-Strong Form [later on Dubbed as “Event Studies”]

▫ the information set includes all information known to all market participants (publicly

available information).

▫ A market is semi-strong efficient if prices reflect all publicly available information.

▫ Past & Future expected performance, results, dividends etc are not useful in finding under-valued

stocks. Fundamental analysis is of no use

• Strong Form [later on Dubbed as “Test for private information”]

▫ the information set includes all information known to any market participant (private

information).

▫ This form says that anything that is pertinent to the value of the stock and that is known to at

least one investor is, in fact fully incorporated into the stock value.

▫ Even private information with insiders, market makers etc is of no use in generating excess

returns.

Taxonomy is relative and does not really shows something as weak or strong in absolute sense.

Momentum, a pure technical phenomenon, remains the biggest anomaly [Fama, 1997]](https://image.slidesharecdn.com/efficientmarkethypothesis-13535761852856-phpapp01-121122032729-phpapp01/75/Efficient-Market-Hypothesis-7-2048.jpg)

![Support for Efficient Walk Hypothesis

• Came in the form of various test results pre 1980

• The major tests in that era were in the form of

▫ Serial Correlation

▫ Run Tests

▫ Filter Test

Buy if price moves up by X% & sell if moves down by X%

Absurd level of simplification to reject technical analysis rules

▫ Event Studies

Impact on price of events such as stock split, earnings announcements etc.

It was found that market usually anticipated, absorbed and adjusted to the

information quickly

• As a result

▫ Weak Form was readily accepted; Semi-Strong form was accepted as well

▫ Strong form was not supposed to be possible

▫ EMH became THE GOD of modern finance for next 15-20 years

Such a powerful God that blasphemous papers (those criticizing EMH) were not

accepted by journals for publication [Until one of the big priests intervened]](https://image.slidesharecdn.com/efficientmarkethypothesis-13535761852856-phpapp01-121122032729-phpapp01/75/Efficient-Market-Hypothesis-9-2048.jpg)

![Inherent Theoretical Flaws with EMH

• Assumes only news flow causes change in market price [Exogamous Markets]

▫ In Reality, Markets may change just in response to change in price

Bubbles are built up in such a fashion only

Market is an endogamous as well as exogamous entity

Theoretical support from French & Roll (1986) who found that return volatility is high for

days when markets are open for trading than on holidays; Dubbed noise by Black (1986)

1987 Crash when Portfolio Insurance (based upon EMH & CAPM) failed and the resulting

chaos caused 22% fall in a single trading session is an important example

The housing market bubble of 2001-2007 is just another example

• Assumes equilibrium but markets are in a constant dynamic environment [Bernstein 1999]

• From the above two, EMH concludes that prices are always right and hence determine

allocational efficiency

▫ If that is the case, how bubbles and their bursting is explained

• Not testable in itself and the pricing models can always be blamed

▫ As Fama & French did in 1992

• Ketch-Up Economics [Summers]

• If markets are efficient due to presence of large no. of rational investors

▫ And they can’t beat the market

Then they will stop looking for beating market and will thus market will become inefficient

Also, there is no incentive for anybody to do research as it’s a costly activity

[Grossman & Stiglitz 1980]

Fisher answered that Noise traders subsidize this cost](https://image.slidesharecdn.com/efficientmarkethypothesis-13535761852856-phpapp01-121122032729-phpapp01/75/Efficient-Market-Hypothesis-10-2048.jpg)

![EMH- Negative Tests

• Test of Fundamental Value

▫ Variance Bound tests [Shiller 1981]

Price fluctuations in the long term are too large to be justified by variation in

dividend payments

It means that people over-react

Shiller rejected EMH altogether

▫ Equity Risk Premium Puzzle

The average risk premium in US between 1889-1978 was 7%

However, as per models of consumer behaviour; for average RFR of 0-4%, risk

premium shall not exceed by 0.35% [ Mehra & Presscot 1985]

• Anomalies

• Behavioral Criticism](https://image.slidesharecdn.com/efficientmarkethypothesis-13535761852856-phpapp01-121122032729-phpapp01/75/Efficient-Market-Hypothesis-11-2048.jpg)

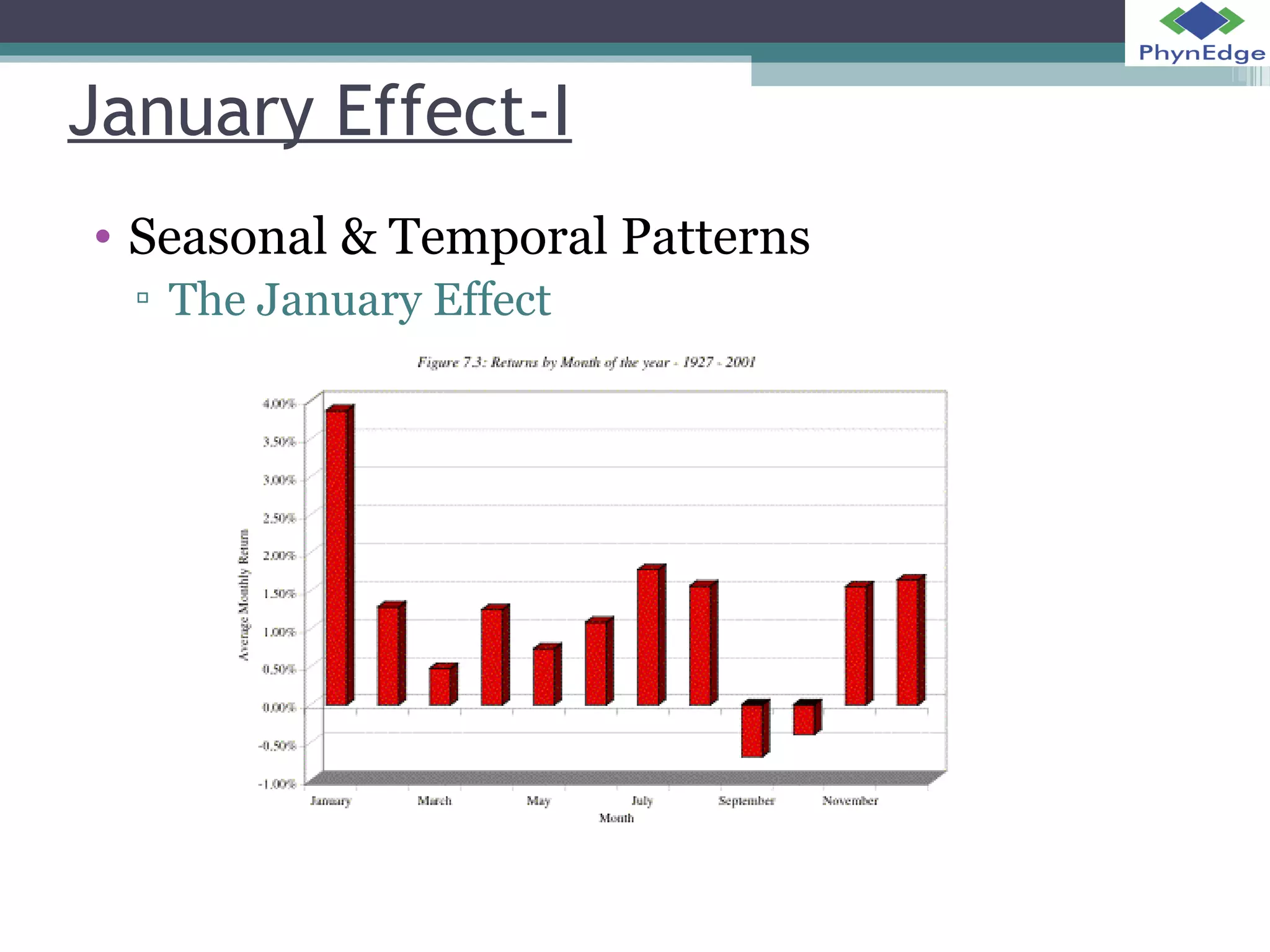

![Anomalies

• Anomaly means deviation from Norm

▫ So the results which are not in confirmation with EMH are dubbed as anomalies

▫ But what if EMH is an anomaly itself?

• With Specific reference to EMH, anomalies are defined as

▫ a regular pattern in an asset’s returns which is reliable, widely known, and

inexplicable [Andrew Lo, 2007]

• Some of the Anomalies are

▫ Size Effect

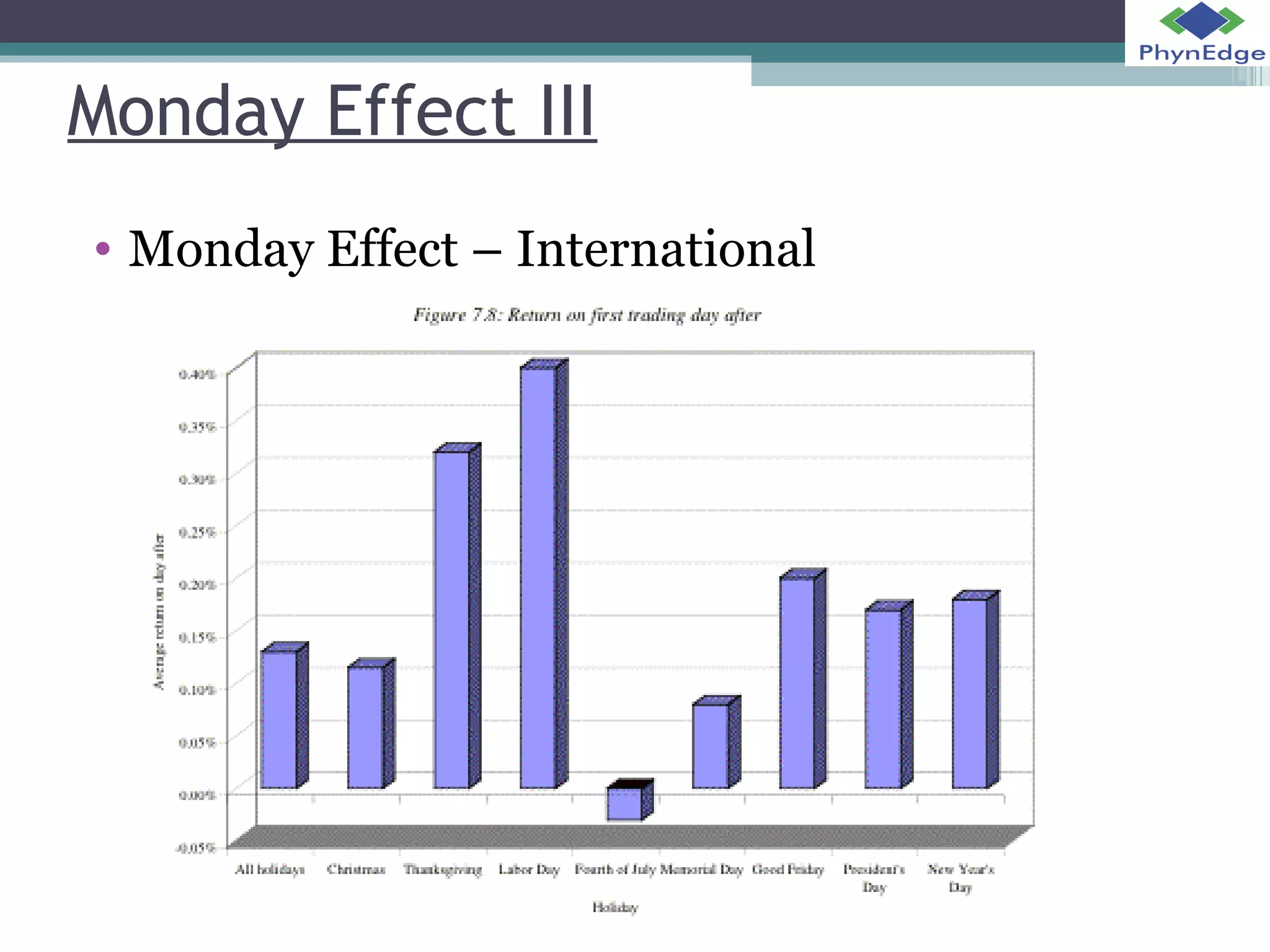

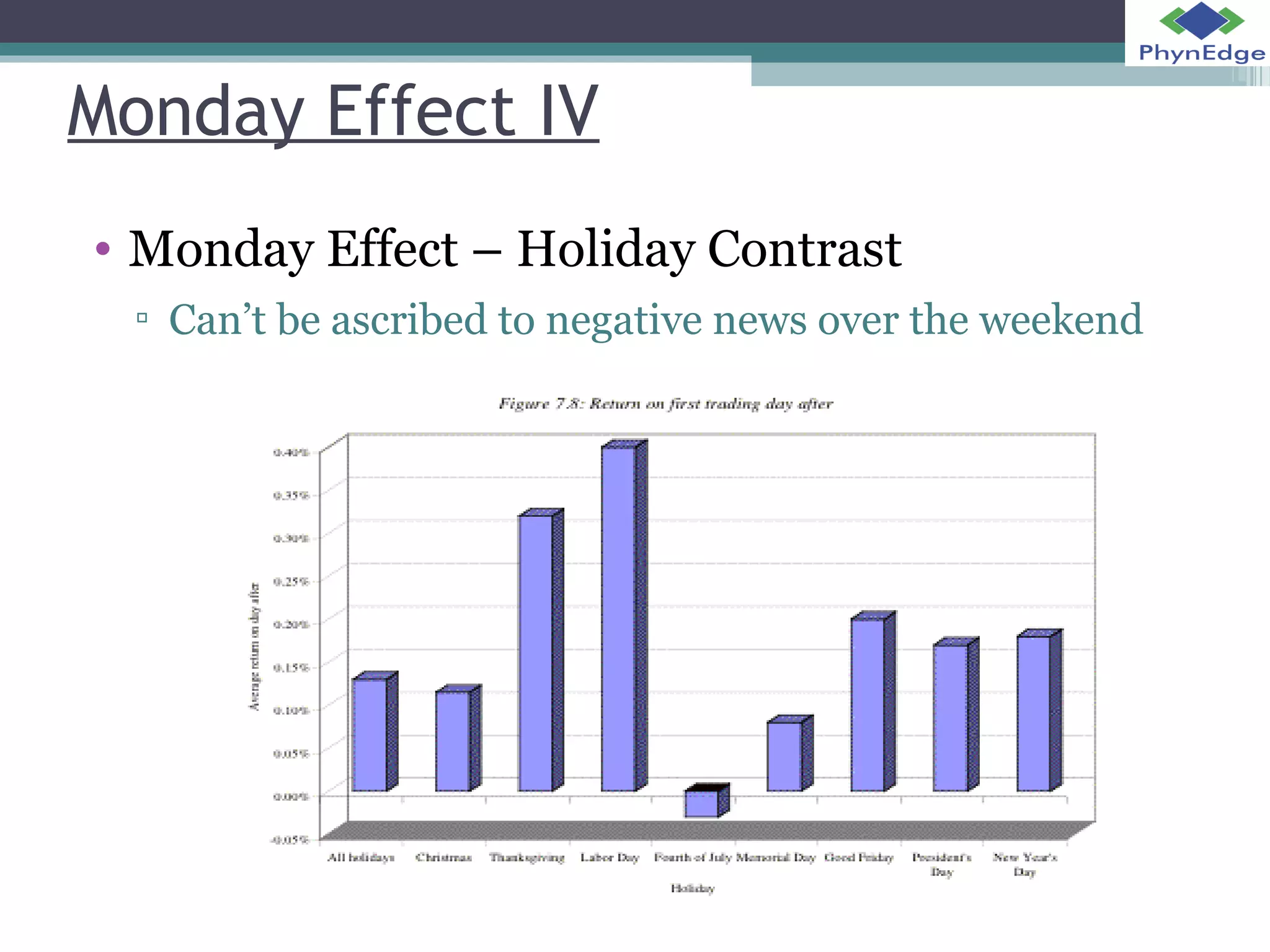

▫ Calendar & Seasonal Effect ---Like January Effect, Monday Effect etc.

▫ Momentum

▫ Mean Reversion](https://image.slidesharecdn.com/efficientmarkethypothesis-13535761852856-phpapp01-121122032729-phpapp01/75/Efficient-Market-Hypothesis-12-2048.jpg)

![Momentum

• For price Movement in Months (3-12)

▫ Jagdeesh & Teetman [2001]

▫ Significant Positive correlation

What Goes Up-Goes Further Up (next 3-12 month)

What Goes Down – Goes Further Down

The phenomenon is known as Momentum

▫ Much more in vogue in US & European markets

▫ Lower in Emerging Markets

However, post 2003-2008 rally, it’s expected that momentum tests will

show positive correlation even in emerging markets now.

Due to significant inflow of money

• For price Movement in Weeks

▫ Andrew Lo [1997] A non-random walk down wall street

▫ Significant Positive correlation

• Momentum has been part of Technical Analysis Literature for long

Trend

Relative Strength

Moving Averages, MACD etc](https://image.slidesharecdn.com/efficientmarkethypothesis-13535761852856-phpapp01-121122032729-phpapp01/75/Efficient-Market-Hypothesis-13-2048.jpg)

![Long-Term Correlation –

Mean Reversion

• For price Movement in Years (5 year returns)

▫ French & Fama [1988]

▫ Study Period [1945-1985]

▫ Significant Negative correlation (Reversion)

▫ Much More on 5 years basis than 1 year basis

▫ 25-40% change could be explained by past data [Andrew Lo]](https://image.slidesharecdn.com/efficientmarkethypothesis-13535761852856-phpapp01-121122032729-phpapp01/75/Efficient-Market-Hypothesis-14-2048.jpg)

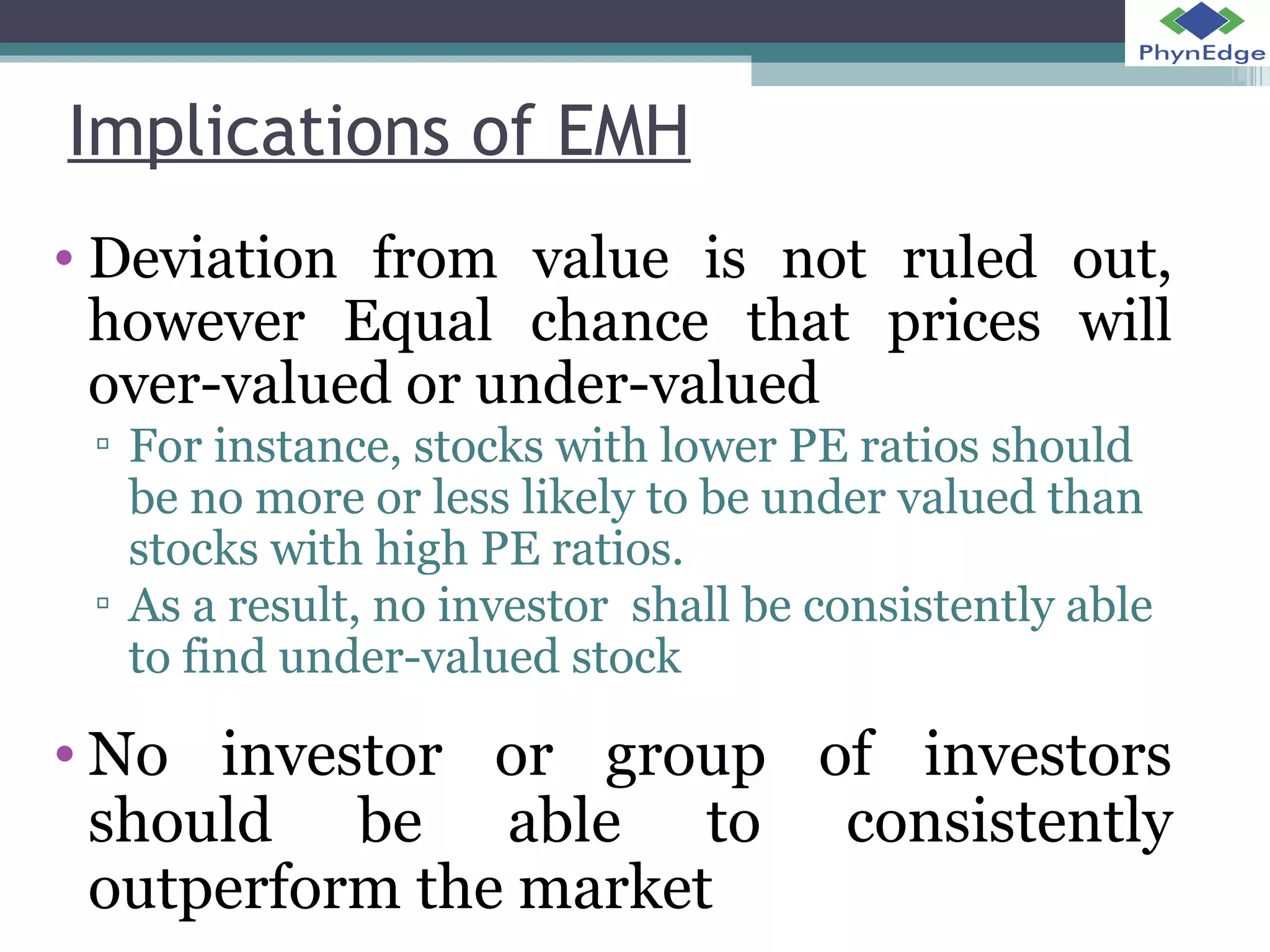

![January Effect-II

• Seasonal & Temporal Patterns

▫ The January Effect – Contd.

[1935-1986] [50% of alpha is generated in January]](https://image.slidesharecdn.com/efficientmarkethypothesis-13535761852856-phpapp01-121122032729-phpapp01/75/Efficient-Market-Hypothesis-16-2048.jpg)

![January Effect-III

• Seasonal & Temporal Patterns

▫ The January Effect – Contd.

[1935-1986] [50% of alpha is generated in January]](https://image.slidesharecdn.com/efficientmarkethypothesis-13535761852856-phpapp01-121122032729-phpapp01/75/Efficient-Market-Hypothesis-17-2048.jpg)

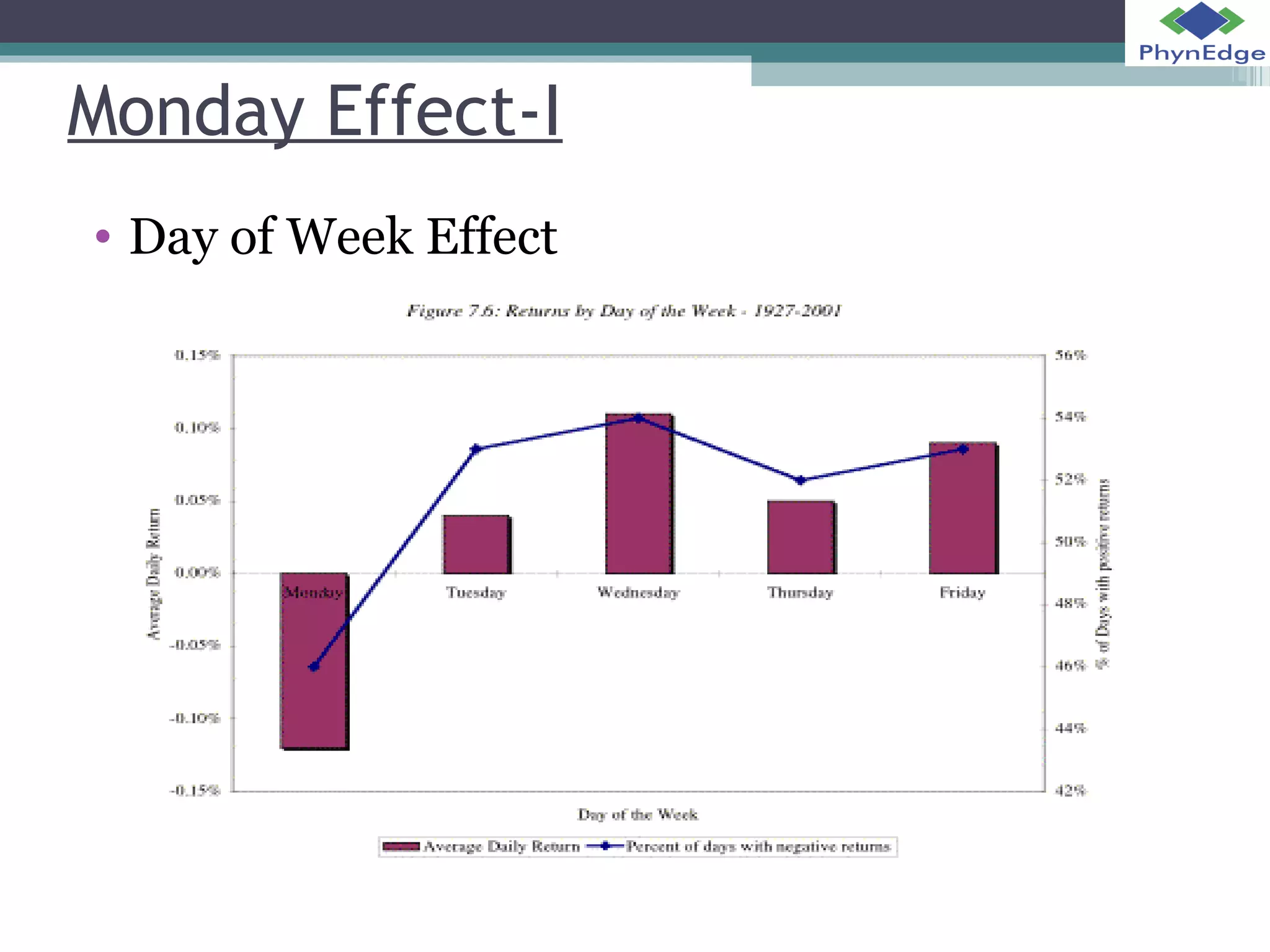

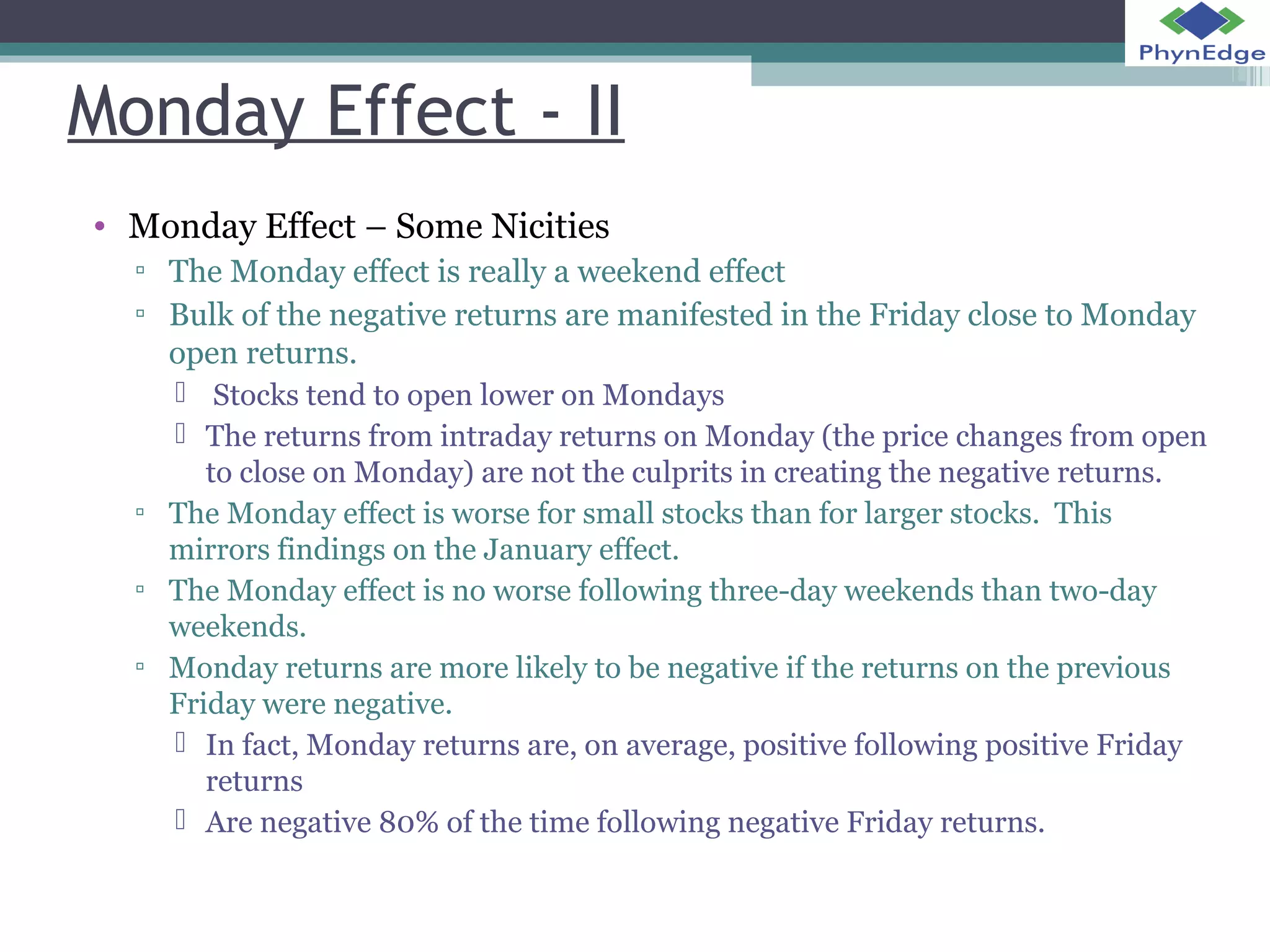

![Volume Behaviour

• Volume Patterns [Lee & Swaminathan 1998]

▫ For Momentum effect documented by Jagadeesh & Titman

More Pronounced for high volume stocks

Insistence of technicians

on High Volume Breakouts

proven

Winners do better with average

volume as extreme volumes

are usually sign of reversal

(In Technical Analysis)](https://image.slidesharecdn.com/efficientmarkethypothesis-13535761852856-phpapp01-121122032729-phpapp01/75/Efficient-Market-Hypothesis-22-2048.jpg)

![Behavioral Finance

• Recognizes that there is no Homo Economicus [Rational Man]

• Brings psychological studies to the field of finance

• Some key Themes

▫ Heuristics:

People often make decisions based on approximate rules of thumb, not strict

logic

▫ Bounded Rationality

▫ Loss Aversion

▫ Heard Mentality

▫ Deviation from rationality

Over-reaction

Overconfidence

Optism

Extrapolation

Loss Aversion

Mental Accounting](https://image.slidesharecdn.com/efficientmarkethypothesis-13535761852856-phpapp01-121122032729-phpapp01/75/Efficient-Market-Hypothesis-23-2048.jpg)

![Reality of Markets [Own Thoughts]

• Markets are dynamic entity, equilibrium in the long run is a foreign concept

▫ I.e., relationship between Risk & Return is unstable

Is guided by investor preferences and regulatory environment

Like the environment of Low Interest Rates in 2001-2007 may have fuelled the mortgage bubble.

• The relationship between Risk & Reward is not as quantitative as EMH assumes

▫ For Example, even a large no of so called intelligent analysts could not gauge the risk in

CDO Securities in the US

Risk in Sectoral Funds – In India

Risk in Zero Cost Options – In India

• Equity Risk premium is time and path dependent

• Arbitrage opportunities exist from time to time

▫ They disappear but only after long period of time : - Pair Trading, Bond Spreads, Value

Arbitrage

• Bubbles, Cycles, Trends, Crashes, Manias all are part of market

▫ Even with passage of time, they won’t be driven away as EMH assumed

• Investment activities will be able to generate super returns but not forever, innovation

is the key

▫ One needs to adapt to the change in market inefficiencies, behaviour, trading environment etc.

• But said that for most of the investors, it’s difficult to generate super-normal returns

▫ As it’s not easy to identify and also act upon profitable opportunities before they are too

common](https://image.slidesharecdn.com/efficientmarkethypothesis-13535761852856-phpapp01-121122032729-phpapp01/75/Efficient-Market-Hypothesis-25-2048.jpg)

![Appendix I - Concept of Random (Stochastic) processes in

Financial Literature [Adopted/Modified from Probability Theory]

• Random Walk – As explained in RWH

▫ Independent Steps , i.e., successive changes are independent &

▫ Price changes confirm to an identical probability distribution

Normal Distribution was assumed in 1953-1965 [named Heterogeneous “RW” ≠ RW]

▫ Implies, random behaviour, no relationship with supply/demand and is like a casino, toss, dice,

etc.

If RW is correct, then price of green pea and price of IBM will move similarly

• Random Walk With Drift

▫ Independent Steps but bias to a particular direction

For example, in stock market prices don’t go below zero, That’s a positive drift.

• Martingale

For a given set of information:-

Pt+1 = Pt +at Such that Mean of at is zero over long run

That means best forecast of price tomorrow is today’s price if there is no change in information

Assumption is that that price changes on information concerning a security or market &

nothing else

• Fair game [aka Martingale Difference]

▫ Zero Expected Gain from forecasting tomorrow’s price based upon today’s information [For

Example 500 heads so far, Next can still be head or tail]

▫ That will mean Expected Return = Realized return [On probability basis in long term]

or Expected Return – Realized Return =0

Implies Price will move randomly around its intrinsic Value](https://image.slidesharecdn.com/efficientmarkethypothesis-13535761852856-phpapp01-121122032729-phpapp01/75/Efficient-Market-Hypothesis-27-2048.jpg)

![Appendix II - From Random Walk to Martingale

• Random Walk [1900; 1953-1963]

▫ Variable and its moments (Mean, Variance, Skewness, Kurtosis, etc.) also shall be

random

▫ Further information flow and expectations about market shall also be random

▫ Kendell (1953) found that though wheat price/mean was random, its variance had

increased post WW I

That means it was a time-dependent function and not a random thing

Moved to heterogeneous RW, which is not RW in real sense of term

▫ The tests of RW, i.e., serial correlation & run tests were found to be deficient on

certain statistical parameters. Post 1980

▫ RW/HRW models were finally rejected.

• Martingale

Mandelbort (1963), Samuelson (1965); Assumes Risk Neutrality;

Variable and only its mean not higher moments are random.

• Fair game

▫ Fama (1965) came up with Fair Game model of EMH where deviation from

expected result is zero. He argued that Info. Flow and expectations may not be

purely random and that expected returns will not be stationery over time; hence

rejected random walk which is a rigid theory than fair game and concluded that for

market efficiency fair game is a sound enough model, RW not needed.](https://image.slidesharecdn.com/efficientmarkethypothesis-13535761852856-phpapp01-121122032729-phpapp01/75/Efficient-Market-Hypothesis-28-2048.jpg)