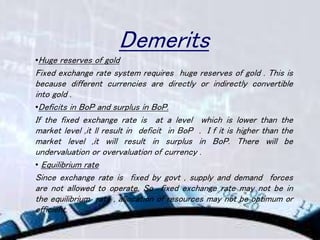

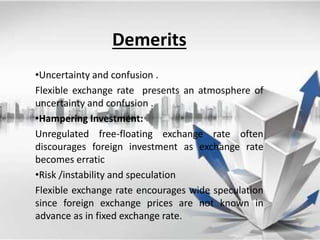

The document discusses foreign exchange rates, distinguishing between fixed and flexible exchange rates. Fixed exchange rates provide stability and attract foreign capital but require large gold reserves and can lead to balance of payments issues. Flexible exchange rates are determined by supply and demand, allowing for automatic adjustments, but they introduce uncertainty and can discourage investment.