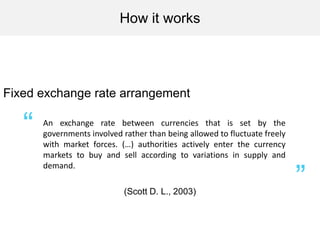

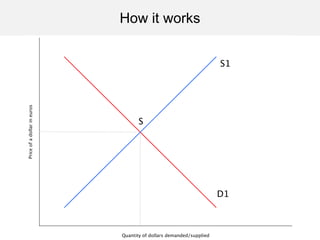

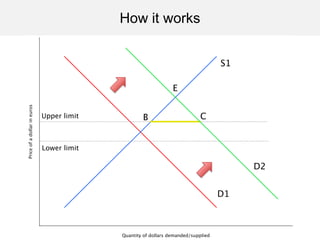

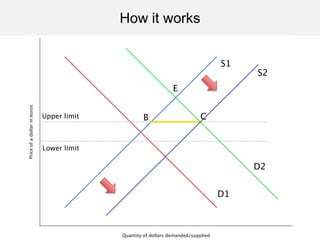

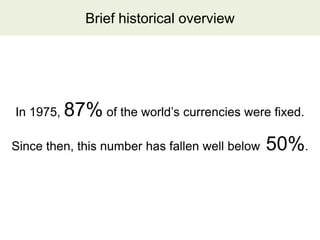

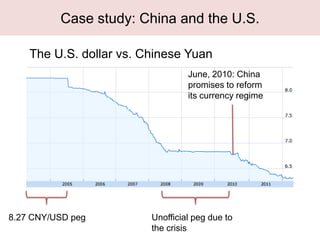

The document provides an overview of fixed exchange rate arrangements, highlighting their historical context and the transition from fixed to more flexible exchange rates since 1975. It discusses the benefits and drawbacks of fixed rates, including their impact on credibility and volatility, as well as factors influencing currency arrangement choices among countries. A specific case study comparing the U.S. dollar and Chinese yuan illustrates the complexities of currency pegs.