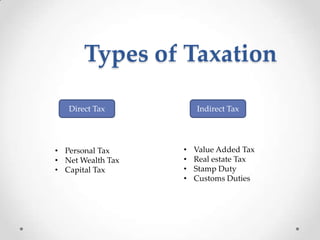

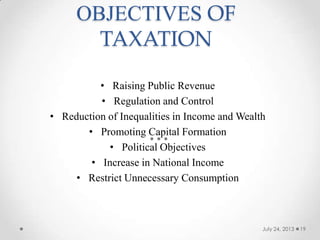

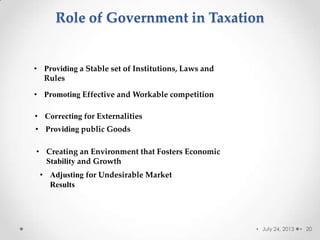

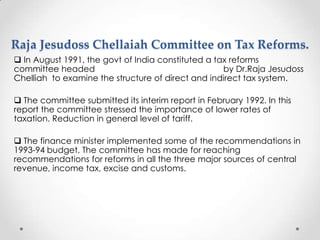

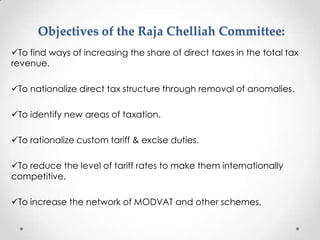

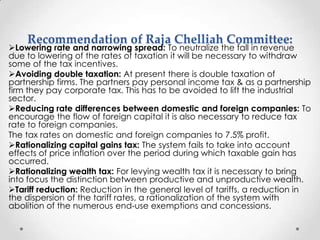

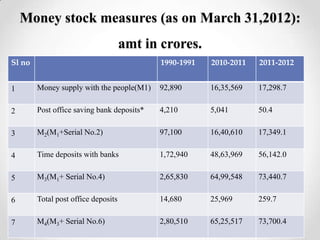

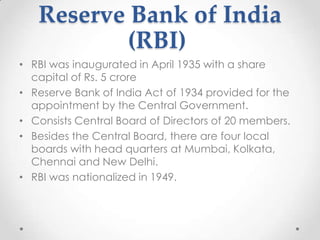

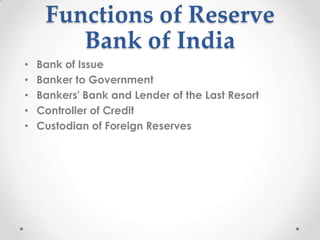

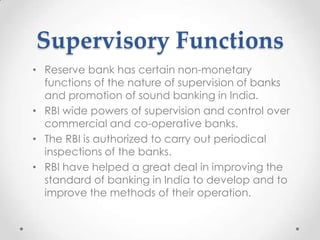

This document summarizes an assignment submitted on economic policy modules, including privatization, fiscal policy, and monetary policy in India. It discusses objectives and instruments of fiscal policy like taxation, public borrowing, and expenditure. It outlines the Raja Chelliah Committee recommendations on tax reforms and the objectives of monetary policy like growth, stability, and employment. Tools of monetary policy discussed include bank rate, cash reserve ratio, open market operations, and moral suasion.