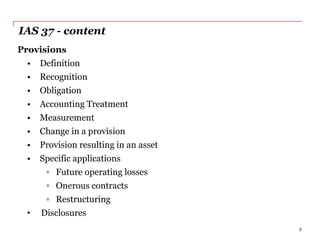

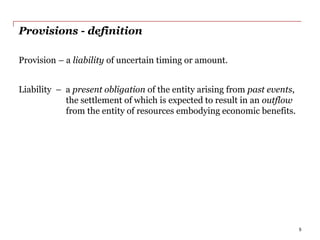

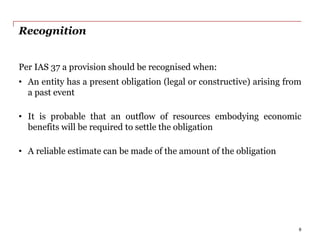

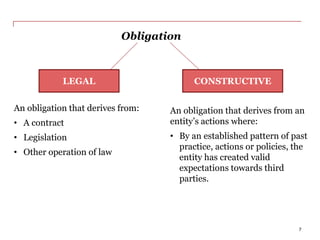

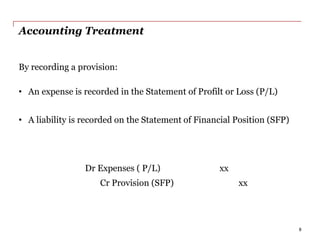

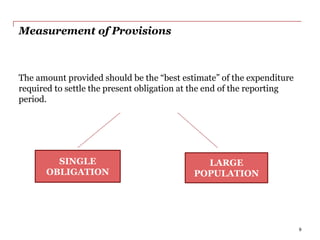

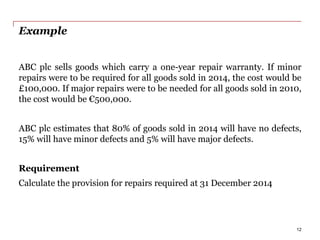

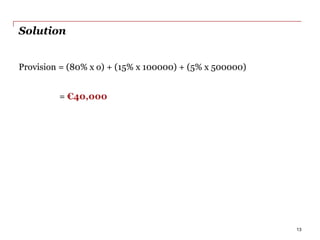

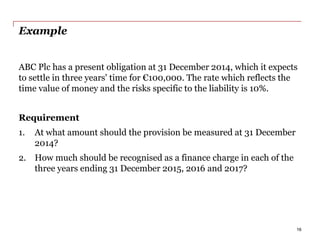

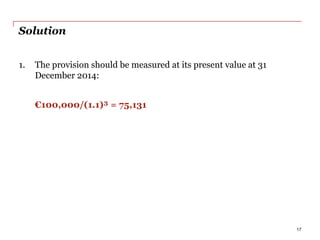

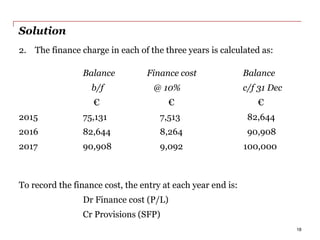

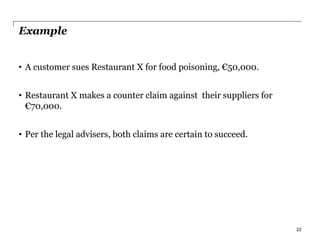

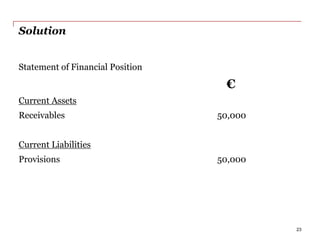

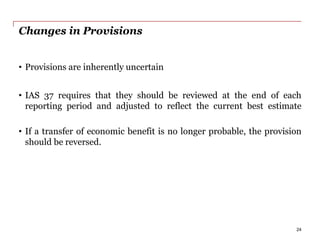

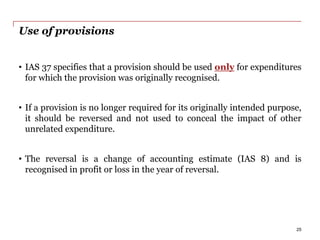

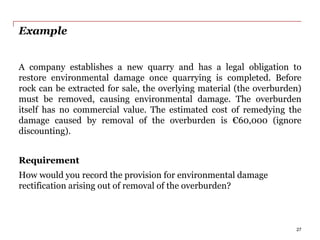

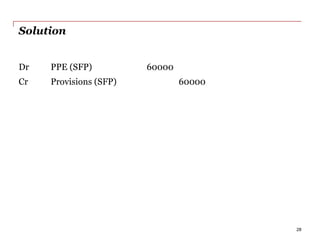

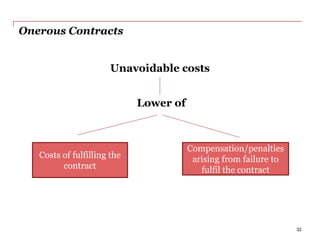

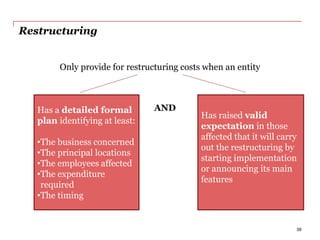

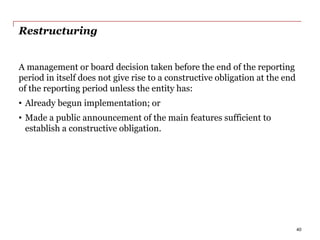

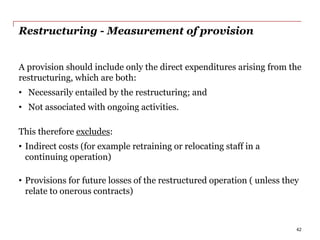

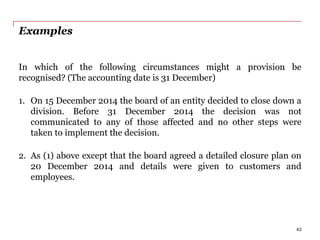

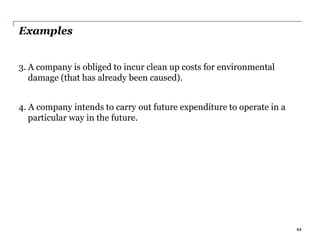

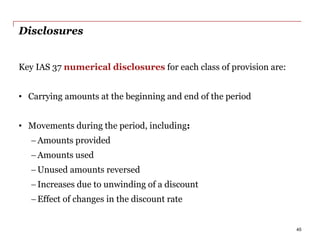

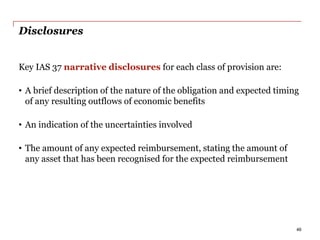

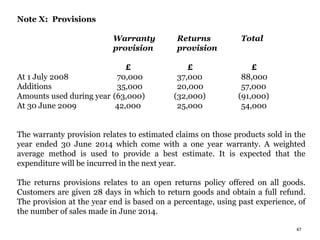

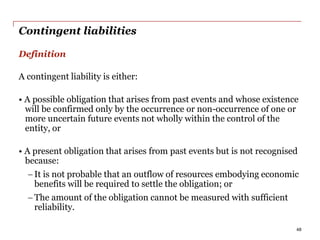

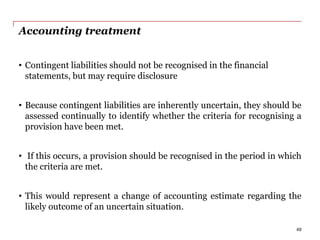

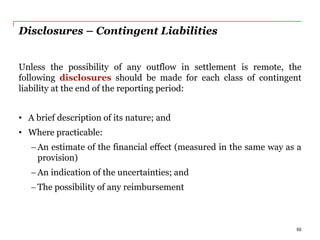

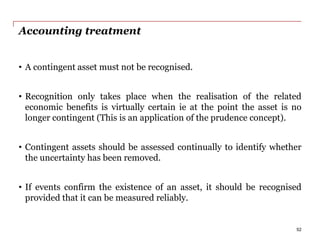

This document provides an overview of the content covered by IAS 37 relating to provisions, contingent liabilities, and contingent assets. It discusses key topics such as the definition of provisions and their recognition criteria, measurement of provisions including discounting, changes in provisions, and specific types of provisions for onerous contracts and restructuring. Contingent liabilities and contingent assets are also defined along with their accounting treatment and disclosure requirements.