Embed presentation

Download to read offline

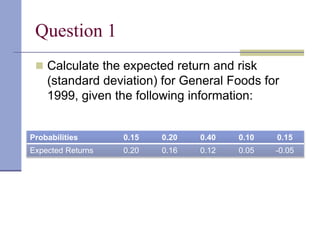

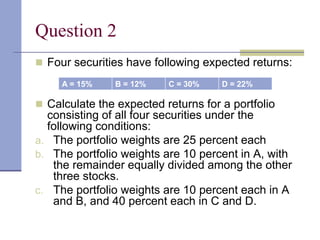

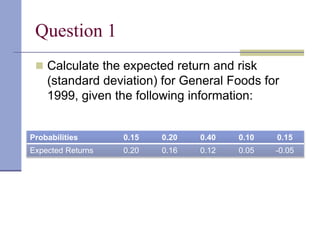

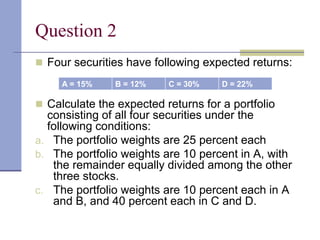

This document contains questions about calculating expected return and risk for stock portfolios. It asks to calculate the expected return and standard deviation for General Foods for 1999 based on given probability and return data. It also asks to calculate the expected return of portfolios consisting of 4 securities under different weighting conditions: with 25% weighting for each security, 10% for A and equal remaining weights, and 10% each for A and B and 40% each for C and D.